Hollywood Box Office Fail: A Memorial Day to Forget

For years, Memorial Day weekend has been the unofficial beginning of summer blockbuster season, with the multitudes rushing in to enjoy free air conditioning, buttered popcorn and big explosions. And though Hollywood has started releasing its blockbusters earlier and earlier (Marvel/Disney, in particular seems to love the first weekend in May), the audiences don’t seem to have gotten the message.

Tomorrowland, the weekend’s No. 1 grossing film, took in an unimpressive $40.7 million, just ahead of 2010’s groan-worthy Prince of Persia on the list of holiday weekend openers.

Memorial Day 2015 was the worst holiday weekend for Hollywood since 2001, when Michael Bay’s infamous WWII flop Pearl Harbor graced the screens. Considering the 44 percent increase in ticket prices over that time, this is a particularly bleak outlook for theaters.

Related: 13 Movies You Should See This Summer

Tomorrowland only barely beat Pitch Perfect 2, in its second week of release.

In 2014, X-Men: Days of Future Past took home $110.6 million, while the previous year had the sixth entry in the Fast and the Furious franchise to drive $97.4 million domestically.

The news is better internationally, where the most recent Avengers film (Avengers: Age of Ultron) continues to rake in the yuan, millions at a time. But the outlook for the rest of the domestic season is less rosy, with no obvious saviors later in the summer (Jurassic World, maybe?).

It’s not even June yet, but it is already looking like a chilly summer for Hollywood.

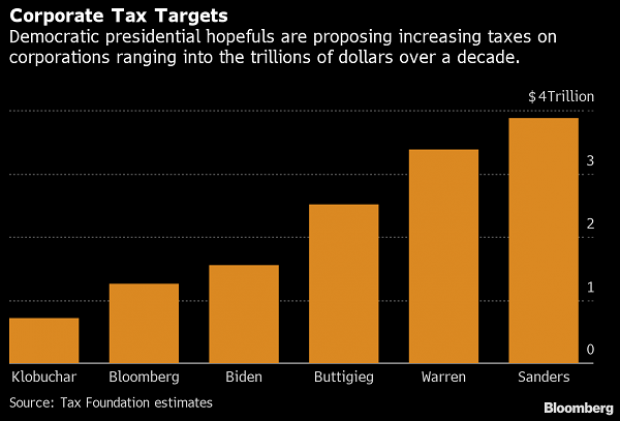

Chart of the Day: Boosting Corporate Tax Revenues

The leading candidates for the Democratic presidential nomination have all proposed increasing taxes on corporations, including raising income tax rates to levels ranging from 25% to 35%, up from the current 21% imposed by the Republican tax cuts in 2017. With Bernie Sanders leading the way at $3.9 trillion, here’s how much revenue the higher proposed corporate taxes, along with additional proposed surtaxes and reduced tax breaks, would generate over a decade, according to calculations by the right-leaning Tax Foundation, highlighted Wednesday by Bloomberg News.

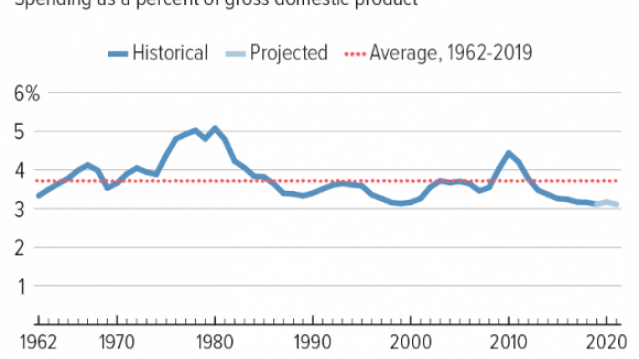

Chart of the Day: Discretionary Spending Droops

The federal government’s total non-defense discretionary spending – which covers everything from education and national parks to veterans’ medical care and low-income housing assistance – equals 3.2% of GDP in 2020, near historic lows going back to 1962, according to an analysis this week from the Center on Budget and Policy Priorities.

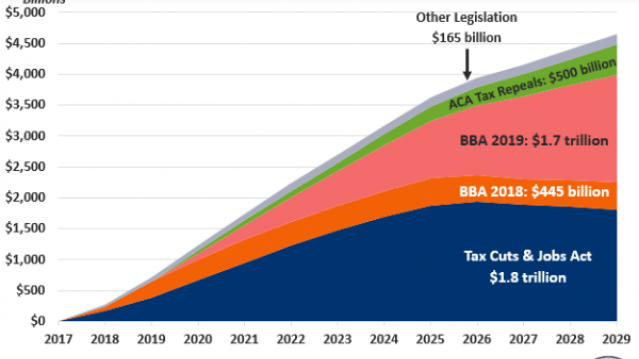

Chart of the Week: Trump Adds $4.7 Trillion in Debt

The Committee for a Responsible Federal Budget estimated this week that President Trump has now signed legislation that will add a total of $4.7 trillion to the national debt between 2017 and 2029. Tax cuts and spending increases account for similar portions of the projected increase, though if the individual tax cuts in the 2017 Republican overhaul are extended beyond their current expiration date at the end of 2025, they would add another $1 trillion in debt through 2029.

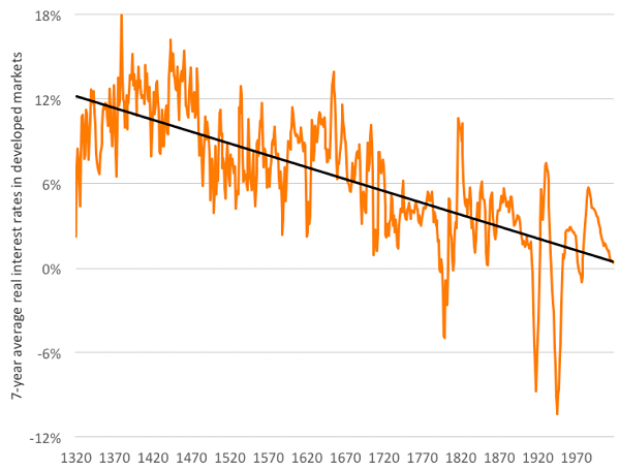

Chart of the Day: The Long Decline in Interest Rates

Are interest rates destined to move higher, increasing the cost of private and public debt? While many experts believe that higher rates are all but inevitable, historian Paul Schmelzing argues that today’s low-interest environment is consistent with a long-term trend stretching back 600 years.

The chart “shows a clear historical downtrend, with rates falling about 1% every 60 years to near zero today,” says Bloomberg’s Aaron Brown. “Rates do tend to revert to a mean, but that mean seems to be declining.”

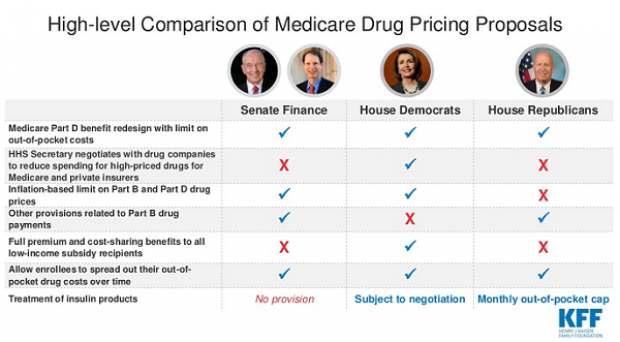

Chart of the Day: Drug Price Plans Compared

Lawmakers are considering three separate bills that are intended to reduce the cost of prescription drugs. Here’s an overview of the proposals, from a series of charts produced by the Kaiser Family Foundation this week. An interesting detail highlighted in another chart: 88% of voters – including 92% of Democrats and 85% of Republicans – want to give the government the power to negotiate prices with drug companies.