Jeb Bush Wasn’t Bashful About Trading on Family Name

While Jeb Bush frequently is touted as both a two-term governor and a successful businessman, his often dubious record as an entrepreneur and investor has been widely documented over the past three decades.

The 62-year-old scion of a powerful political family and now an announced candidate for the 2016 GOP presidential nomination was involved in a myriad business ventures dating back to the mid-1980s, The Washington Post noted on Monday in the latest media examination of Bush’s entrepreneurial exploits as he tried to amass his fortune.

Related: Jeb Bush Shows Some Fire in Campaign Launch

Bush brokered numerous real estate deals in Miami, helped to arrange bank loans in Venezuela, marketed shoes in Panama, sought out Mexican investors for a building-materials company, advised transnational financial services firms — you name it. He also made a boatload of money by sitting on a handful of corporate boards. And ever since he left the Florida governor’s office in 2007, Bush — like Democrat Hillary Clinton — has raked in substantial income by giving speeches while also consulting and managing investments for others.

“Jeb Bush had a successful career in commercial real estate and business before serving as Florida’s governor,” Kristy Campbell, a spokeswoman for Bush, told the Post. “He has always operated with the highest level of integrity throughout his business career.”

And yet the Post’s lengthy review of Bush’s business career — culled from records, lawsuits, interviews and newspapers accounts dating back more than 30 years — reveals a picture of a young man on the make who “often benefited from his family connections and repeatedly put himself in situations that raised questions about his judgement and exposed him to reputational risks.”

Related: Can Jeb Bush Unite the GOP’s Establishment and Religious Wings?

Five of Bush’s former business associates have been convicted of crimes; one remains an international fugitive on fraud charges. Bush has disavowed any knowledge of the wrongdoing and conceded that some of the businessmen he met in Florida took advantage of his relative youth and naiveté.

One thing that comes through loud and clear in the Post report is that Jeb Bush had no compunction about trading on his family name in trying to make a buck.

Major case in point: In early 1989, seven weeks after his father, George H.W. Bush, took office as president, Jeb Bush took a trip to Nigeria with the executive of a Florida company called Moving Water Industries. Bush had just been hired to help market the firm’s water pumps.

With no less than a special escort from the U.S. ambassador to Nigeria, Bush and his new boss met with the nation’s political and religious leaders as part of the company’s effort to land a deal that would be worth $80 million.

“My father is the president of the United States, duly elected by people that have an interest in improving ties everywhere,” the young Bush told the group. “The fact that you have done this today is something I will report back to him very quickly when I get back to the United States.”

Just days after Bush returned to the U.S., his father sent the president of Nigeria a handwritten note thanking him for hosting his son. Not surprisingly, Moving Water Industries eventually landed the deals it was seeking, according to the Post.

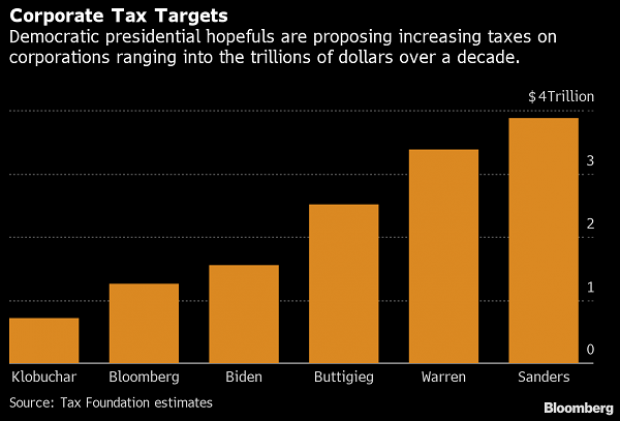

Chart of the Day: Boosting Corporate Tax Revenues

The leading candidates for the Democratic presidential nomination have all proposed increasing taxes on corporations, including raising income tax rates to levels ranging from 25% to 35%, up from the current 21% imposed by the Republican tax cuts in 2017. With Bernie Sanders leading the way at $3.9 trillion, here’s how much revenue the higher proposed corporate taxes, along with additional proposed surtaxes and reduced tax breaks, would generate over a decade, according to calculations by the right-leaning Tax Foundation, highlighted Wednesday by Bloomberg News.

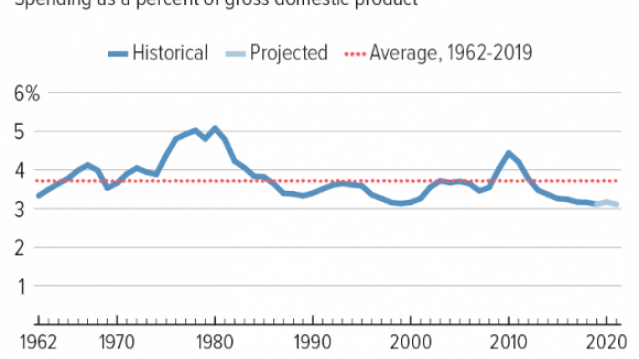

Chart of the Day: Discretionary Spending Droops

The federal government’s total non-defense discretionary spending – which covers everything from education and national parks to veterans’ medical care and low-income housing assistance – equals 3.2% of GDP in 2020, near historic lows going back to 1962, according to an analysis this week from the Center on Budget and Policy Priorities.

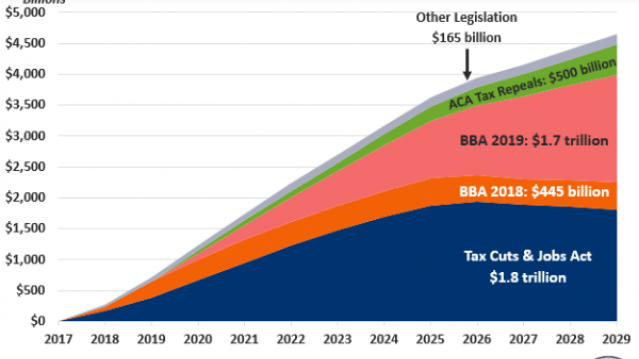

Chart of the Week: Trump Adds $4.7 Trillion in Debt

The Committee for a Responsible Federal Budget estimated this week that President Trump has now signed legislation that will add a total of $4.7 trillion to the national debt between 2017 and 2029. Tax cuts and spending increases account for similar portions of the projected increase, though if the individual tax cuts in the 2017 Republican overhaul are extended beyond their current expiration date at the end of 2025, they would add another $1 trillion in debt through 2029.

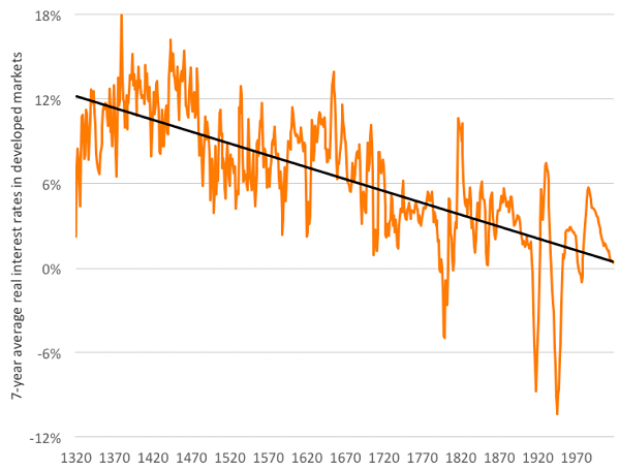

Chart of the Day: The Long Decline in Interest Rates

Are interest rates destined to move higher, increasing the cost of private and public debt? While many experts believe that higher rates are all but inevitable, historian Paul Schmelzing argues that today’s low-interest environment is consistent with a long-term trend stretching back 600 years.

The chart “shows a clear historical downtrend, with rates falling about 1% every 60 years to near zero today,” says Bloomberg’s Aaron Brown. “Rates do tend to revert to a mean, but that mean seems to be declining.”

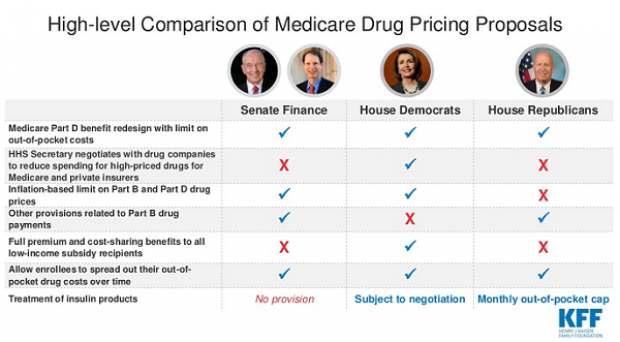

Chart of the Day: Drug Price Plans Compared

Lawmakers are considering three separate bills that are intended to reduce the cost of prescription drugs. Here’s an overview of the proposals, from a series of charts produced by the Kaiser Family Foundation this week. An interesting detail highlighted in another chart: 88% of voters – including 92% of Democrats and 85% of Republicans – want to give the government the power to negotiate prices with drug companies.