Hackers’ Delight: 1 Million Miles for Reporting United Airlines Security Flaws

Now here’s a rewards program Julian Assange could love. United Airlines has confirmed that it paid 1 million frequent flier miles each to two hackers who found serious flaws and security breaches in its computer systems.

Related: Millions of Samsung Galaxy Phones May Be Vulnerable to Hackers

This past May, United started a “bug bounty” program to find loopholes in its security, but it’s hardly the first corporate entity to do so. Google, Facebook and Yahoo all offer rewards or incentives to hackers who report bugs to them privately. Netscape engineer Jarrett Ridlinghafer is largely credited with coming up with the concept of rewarding good, or “white hat,” hackers for trouble-shooting in 1995.

Jordan Wiens, founder of cybersecurity company Vector 35, was one of two winners to claim a million airline miles for his prize. He posted a screenshot of his mileage account on Twitter. (He submitted the bug on May 15, got a response on May 19, a validation notice on June 24 and then the payout on July 10.) A second bug he reported won a lesser prize of 250,000 miles. Kyle Lovett from Montgomery, Calif., was the other million-mile winner. Lovett Tweeted that he will use some of the miles to fly out his mother and brother to California.

Wow! @united really paid out! Got a million miles for my bug bounty submissions! Very cool. pic.twitter.com/CEclmhmyUq

— Jordan Wiens (@psifertex) July 10, 2015No doubt the airline saved a ton of money in preventing computer issues. In recent months United has had to ground it flights twice as a result of computer system glitches. On June 2, an automation issue affected 150 flights, or 8 percent of its morning schedule. On July 8, a network connectivity issue due to a router malfunction locked up its reservations system and grounded thousands of flights worldwide.

Looks like the airline has more miles to dole out, too: Twitter was full of happy pronouncement from hackers claiming smaller prizes and begging Delta to do the same.

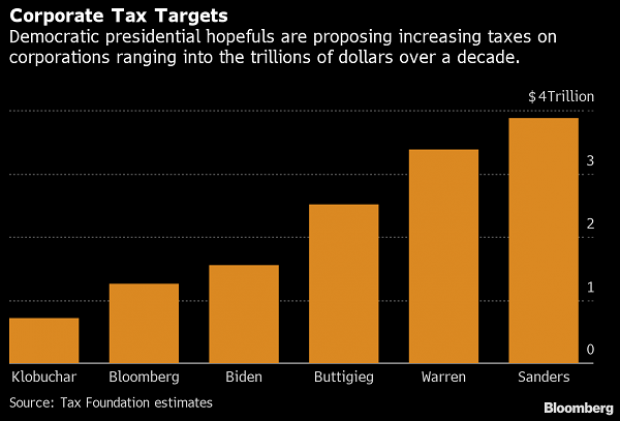

Chart of the Day: Boosting Corporate Tax Revenues

The leading candidates for the Democratic presidential nomination have all proposed increasing taxes on corporations, including raising income tax rates to levels ranging from 25% to 35%, up from the current 21% imposed by the Republican tax cuts in 2017. With Bernie Sanders leading the way at $3.9 trillion, here’s how much revenue the higher proposed corporate taxes, along with additional proposed surtaxes and reduced tax breaks, would generate over a decade, according to calculations by the right-leaning Tax Foundation, highlighted Wednesday by Bloomberg News.

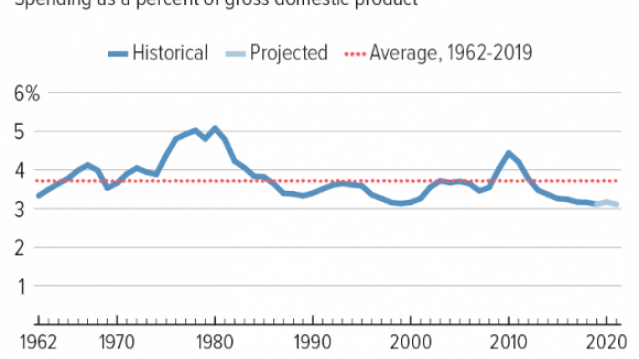

Chart of the Day: Discretionary Spending Droops

The federal government’s total non-defense discretionary spending – which covers everything from education and national parks to veterans’ medical care and low-income housing assistance – equals 3.2% of GDP in 2020, near historic lows going back to 1962, according to an analysis this week from the Center on Budget and Policy Priorities.

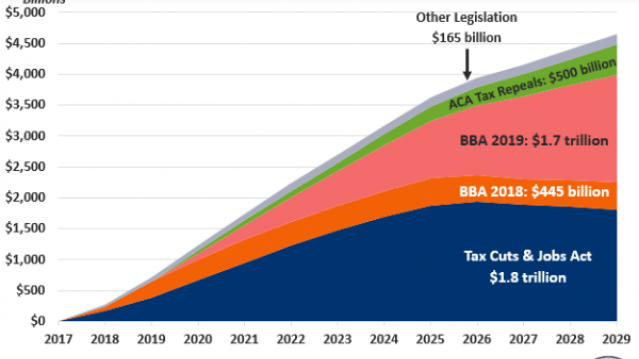

Chart of the Week: Trump Adds $4.7 Trillion in Debt

The Committee for a Responsible Federal Budget estimated this week that President Trump has now signed legislation that will add a total of $4.7 trillion to the national debt between 2017 and 2029. Tax cuts and spending increases account for similar portions of the projected increase, though if the individual tax cuts in the 2017 Republican overhaul are extended beyond their current expiration date at the end of 2025, they would add another $1 trillion in debt through 2029.

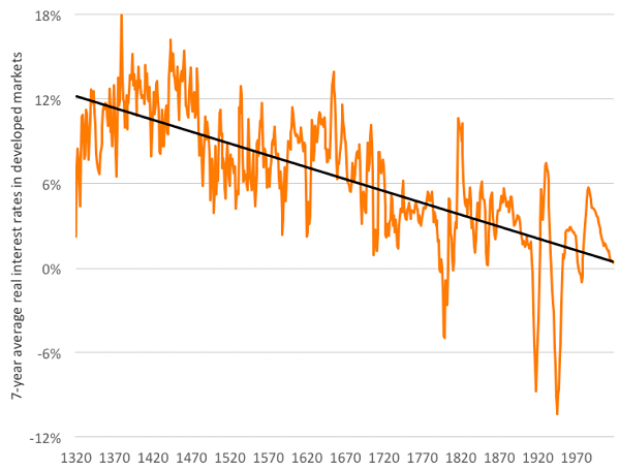

Chart of the Day: The Long Decline in Interest Rates

Are interest rates destined to move higher, increasing the cost of private and public debt? While many experts believe that higher rates are all but inevitable, historian Paul Schmelzing argues that today’s low-interest environment is consistent with a long-term trend stretching back 600 years.

The chart “shows a clear historical downtrend, with rates falling about 1% every 60 years to near zero today,” says Bloomberg’s Aaron Brown. “Rates do tend to revert to a mean, but that mean seems to be declining.”

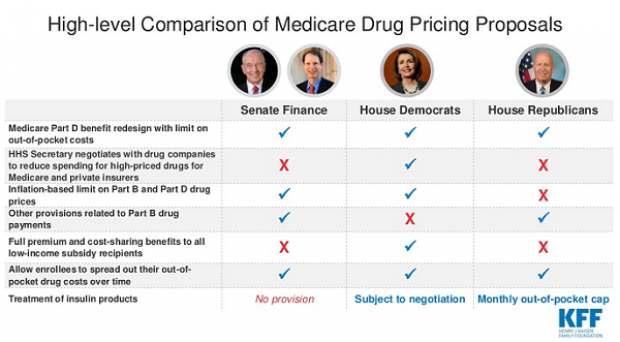

Chart of the Day: Drug Price Plans Compared

Lawmakers are considering three separate bills that are intended to reduce the cost of prescription drugs. Here’s an overview of the proposals, from a series of charts produced by the Kaiser Family Foundation this week. An interesting detail highlighted in another chart: 88% of voters – including 92% of Democrats and 85% of Republicans – want to give the government the power to negotiate prices with drug companies.