On Campaign Trail, Rubio Truant in the Senate

Last week Sen. Marco Rubio warned it’s “important to be qualified, but if this election is a resume competition, then Hillary Clinton's gonna be the next president” because of her long history in office and in federal government.

For his sake, he’d better hope the GOP primary doesn’t turn into a disqualifying truancy competition, too.

A study by The Tampa Bay Times found that of the four Republican senators running for the White House, Rubio has missed the most Senate votes.

In June alone, Rubio missed 67 percent of the Senate votes, and he wasn’t there for more than half of them in July, according to The Times.

Related: The New York Times Just Made Rubio the Hero of the Struggling Middle Class

In all, the first-term lawmaker missed 29 percent of Senate votes, or 76 of 262 recorded, in the first six months of 2015. Over 50 of those came after his April 13 campaign announcement.

The numbers show how much time Rubio has had to spend off Capitol Hill and on the campaign trail as he looks to break out of a crowded GOP field that includes his friend and former Florida Gov. Jeb Bush.

By contrast, Sen. Ted Cruz (R-TX) has missed 54 votes since declaring his candidacy in March, while Sen. Lindsey Graham (R-SC) was truant for 35 votes since he launched his presidential bid on June 1.

Sen. Rand Paul (R-KY) has skipped only three votes throughout 2015 and only one since declaring for president.

On the Democratic side, Sen. Bernie Sanders (I-VT) has missed four votes since hitting the campaign trail.

Rubio has missed nearly 11 percent of votes since he joined the Senate in January 2011, The Times analysis shows, well above the median 1.6 percent rate for the lifetimes of current senators.

A Rubio spokesperson did not respond to a request for comment.

Top Reads from The Fiscal Times:

- Trump’s Debate Performance Should Kill His Candidacy … but Won’t

- Battle Lines Form in the Fight Over Social Security Payment Reductions

- Robert Gates Says U.S. Got ‘Out-Negotiated’ on Iran Deal, Backs It Anyway

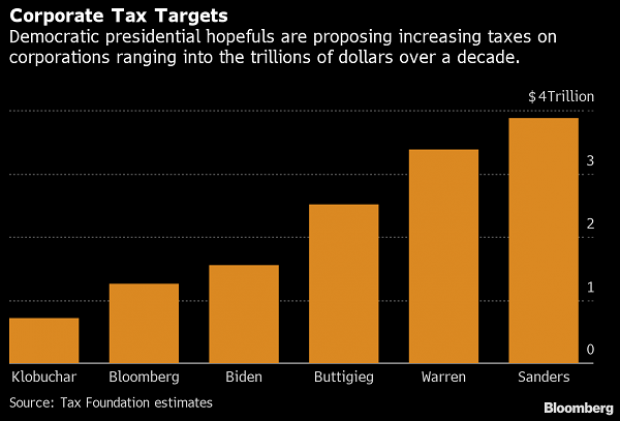

Chart of the Day: Boosting Corporate Tax Revenues

The leading candidates for the Democratic presidential nomination have all proposed increasing taxes on corporations, including raising income tax rates to levels ranging from 25% to 35%, up from the current 21% imposed by the Republican tax cuts in 2017. With Bernie Sanders leading the way at $3.9 trillion, here’s how much revenue the higher proposed corporate taxes, along with additional proposed surtaxes and reduced tax breaks, would generate over a decade, according to calculations by the right-leaning Tax Foundation, highlighted Wednesday by Bloomberg News.

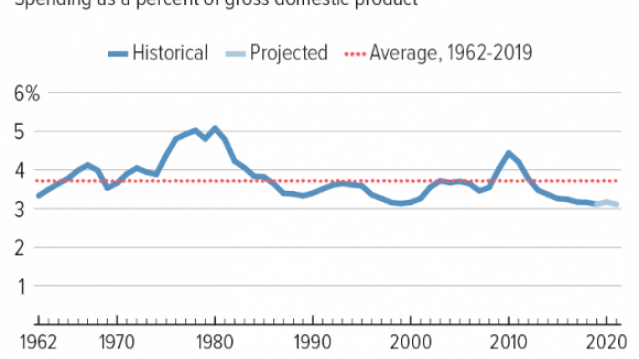

Chart of the Day: Discretionary Spending Droops

The federal government’s total non-defense discretionary spending – which covers everything from education and national parks to veterans’ medical care and low-income housing assistance – equals 3.2% of GDP in 2020, near historic lows going back to 1962, according to an analysis this week from the Center on Budget and Policy Priorities.

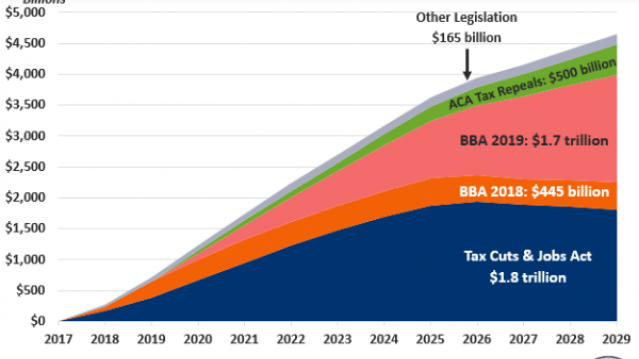

Chart of the Week: Trump Adds $4.7 Trillion in Debt

The Committee for a Responsible Federal Budget estimated this week that President Trump has now signed legislation that will add a total of $4.7 trillion to the national debt between 2017 and 2029. Tax cuts and spending increases account for similar portions of the projected increase, though if the individual tax cuts in the 2017 Republican overhaul are extended beyond their current expiration date at the end of 2025, they would add another $1 trillion in debt through 2029.

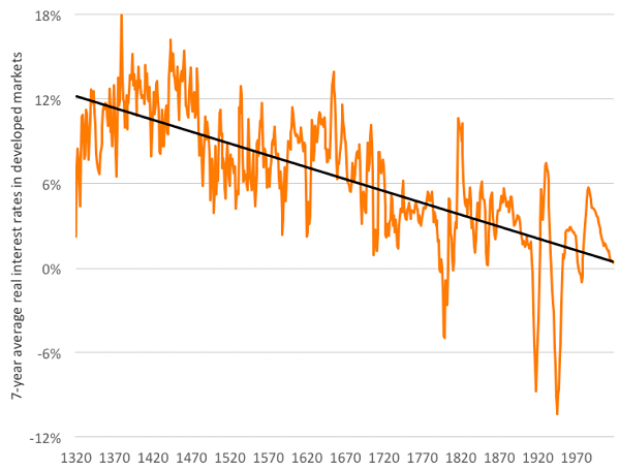

Chart of the Day: The Long Decline in Interest Rates

Are interest rates destined to move higher, increasing the cost of private and public debt? While many experts believe that higher rates are all but inevitable, historian Paul Schmelzing argues that today’s low-interest environment is consistent with a long-term trend stretching back 600 years.

The chart “shows a clear historical downtrend, with rates falling about 1% every 60 years to near zero today,” says Bloomberg’s Aaron Brown. “Rates do tend to revert to a mean, but that mean seems to be declining.”

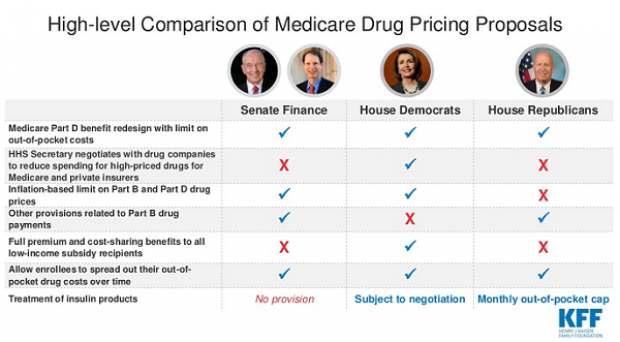

Chart of the Day: Drug Price Plans Compared

Lawmakers are considering three separate bills that are intended to reduce the cost of prescription drugs. Here’s an overview of the proposals, from a series of charts produced by the Kaiser Family Foundation this week. An interesting detail highlighted in another chart: 88% of voters – including 92% of Democrats and 85% of Republicans – want to give the government the power to negotiate prices with drug companies.