Republicans say the Tax Cuts and Jobs Act unveiled on Thursday “will deliver real tax relief to Americans across the country – especially low- and middle-income Americans who have been struggling for far too long to earn a raise and get ahead.” But early analyses suggest that the benefits to the middle class are smaller than those for top earners, and while most middle-class taxpayers would see their taxes cut, millions could face higher taxes as soon as next year — and millions more would be left paying higher taxes within a decade.

Preliminary calculations by The New York Times found that the changes being proposed “would actually raise taxes on nearly 13 million tax filers who earn $100,000 a year or less.” A separate analysis by Ernie Tedeschi, a former economist for the Obama Treasury Department and now head of fiscal analysis at research firm Evercore ISI, found that 25 million mostly middle-class taxpayers would pay higher taxes next year — and 47 million would pay more by 2027 under the GOP plan. In other words, by 2027 roughly one in four taxpayers would see their taxes go up, including about a third of households earning between $50,000 and $100,000 a year.

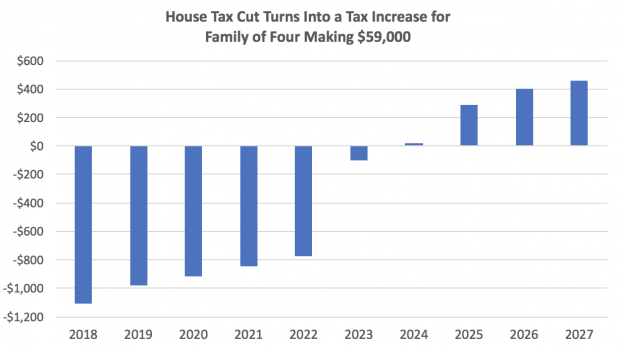

The early analyses raise even more problems for Republicans. House Speaker Paul Ryan on Thursday sought to hammer home the message that a typical married couple that earns $59,000 a year and has two children would save $1,182 next year under the tax plan. But David Kamin, an NYU law professor and former economic adviser to President Obama, writes in a Medium post that even that average middle-class family would be paying more by 2024 — and by 2027, that family would wind up paying about $450 more under the new plan. Welp.

A large chunk of that is the result of the sunsetting after 2022 of a $300-per-adult “Family Flexibility Credit” created under the new bill, with reduced adjustments for inflation also helping to turn a tax cut into a tax increase over time. By contrast, the cuts for wealthy taxpayers and corporations are permanent.

These analyses leave aside one key argument Republicans have been making about the benefits of the bill: That the economic boost from the corporate tax code changes would lead to more jobs and higher wages, lifting middle-class incomes by thousands of dollars a year. But that’s not an easy case to make convincingly or definitively. As The New York Times editorial board noted on Friday: “Credible economists believe the benefits of the cuts would accrue nearly exclusively to shareholders and executives."

Ultimately then, focusing only on the effects of the individual income tax changes, the early analyses of the bill could create more headaches for Republicans, or at least force some further revisions to their bill. But any tweaks to reduce middle-class taxes would need to be offset, adding to the challenges the tax overhaul already faces. “The coming days will see much more in-depth analysis of the impact of the provisions on people in all income brackets,” writes Politico’s Ben White. “If they turn up significant hikes (or vanishing cuts) for middle- to upper-middle income taxpayers while handing permanent big breaks to the rich and corporations, the bill could wind up in serious and potentially existential trouble.”