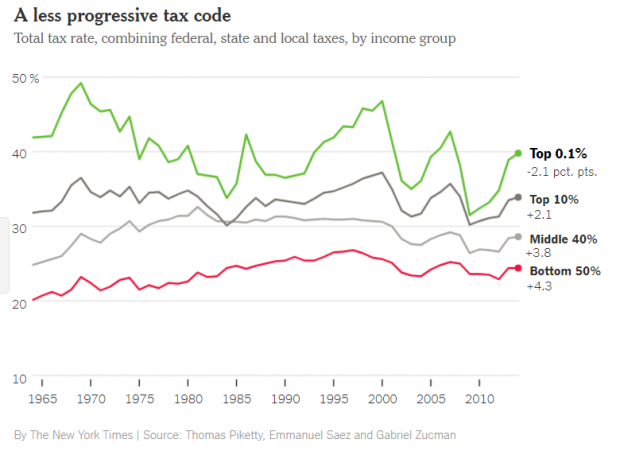

“The great tax-cutting revolution of the last half-century hasn’t actually been a tax-cutting revolution for most Americans,” writes New York Times columnist David Leonhardt.

Despite a series of income-tax rate cuts, the middle class and poor now pay higher overall tax rates than they did in the mid-1960s because of increases to the payroll tax.

“It funds Social Security and Medicare, and it has been rising in response to the aging of society and rising medical costs. It increased from 2 percent just after World War II to 6 percent in 1960 to 12.4 percent in 1990, where it is today. It has risen so much that it’s now the largest tax that 62 percent of American households pay — larger than the income tax, which gets much more attention.”

The Republican tax plan doesn’t touch the payroll tax, and its deficit-financed cuts — plus the reductions in spending that will ultimately be introduced to pay for the higher deficits — amount to “an enormous effort to increase inequality” over the longer term, Leonhardt writes. Read his full column here.