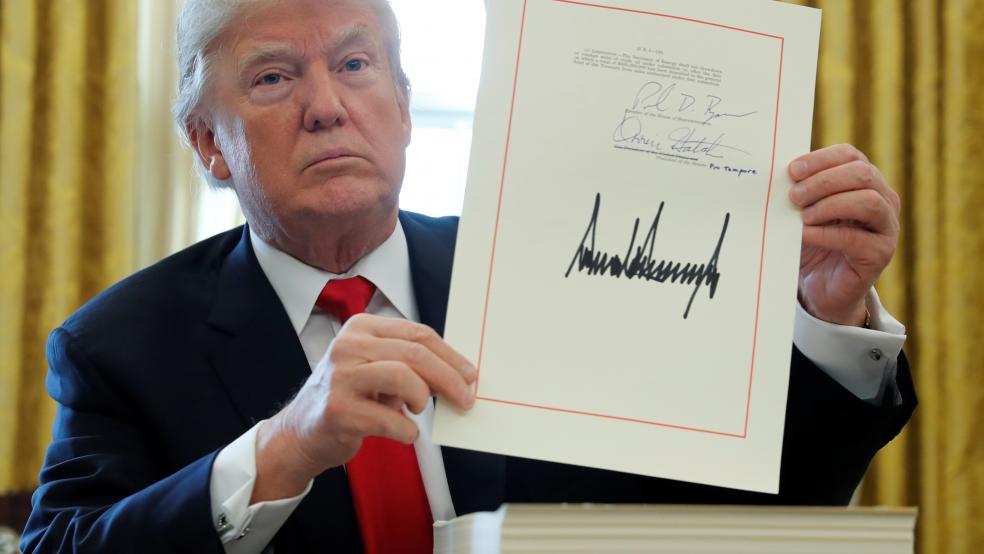

Sunday marks four months since President Trump signed the Republican tax overhaul into law. So it surprised us just a bit to see economist Andrew Hunter of Capital Economics already asking: “Have the tax cuts flopped?”

The question arises because of a slowdown in consumer spending growth in the first quarter of 2018. American workers started seeing the effects of the tax cuts in their paychecks over those months, but according to the data available so far, the income boost hasn’t resulted in a significant jump in consumer spending.

Consumption fell in January and was flat in February. Preliminary data suggests March saw only a modest rebound, according to Hunter. As a result, Capital Economics has produced a growth estimate of about 1 percent for the first quarter, down from a 4 percent annualized growth rate in the final quarter of 2017.

While slower growth in the first quarter is not unusual, Hunter was surprised to see no discernible positive effect on consumption levels from the tax cuts. “The weakness of real consumption growth … suggests that the recent tax cuts have so far failed to provide any meaningful boost to activity,” Hunter wrote. “After many months of anticipation, there are now rising concerns that the Republicans’ tax bill isn’t all it was hyped up to be.”

One possible explanation for the lackluster data, Hunter said, is the tax cuts aren’t providing a significant income boost for the workers most likely to spend additional income. The tax cuts provide a larger benefit to high-income workers, who will see thousands more over the course of the year but who are more likely to save rather than the spend the money. Low-income workers, who tend to spend a higher proportion of their incomes, will receive at most a few hundred dollars per year, which may not be enough to spark a change in their consumption levels, especially with the increase spread out over weekly paychecks. Given this dynamic, Hunter said he expects “the fiscal multiplier for the tax bill to be low.”

At the same time, it might still be too early to write off any consumer effects of the tax cuts. The economy has considerable momentum, with a strong labor market, record household wealth and strong consumer sentiment, Hunter said, and the income boost from the tax cuts may show a positive effect on consumption later in the year as the benefits accumulate. Capital Economics’ estimate for first quarter GDP growth is 2.3 percent, roughly midway between Barclay’s recent estimate of 1.5 percent and the New York Federal Reserve Bank’s current forecast of 2.9 percent.