The national debt is now approaching $23 trillion, up nearly $9 trillion from the end of 2010, and the debt held by the public now stands at nearly $17 trillion, up about $7.5 trillion from since the end of 2010. But in a new report, the left-leaning Center on Budget and Policy Priorities says that, while the debt is expected to continue rising as a share of the economy, the nation’s long-term finances “have notably improved” compared with the outlook in 2010.

“In January 2010 we projected that debt would reach 251 percent of GDP by 2044; we now project 111 percent,” the CBPP authors Richard Kogan, Paul Van de Water and Kathleen Bryant write.

The report finds that the annual “fiscal gap” through 2044 — the average amount of deficit reduction needed to stabilize the debt as a share of the economy at its current level of 78% — is 1.5% of GDP, up from 1.4% a year ago, but just a third of the 4.5% projected in early 2010.

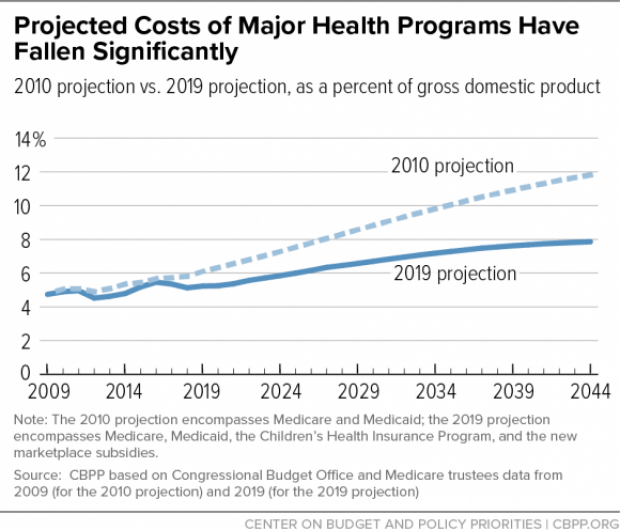

The difference is largely the result of lower projected health-care and interest costs. The projected costs of Medicare and Medicaid, for example, were estimated in the 2010 analysis to reach 11.8% of GDP in 2044. Now, CBPP projects that in 2044, Medicare, Medicaid (including the expansion under the Affordable Care Act), CHIP and the federal health insurance marketplace subsidies will together cost 7.9% of GDP.

“Indeed, the fact that health care costs remain the largest driver of future spending increases should not obscure how much their projected costs have fallen over the last decade,” the authors write. They attribute the slower growth in health-care costs to lower Medicare payment rates and other changes introduced by the Affordable Care Act and the 2015 Medicare Access and CHIP Reauthorization Act as well as to a broader slowdown that was underway before the Obama health law took effect.

Closing the fiscal gap: A 25-year fiscal gap of 1.5% of GDP annually might not sound like all that much, but the report highlights just how challenging it would be to close:

“It is equivalent to 8.1 percent of revenues over the period; to eliminate the gap through revenue increases alone, projected revenues — including income taxes, payroll taxes, gasoline and other excise taxes, the estate tax, and tariffs — would need to rise by an average of 8.1 percent. Alternatively, eliminating the gap through program cuts alone would entail cutting all programs — Social Security, health care, defense, education, veterans’ benefits, law enforcement, transportation, and so on — by an average of 7.2 percent. Of course, if any tax provisions or spending programs were protected, the rest would have to be hit correspondingly harder.”

And it could well be even more challenging than that: At the same time, the report warns that the fiscal outlook would be considerably worse if Congress decides to extend some temporary tax laws, including the 2017 tax cuts now set to expire after 2025. “If policymakers made current tax policies permanent without offsetting the cost, our projected debt ratio in 2044 would rise from 111 to 139 percent and our 25-year fiscal gap would rise from 1.5 to 2.8 percent of GDP,” the report says.

Even without extending those tax cuts, the debt is still projected to rise as a share of the economy. “An aging population and rising health care costs will necessarily drive up spending for Social Security, Medicare, and Medicaid,” the report warns, adding that costs for Social Security and major health programs is expected to rise from 53% of primary (non-interest) spending this year to 67% by 2044. Net interest costs are also projected to climb from 1.8% of GDP today to 2.5% by 2029 and 3% by 2044.

The bottom line: CBPP’s report recommends raising revenue and looking for spending reforms that wouldn’t increase poverty, racial inequity or inequality. “While acting to limit the growth of projected debt-to-GDP ratios is appropriate, policymakers should accomplish this through carefully designed policies that include significant additional revenues and impose costs on those best able to bear them.”

Read the full report, including a breakdown of changes in projections since 2010, here.