The Obama Administration has been fighting a losing battle against mortgage foreclosures until now, but its newest initiatives could be a game-changer for troubled homeowners and the housing market.

A little over a year ago, the Treasury Department rolled out HAMP (Home Affordable Modification Program), but it didn’t address the underlying problem. Nearly a quarter of all homeowners owe more than their houses are worth, a situation known as negative equity. That creates an enormous incentive for homeowners to simply walk away from their mortgages, even if they can afford their payments. Meanwhile, more than half of all loan modifications under the program have gone back into default, and foreclosures continue to skyrocket.

The new policy, announced on March 26 of this year, attacks the heart of the problem, addressing not only the affordability of mortgages but the willingness of borrowers to pay. For the first time, Washington is giving financial incentives to encourage lenders to write down the balance due on the loan, using funds already set aside for the Troubled Asset Relief Program (TARP). Mortgage modifications that involve principal reduction, analysts say, will lower, and in some cases eliminate, negative home equity, and decrease the likelihood of another default. “If these programs meet with even moderate success, they will change the bleak housing landscape for the better,” economists at Morgan Stanley said in a recent research report.

The new incentive plans include the following:

- “Earned principal forgiveness,” which reduces the balance due on a loan and forgives that reduction over a three-year period.

- Modified second mortgages for delinquent borrowers who have nowhere else to turn.

- The Federal Housing Authority will offer financial incentives to lenders who help underwater borrowers refinance, even if they are still current on their payments. Unemployed homeowners will receive special treatment.

Despite a positive jump in home sales last month, the possibility that another wave of foreclosures will flood the market and depress prices still exists. Foreclosures hit a record 1.7 million in 2009, and in the first quarter of 2010 rose 16 percent from the same quarter last year, according to RealtyTrac.

| Top Ten States In Foreclosure Activity First-Quater, 2010 | ||

| State | Foreclosures 2010 QI | Percent of U.S. Total |

| California | 216,263 | 23.2% |

| Florida | 153,540 | 16.5% |

| Arizona | 55,686 | 6.0% |

| Illions | 45,780 | 4.9% |

| Michigan | 45,780 | 4.9% |

| Georgia | 39,991 | 4.3% |

| Texas | 37,354 | 4.0% |

| Nevada | 34,557 | 3.7% |

| Ohio | 33,221 | 3.6% |

| Colorado | 16,023 | 1.7% |

| Total Top 10 | 678,067 | 72.7% |

| U.S. Total | 932,234 | 100.00% |

| Data: RealtyTrac | ||

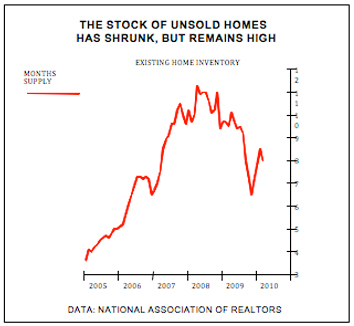

So far, most measures show home prices are stabilizing. The widely followed Standard & Poor’s/Case-Shiller index stopped falling last May, and has been edging higher since then. “Foreclosures have been feeding into the inventory pipeline at a fairly steady pace and are being absorbed,” says Lawrence Yun, chief economist at the National Association of Realtors. The new efforts to reduce mortgage principal could help keep that trend in place, especially after the homebuyer tax credit expires at the end of this month. Buyers must sign a purchase contract by April 30, with a June 30 deadline to close the deal.

The tax credit $8,000 for first-time buyers and $6,500 for current owners, clearly helped March sales. Purchases of existing homes jumped 6.8 percent from February after a period of weakness in recent months, putting sales 16.1 percent ahead of a year ago. March purchases of new homes soared 26.9 percent from the prior month, the biggest increase in the 47-year history of the data. After the tax credit expires, further improvement in the job market and continued low mortgage rates will be needed to support sales and keep inventories down.

A manageable level of foreclosures may be helping sales right now by lowering prices. The realtors’ association notes that foreclosed properties are selling fast, especially at lower prices attractive to first-time buyers. Distressed homes, including both foreclosures and so-called short sales (homes that sell for less than the mortgage value), accounted for 35 percent of March sales, and purchases by investors were 19 percent of total sales. March inventories of unsold homes represented an eight-month supply at the current sales rate, down from a peak of 11.3 months nearly two years ago.

Economists say supply below five months is normal, but even a level below seven months would indicate a better balance between supply and demand and further bolster the overall price outlook.

Reducing the risk of default may also lift prices of mortgage-backed securities, boosting the flow of mortgage credit and helping to hold mortgage rates down. Stronger prices for mortgage-backed securities also would help the balance sheets of many financial institutions holding them, especially now that the Federal Reserve has ended its purchases of these securities from Fannie Mae and Freddie Mac.

Even with government help, the U.S. housing market remains in a deep slump. Before the new policies were announced, analysts at Morgan Stanley had expected an additional 2 million to 3 million mortgage delinquencies on top of 8 million currently. While these latest initiatives, aimed at 3 million to 4 million homeowners, may help, they are no magic cure. Still, the plan could be an important step to keeping housing recovery on track.

Jim Cooper is an economist and former writer for Business Week who has been analyzing and forecasting the U.S. economy for more than 30 years.