Two years after Washington had to spend hundreds of billions to bail out much of Wall Street, members of a Financial Crisis Inquiry Commission said Thursday the country still has a problem with financial institutions that are “too big to fail.”

Federal officials and most financial experts agree that so-called too-big-to-fail-institutions like AIG and Citigroup helped cause the crisis and were a huge drain on the Treasury and Federal Reserve.

The major financial overhaul legislation pushed through by President Obama this year put in safeguards to try to avoid a repeat of the crisis in which federal officials were forced to decide which firms would go under or be auctioned off and which had to be propped up because of their importance to the financial world. But commissioner Byron Georgiou, a skeptic, noted that the six largest financial groups in 2009 constituted 63 percent of gross domestic product, an increase over the 58 percent of GDP they represented in 2007, at the height of the housing bubble, and both up from a mere 17 percent in 1995.

with a set of even larger banks and fewer of them.”

“Given their increasing size, do you really believe these institutions would be allowed to fail today?” said Georgiou, a personal injury and financial fraud lawyer. “Are we really in any better shape today to avoid the bailouts that have been so criticized in the last few years?”

“This is going to be a particularly challenging environment with a set of even larger banks and fewer of them,” predicted Commission Chairman Phil Angelides. “If we are going to have banks that are too big to fail, we need to have regulators who are too tough to fold.”

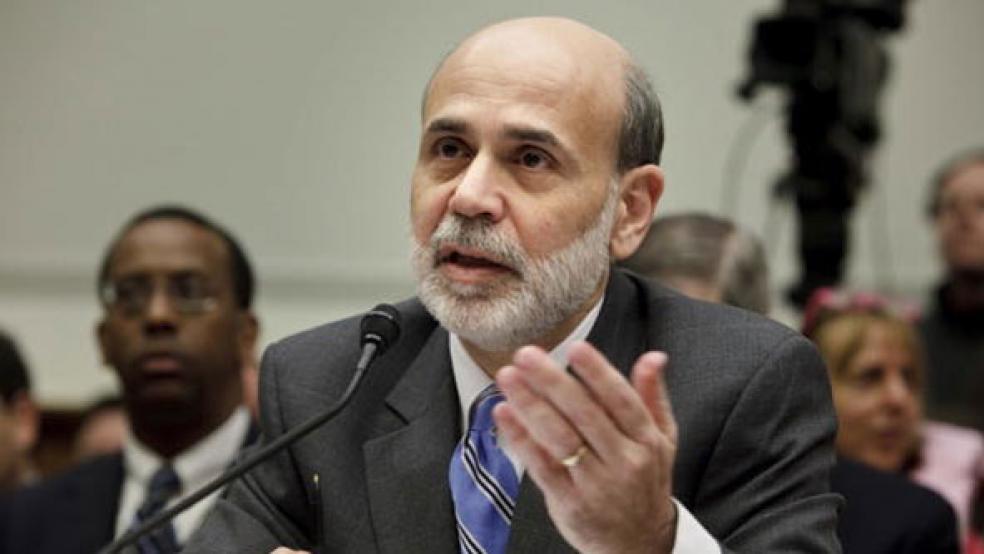

Bernanke Testifies

Federal Reserve Chairman Ben Bernanke, who testified before the panel, contended that this summer's sweeping financial regulatory legislation will give regulators important new tools to protect the financial system, such as tougher oversight and a new method of unwinding unstable firms that threaten the system. But he declared that federal regulators must be ready to close down the largest banks and financial institutions if they once again threaten to bring down the global financial system.

As regulators implement the dozens of new rules called for in the Dodd-Frank law, Bernanke said he expects to see fewer mammoth financial institutions.

“The most important lesson of this crisis is that we have to end too big to fail,” Bernanke said during the hearing on Capitol Hill. “My projection is that even without direct intervention by the government, that over time we're going to see some breakups and reduction in the size and complexity of these firms.”

President Obama signed a law creating the 10-member bipartisan commission to examine the causes of the 2008 mortgage meltdown and a string of near-failures by major financial institutions that threatened the stability of world markets and led to the worst recession in modern U.S. history. The panel will send a report to Congress in December, based on its dozen-plus days of hearings, more than 500 interviews with key players in the financial crisis, and hundreds of thousands of pages of government and internal Wall Street documents.

The report could offer policy recommendations, but at the least it aims to provide a definitive analysis of what went wrong in regulation and the markets.

In the panel's final Washington hearing, before field hearings in areas of the country most affected by the recession, commissioners questioned the effectiveness of the government and market response to the crisis. The Dodd-Frank legislation created a new council of regulators to monitor large firms that might threaten the stability of the financial system, even if they're not banks, and gave regulators the power to seize and dismantle a too-big-to-fail institution. The law also created a new consumer protection regulator, put limits on the derivatives markets, and restricted bank activities.

The Fed: Past Mistakes and Future Changes

Bernanke noted that the new law prohibits the Fed from lending directly to an individual institution, instead requiring a liquidation of any systemically important firm whose failure could destabilize the financial system. That makes it all the more important to ensure that the new resolution regime works, he said.

Bernanke also acknowledged mistakes on the part of the Fed and other bank regulators in the months and years leading up to the crisis, especially with regard to subprime mortgages, and said it's impossible to prevent all crises. However, it was the combination of the triggers — mortgage meltdown and failing firms — with the vulnerabilities of the overall system that made the crisis as bad as it was. “If we had a healthy, strong, stable financial system, it could've accepted this problem without creating a major crisis,” he said. "E coli got into the food supply and it created a much bigger problem.”

Bernanke helped lead the economy through the financial crisis and the worst recession since the 1930s. The Fed took extraordinary measures to pump hundreds of billions of dollars into the crisis-ridden financial system. Members of the commission have questioned the government’s decision to let Lehman Brothers fall while pumping billions of dollars into other big financial institutions during the crisis.

Former Lehman CEO Richard S. Fuld Jr. testified Wednesday that his former firm could have been rescued, but the regulators refused to pursue all possible options to keep Lehman afloat.

Bernanke disputed this claim Thursday, saying that bailing out Lehman would have saddled taxpayers with billions of dollars in losses. He said other companies that were bailed out, including American International Group Inc., had valuable assets which could back up the Fed’s emergency loans.

“The only way we could've saved Lehman would've been by breaking the law and I'm not sure I would've been prepared to accept the consequences,” Bernanke said. “I wish we could've saved Lehman and we tried very, very hard to do so.”