A new study suggests the United States could be just two years away from a fiscal crisis if deficit reduction measures aren’t enacted soon.

The Sovereign Fiscal Responsibility Index released Wednesday by Comeback America Initiative (CAI), a deficit watchdog group, and Stanford University ranks the U.S. 28 out of 34 countries studied, just above Hungary and Ireland and below Italy.

“If we have a debt crisis in the U.S. it would cost something much worse than a recession and it would not be confined to the U.S.,” said David Walker, former U.S. Comptroller General and founder and CEO of CAI. “It would be a global depression.”

Australia tops the list of fiscally responsible countries in the index, followed by New Zealand. The top ten countries also include emerging markets, Brazil, Mexico and China. Not surprisingly, more developed countries such as Portugal, Italy and Greece are ranked near the bottom as they fight to stay afloat in the European debt crisis. Japan, whose debt rating was downgraded by Moody’s in January, is No. 31, followed by Iceland, which has already defaulted.

“Americans aren’t used to seeing us rank that low in anything, nor should we be,” said Walker. “Americans should be embarrassed by how low the U.S. ranks.”

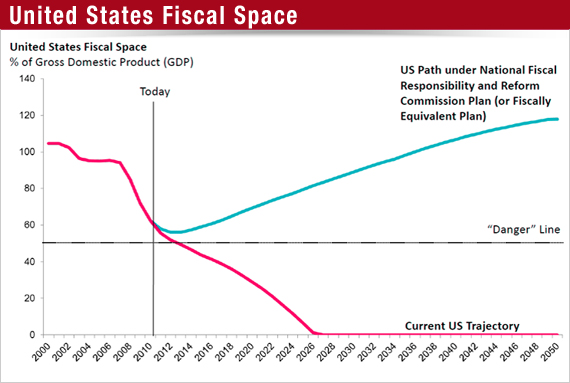

If no reforms to federal spending or safety net programs are made, the study found that the U.S. will hit its debt limit in 2027, but Walker said it could come in as little as two years due to the risk of rising interest rates and market concerns. Interest rates are at currently at historically low levels and for every one percent increase in rates, the amount of interest the U.S has to pay will go up $100 billion based on current debt, Walker said.

“It’s very important that people not derive a false sense of security about the potential number of years of fiscal space the U.S. might have left,” Walker said. “We could have up to 16 years left but that is based on a number of assumptions, including interest rates.”

There are three components of the Index to measure fiscal sustainability:

- Fiscal space captures the current level of debt for a country. U.S. debt stands at $14.1 trillion, or $121 billion below the current federal debt limit. According to the index, U.S. “fiscal space” is around 62 percent of gross domestic product.

- Fiscal path measures a country’s fiscal space each year into the future, or the sustainability of government debt levels over time. It is based on International Monetary Fund’ data on future spending patterns and concludes the U.S. will hit a debt ceiling in 16 years. Disclaimer: the study said this component is not an exact science and no one can accurately predict when a fiscal crisis will occur.

- Fiscal Governance assesses the rules and institutions in place to make fiscal decisions.

The group said if recommendations of President Obama’s fiscal commission were adopted, the U.S. would rank No. 8 in the index. Democrat Erskine Bowles and Republican Alan Simpson last year co-chaired the White House's deficit-reduction panel and proposed steep spending cuts, entitlement reform and revenue increases that would cut $4 trillion from the deficit over 10 years. Since then, a bipartisan group of six senators, known as the “Gang of Six,” have been working to put some of those proposals into law.

Deficit reduction and spending cuts have emerged as high priorities amid budget battles on Capitol Hill. Congress has yet to agree upon a long-term spending plan for fiscal year 2011, which began last Oct. 1. The latest stopgap spending measure expires April 8. Once Congress reaches agreement on 2011 and 2012 spending levels, Walker said lawmakers should focus on the debt ceiling as an opportunity to deal with the larger budget expenditures such as defense and entitlements. The U.S. is expected to hit its debt ceiling by May.

Walker said entitlement and tax reform, along with defense spending cuts and statutory budget controls are critical to avoid falling into a fiscal crisis. Echoing comments by Rep. Paul Ryan, R-Wisc., at an event last week, Walker said entitlement reform and comprehensive tax reform is unlikely to be tackled before the 2012 election. Corporate tax reform, however, is the likely to be addressed sooner, he said, because it could help improve the country’s competitive posture and can generate jobs.

Inaction by Congress could lead to dramatic and draconian measures, the CAI-Stanford group said. Walker said one likely scenario would be a dramatic increase in interest rates, which would raise the cost of borrowing throughout the economy. Another could be a significant decline in the value of the U.S. dollar.

Related Links:

Global Fiscal Positions: How Does the U.S. Rank? (Wall Street Journal)

Manchin: Raising Fed Debt Ceiling Tied to Debt Cut (Business Week)

US Stocks Decline on Euro Zone Debt Worries (International Business Times)