The financial crisis dealt a devastating blow to the household wealth and retirement expectations of aging baby boomers, which may account for the anemic economic recovery, a top Federal Reserve Board official said this week. The loss in both investments and home values had a chilling effect on spending among the 78 million people who were once the main consumer engine of the economy.

“There are signs of delayed retirement and greater desire to save and to avoid risk,” said Federal Reserve Board governor Elizabeth Duke, who prior to serving on the Fed was a Virginia community banker. “Wealth shocks . . . could be a factor in the slow recovery of spending.”

Duke offered her views during a speech to the Virginia Association of Economists after reviewing the most recent Fed survey of consumer finances, which is issued every two years. The latest data reflect consumer attitudes during late 2009, when the economy was finally beginning to emerge from the worst economic downturn since the Great Depression.

Duke said the attitudes reflected in the survey may signal significant long-term damage to consumer confidence, especially among people over 50. She said aging baby boomers’ reluctance to spend or invest was as common among older adults who suffered substantial losses during the downturn as it was among those who made significant gains, which some did.

“More than two-thirds of the preretirement group reported that their expected retirement age was at least a year later than what they reported in 2007,” she said. “The share of families expecting to extend their working life was very similar regardless of their change in wealth. This likely suggests increased uncertainty about the future, no matter what their experience during the financial crisis.”

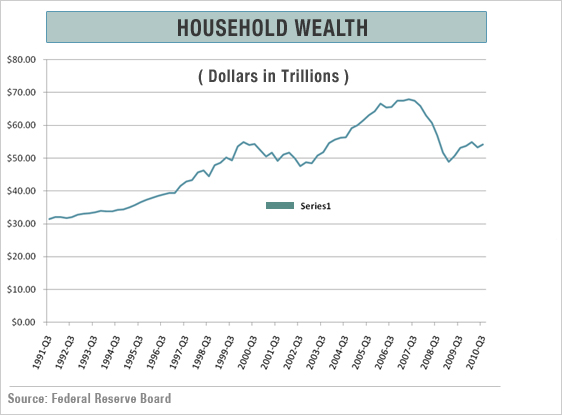

Fed surveys showed that overall household wealth plunged 28 percent from its peak in mid-2007 to its recession nadir in mid-2009, wiping out all gains posted since the technology crash in 2001-02. While there was some recovery in the past 18 months, overall household wealth remains about 15 percent below its pre-recession peak.

But not everyone was affected equally by the bursting of the real estate bubble and the financial sector’s collapse. While 43 percent of families saw a wealth decline equal or greater than six months of their usual income, and almost a third saw a loss greater than an entire year’s income, about 20 percent of aging boomers saw a gain in wealth that was equal to six months of income or more.

“It would be reasonable to expect households’ plans and attitudes to vary based on the individual wealth outcomes they experienced,” she said. “But in comparing responses from boomer families that lost wealth to those that gained wealth, we found remarkably similar answers.” Families said they needed more money to cope with emergencies and other unexpected events. That drove the savings rate higher. The survey showed the largest percentage increase in the savings rate was among families that experienced wealth gains. “It made them more cautious,” she said.

Families that see their assets increase — whether through higher values on their homes or through growth in their retirement accounts — are sometimes willing to spend more on current consumption, a phenomenon known as the “wealth effect.” Never very large — the survey in 2007 showed just 30 percent of all adults were willing to spend some of their paper wealth at the peak of the housing bubble. That percentage took a sharp downward turn in the 2009 survey.

Moreover, the unwillingness to spend was most pronounced among aging boomers, who are nearing retirement. “Boomer families remained cautious or grew more cautious about spending out of their asset gains — regardless of whether they experienced significant losses during the crisis,” she said. “This may help explain the . . . continued sluggishness of consumer spending even as asset values have recovered.”

Related Links:

Baby Boomers Reveal Biggest Retirement Fears (U.S. News and World Report)

Duke Says Recovery May be Slower on Households’ Caution (Bloomberg)