As the April 18 tax-filing deadline approaches and Americans struggle to decipher tax-form instructions seemingly written in an obscure ancient language that would confuse even Indiana Jones, their biggest worry may be more basic: What are my chances of getting audited?

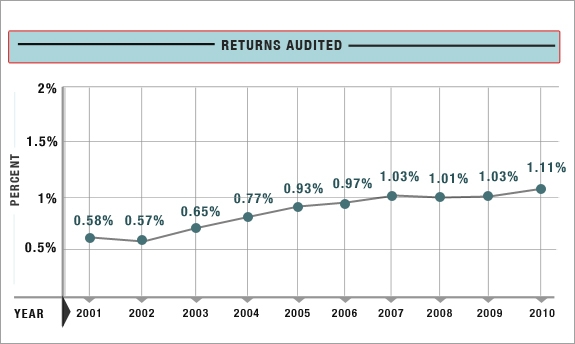

The general answer: Much greater than a decade ago and likely to increase in coming years — but still small overall. Here are the latest numbers:

- The Internal Revenue Service audited about 1.6 million individual income-tax returns in fiscal 2010, up 11 percent from 2009 — and more than double the 731,756 audits done in 2001. President Obama's proposed 2012 budget calls for expanding the IRS's army of auditors in an effort to shrink the nation's "tax gap," or the difference between what the IRS actually collects each year and what officials think they should be collecting. The IRS has estimated the tax gap at about $290 billion.

- Even so, 2010 audits represented only 1.1 percent of all individual income-tax returns filed in the previous calendar year. The audit rate has hovered at around 1 percent for each of the past six years.

Before you relax, though, keep in mind that the odds of getting audited can rise sharply depending on details of your return. Naturally, IRS officials are reluctant to discuss details of their audit-selection processes for fear of helping wrongdoers avoid detection. But there are clues to the taxman’s thinking in IRS publications and speeches, as well as from interviews with IRS officials, present and past, and private-sector experts who represent taxpayers in their battles with tax officials.

What's the DIF?

The IRS has a computerized "DIF" system ("Discriminant Function System") that assigns a score to each return indicating its potential for questionable issues. The IRS also studies returns for potential unreported income. As the IRS puts it in one of its publications: "If your return is selected because of a high score under the DIF system, the potential is high that an examination of your return will result in a change to your income tax liability." The ingredients of the DIF system remain as closely guarded as the formula for Coca-Cola.

There’s also what’s known as "document-matching." IRS computers match what taxpayers report on their returns against what the agency receives from other sources, such as employers, banks, brokerage firms, and other institutions.

Tips from informants can trigger audits. This information "can come from a number of sources, including newspapers, public records and individuals," the IRS says. Or your return may be singled out for special attention "to address both the questionable treatment of an item and to study the behavior of similar taxpayers (a market segment) in handling a tax issue,” the IRS says.

Audits are considered critically important in keeping taxpayers honest, and they're significant moneymakers. The IRS took in $57.6 billion last year from "enforcement" actions, up 18 percent from 2009. These figures include not only audits but also collection activities, results of appeals, and "document matching" programs.

The audit rate tells only part of the story. Most audits are done by mail, rather than in person, and typically involve specific issues. For example, the IRS might want documentation for a tax credit or deduction, such as a charitable donation. These audits usually are less intrusive than face-to-face meetings with IRS agents, although a letter from the IRS can strike fear into anyone’s heart. Last year the IRS did about 1.2 million “correspondence” audits, up from about 1.1 million the prior year. There were about 343,000 "field" audits, up from 326,000.

Frequent Targets

A few examples of targets for potential audits:

- In recent years IRS officials have greatly increased audits of upper-income taxpayers, such as those earning $200,000 or more, and especially those making $1 million or more. "The higher end, that's where the money is," says Bob Scharin, senior tax analyst at Thomson Reuters in New York. The 2010 audit rate was only about 1 percent for those with income under $200,000. But it was 3.1 percent for those making $200,000 or more and 8.4 percent for those making $1 million or more — and about 18 percent for those making $10 million or more.

- Self-employed taxpayers face scrutiny, especially those who routinely deal in large amounts of cash, and whose income isn't reported separately to the IRS. IRS research shows that taxpayers generally are much more compliant when taxes are withheld by their employers and when income is reported separately to the IRS by employers and others. Compliance is much lower when there is no tax withholding and no third-party reports to the IRS.

- Some people try to argue that it's somehow "voluntary" to file a tax return and pay tax. There is a list of these and other claims dubbed “frivolous” on the IRS website; just type "frivolous arguments" in the search box in the upper right-hand corner. Even if you genuinely believe any of these theories, don't even think of raising them with IRS officials or the courts. You're not going to win, and judges may impose stiff penalties for frivolous or delaying tactics.

- U.S. government officials have greatly intensified efforts to get Americans to disclose — and pay taxes on — taxable income in foreign accounts. Earlier this year, the IRS launched its Offshore Voluntary Disclosure Initiative, "designed to bring offshore money back into the U.S. tax system and help people with undisclosed income from hidden offshore accounts get current with their taxes." It gave them until Aug. 31, 2011, to “file all returns and pay any taxes, interest and accuracy-related penalties due.”

- Tricky valuations, such as a donation to an art museum of a hard-to-value work of art or a gift of a conservation easement to charity, may trigger an audit.

- IRS officials have been waging war for many years on bogus tax shelters. These generally are transactions that have no real business purpose other than reducing or even eliminating taxes.

- Get ready for an audit if the IRS suspects that your tax-return preparer has done something wrong on numerous returns. "Our tax system and a large number of taxpayers may be poorly served by some return preparers," IRS Commissioner Douglas Shulman said in a speech last year. “Let no one forget that it is the taxpayer who is legally responsible for penalties and interest if their return is not accurately prepared, or they claim deductions or tax credits to which they are not entitled."

- And you may just be unlucky. The IRS audits a small number of returns selected largely at random from various income categories. The agency uses the results in its basic research to help update its DIF scoring system.

To read all of The Fiscal Times’ Tax Day Countdown Series click here.

Related Links:

IRS Softens Lien Rules for Tax Scofflaws (The Fiscal Times)

The Byzantine, Bizarre and Sometimes Inequitable Tax Code (The Fiscal Times)

IRS Audit Risk If You’re Rich (Forbes)