It's easy to find lists of the best places to retire in the United States. The AARP has one, so does Forbes, U.S. News and a host of retiree-oriented websites. The same cities and states tend to appear on each list – Tucson, Ariz.! Austin, Texas! — in part because the things that matter most as people pick a place to retire – proximity to good medical care, tax advantages for seniors, nice climate and safe streets – never really go out of style.

But the states, cities and communities in which retirees enjoy those tax breaks, tee times, affordable homes and other trappings of a comfortable retirement have not proven to be nearly as stable. With states and municipalities still reeling from the Great Recession, the security that retirees prize has become more and more elusive.

And so, instead of another list of the best places to retire, we offer something a little bit different and – in keeping with the tenor of the times – perhaps a little bit more realistic. Here is The Fiscal Times list of The Worst Places to Retire. Consider it a field guide of what to avoid … and consider yourself warned.

1. A Golf Community Goes Off Course

Lake Las Vegas, Nevada

Even when judged by the dizzying, everyone-gets-a-jetpack promises made standard by boom-era planned communities, Lake Las Vegas was a doozy. Conceived in 1972, the development – including an artificial lake carved out of the dessert that cost $2 million a year to keep filled – became a reality, and a hit, in the 1990s. Now, to the chagrin of the retirees (and others) who bought thousands of homes in the community, Lake Las Vegas has become a well-heeled version of limbo. Golf courses nationwide have suffered since the recession, and for the fifth straight year, more closed than opened in 2010. But all three of the Lake Las Vegas golf courses went into foreclosure, and only the Golf Club at South Shore is back in operation – no longer as a private club, but as one open to anyone willing to pay a $600 annual fee. Initiation fees dropped from $175,000 to, um, zero dollars. The development's casino, Casino MonteLago, closed in March of 2010, and the Ritz-Carlton Lake Las Vegas shut down two months later. The lake isn't going anywhere, but the waterfront and the triple-digit temperatures are there to stay.

2) The Nation’s Biggest Housing Mess

Greater Phoenix, Arizona

There's no shortage of places in the U.S. with rotten housing markets. But Arizona deserves a special place on this list. It was dramatically overbuilt during the real-estate boom, and the massive inventory glut that followed cut the bottom out of home values across the state. In 2006, Arizona's median home value was $270,000; in 2010, it was $143,000. About 40 percent of mortgages in Phoenix, the state's biggest city, are underwater. Arizona State University real estate professor Jay Butler told Fox Business he doesn’t see the market turning around "for many years down the line." Even if you're not buying a retirement home, that's cause for pause.

3) A Retirement Ghost Town

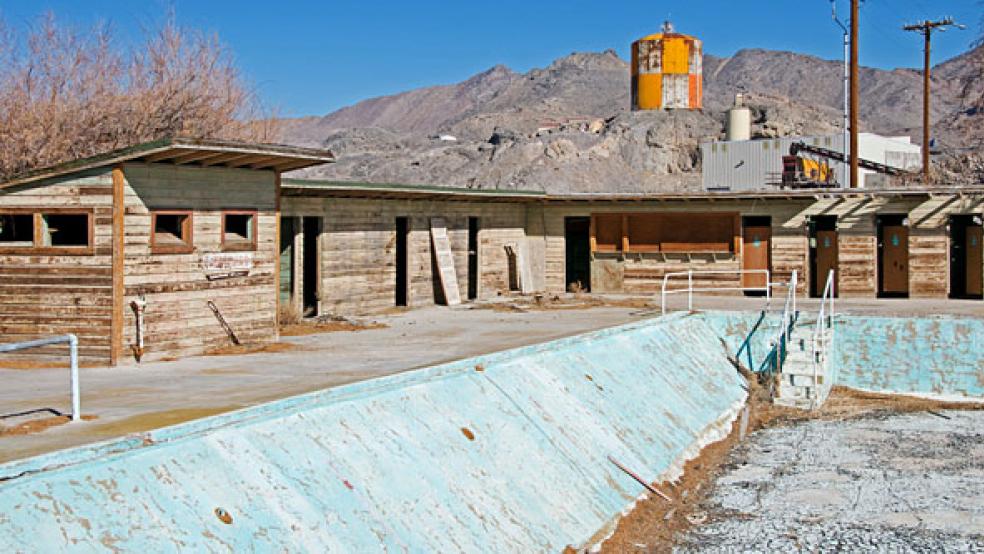

La Cresta Community, Davenport, FL

It looked like the 90 homeowners in Davenport, Fla.'s, La Cresta, a planned 55-and-over community from mega-developer Del Webb, were making a solid investment. After all, Webb's active-retirement empire has 50 years of success behind it, and includes more than 50 developments in 20 states. But Cresta ended up becoming that spookiest of bad retirement destinations – a retirement ghost town. After a dispute with the company that owned the land, Webb in 2009 effectively abandoned the place, peeling its name off La Cresta's sales office, locking the doors, and boarding up the windows. The community was half-finished and half-occupied — complete with an activity center, abandoned pools and blocks of empty lots and half-built homes.

There’s more bad news for those who bought in. Even though it has long been a haven for retirees, Florida is on the list of states cutting aid to seniors: 69,000 seniors had their home aid delayed last year.

4) High on Retirement

Laguna Woods Village Retirement Community, Orange County, CA

Admittedly, this is a one-of-a-kind case, but it shows how changing state laws can transform a retirement experience. The Laguna Woods Village retirement community in Orange County, is home to a marijuana-growing collective, with varietals of cannabis with names like Super Silver Haze. They’re also experimenting with different hybrids of marijuana said to have anti-inflammatory properties that could help arthritis sufferers. The seniors who grow (and smoke) the stuff do so legally under California state law, but marijuana is still illegal under federal law, and the government has made life difficult for marijuana growers. Some residents oppose the collective, since the last thing most retirees wants is a DEA agent kicking in the door.

Retirees in the Golden State already have enough to worry about. Thirty six states don't tax Social Security benefits at all, and California is one of them. The state is also a “retiree’s tax nightmare,” according to Kiplinger. All other retirement income is taxed at one of the nation's highest rates, and California’s sales tax is also among the highest in the nation. Property taxes are not especially friendly, either. On the other hand, it's California: the weather is beautiful, there's no shortage of cultural events and...well, maybe the residents of Laguna Woods Village are onto something.

5) High Costs, High Crime

Clark County, Nevada

An astonishing 71.1 percent of homes in Clark County, Nevada – a retirement Mecca that's home to both Las Vegas and large sprawl-burb Henderson – are underwater on their mortgages, and Moody's Analytics economist Celia Chen estimated that housing values there won't approach their 2006 levels until 2030. Given the state’s relatively high cost of living (105 percent of the national average), a 14.3 percent unemployment rate, the nation's worst home-foreclosure figures and a serious violent crime issue (third in the nation), its no wonder Money-Rates.com named Nevada the worst state for retirement. "A large percentage of people who relocate [to Nevada], from what I've seen, actually wind up moving back with a year or two," says Bill Losey, a retirement advisor and author. "A nice place to visit isn't necessarily going to be a place you want to live."