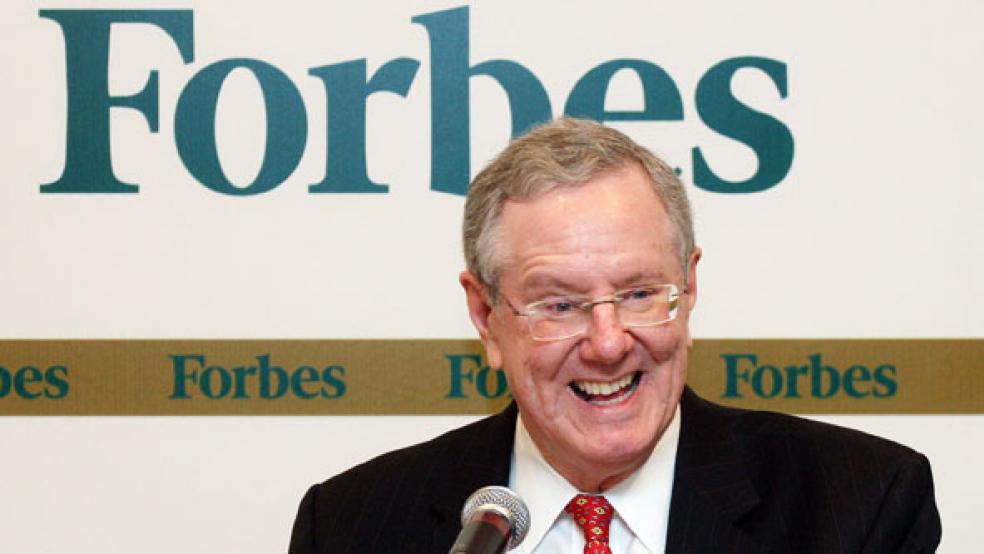

The chairman of Forbes Inc, a two-time GOP presidential candidate, and the editor-in-chief of an iconic magazine once marketed as the “Capitalist Tool,” Steve Forbes has had his hand in economic policy for decades. He’s currently fighting to keep his family’s empire together, speaking out on everything from unions to tax reform. And he's still pushing for a flat tax – where everyone (except families earning less than $46,000) would pay a flat rate of 17 percent. In an exclusive interview with The Fiscal Times, Forbes gives his thoughts on Obama’s performance, the sluggish economy, and why Forbes himself, with an estimated net worth of more than $430 million, shouldn’t pay more taxes.

TFT: What do you think about Obama and how he’s handling the current fiscal crisis?

SF: Clearly he’s been a failure. His policies have made the economic crisis worse, not better. We should’ve been in a good recovery right now. Always, after a sharp downturn, you get, at least initially, a sharp upturn. And the fact that it hasn’t happened is attributable to the administration’s weak dollar policy, their binge spending and massive new regulations. What should have been a vigorous recovery has turned into a very feeble one.

TFT: Do you think we’re headed for a double-dip recession?

SF: I don’t think we’ll have a double-dip recession. I actually think we’ll show a little more growth in the second half of this year than we did in the first half. But that’s similar to an automobile increasing its speed on a superhighway from 20 to 30 miles an hour – it’s still not up to the 70 or 75 it should be going.

TFT: What are some of your recommendations to stimulate the economy, create jobs, and deal with the deficit?

SF: First and foremost they have to stabilize the dollar. A weak dollar always means a weak recovery. It leads to private capital leaving the U.S. and going overseas. If the Fed hadn’t printed so much money, we never would have had the housing bubble. They should also simplify the tax code with something like the flat tax. We should reduce tax rates instead of increasing them. They should repeal Obamacare and start over for a more patient-oriented health care system. They should repeal Dodd-Frank because it does far more harm than good.

TFT: You mentioned tax reform. Do you still think a 17 percent flat tax is the way to go?

SF: More than ever. I think about 26 countries have the flat tax now, and it’s worked wherever it’s been tried. You have a low rate, generous deductions for adults and for children, and you can literally do your tax return on a single sheet of paper instead of spending as we do now 7.5 billion hours a year filling out tax forms. That number 7.5 billion comes from the IRS [laughs].

TFT: Warren Buffett proposes raising taxes on the rich. Do you agree?

SF: Well, rich is $200,000 or $250,000 a year, which is a couple’s peak earning years. Increasing taxes on salaries is not the way to go. Also,because of our tax code, a lot of businesses are taxed at personal rates, so it will hurt businesses that employ 20-50 people. It’s a capital destroyer. Buffett only pays 17 percent of his income in taxes. When he talks, he mixes taxes on dividends and capital gains with taxes on salaried income. In this country, salaried income is taxed at the federal level at the high rate of 35. And then you put in state income taxes, you can get 42 or 45 percent. Raising taxes on dividends, which Buffett implies we should do, destroys capital. And raising the tax on capital gains, where there is no certainty, as the market’s always reminding us, reduces risk-taking, which hurts enterprises for the future.

TFT: But he’s proposing raising taxes on those earning $1 million or more, not $250,000.

SF: It’s the same thing. It’s a destroyer of capital. And between 2007 and 2009, tax receipts in those high brackets went down because the economy was bad. Capital gains disappeared. So raising the rate is just going to have people clutch their cash even more. We should be reducing the rates, not increasing them. Every time we’ve increased the rates, we’ve ended up with less revenue than anticipated and a weaker economy than would have been the case otherwise.

TFT: Could you afford to pay more in taxes?

SF: It’s not a matter of affordability. If rates are high, people are going to not put their money to work, and so you hurt the economy. Right now the top 3 percent of income earners pays more tax than the remaining 97 percent, so it’s not a lack of progressivity but it is harmful. We should have learned that from the 70s and the early 90s.

TFT: How about the GOP candidates. Who are you supporting?

SF: I’m very interested in Gov. Perry of Texas; he’s had an excellent record as governor. I like the fact that he’s going after the Federal Reserve, which has been a very destructive agency in terms of printing too much. Gov. Romney, I’ve been disillusioned by what he did in Massachusetts on health care, and Congresswoman Bachmann has been a very good leader in fighting some of the excesses in the last couple of years, but I like the fact that Gov. Perry has had some executive experience. But I haven’t made a final decision yet.

TFT: Do you support the Tea Party? A New York Times article the other day suggested that the Tea Party is basically the Christian right in different clothes.

SF: The Tea Party came into existence two years ago in reaction to the blowout in government spending, and they’re mostly people who’d never been involved in politics before, so the left of the Democrat party hates the Tea Party because they’re doing things without their permission. They’re very effective in getting good anti-spending, tax-cutting candidates for the Republicans.

TFT: How about the current state of the media industry? There have been reports that Forbes Media is under a lot of financial strain.

SF: Well, the last few years the whole media industry has been under stress. The New York Times nearly went under two years ago, but we’ve got exciting strategies in place and we’re moving forward. The readership of the magazine’s never been higher, our share of a much shrunken ad market is higher than our competitors and on the web, we now have about 19 to 20 million unique visitors a month, and our affiliated websites have another 5 or 6 million and so while BusinessWeek was sold for a dollar and Newsweek was sold for a dollar because they’re both broke, we’re growing and moving ahead. We’re hiring people. It’s a good thing. [laughs]