Google is a spectacularly successful 21st century company, and appears to be using its vast brainpower and enormous treasure (including $41 billion in cash) to expand from Web searching, which it continues to dominate, into nearly every part of the digital economy, both online and off.

It has made more than 100 acquisitions in the last decade. Just in the last few months it bought restaurant-review publisher Zagat, a few daily deal sites, and it announced its biggest acquisition yet -- Motorola’s handset business for $12.5 billion. Google has mail, maps and apps. It is helping to build sprawling solar power plants in the west and a massive undersea electrical cable in the east. A library of nearly every book ever published will soon bear its name. It even has a car that drives itself.

But Google faces increasing competition and some analysts worry that the company may be starting to lose focus. Last week a Stifel Nicolaus analyst, Jordan Rohan, downgraded Google from “buy” to “hold,” saying that “the Internet’s center of gravity is shifting from Google to Facebook.” A recent Nielsen report found that 23 percent of the time people spend online is spent on social networks, led by Facebook and Twitter.

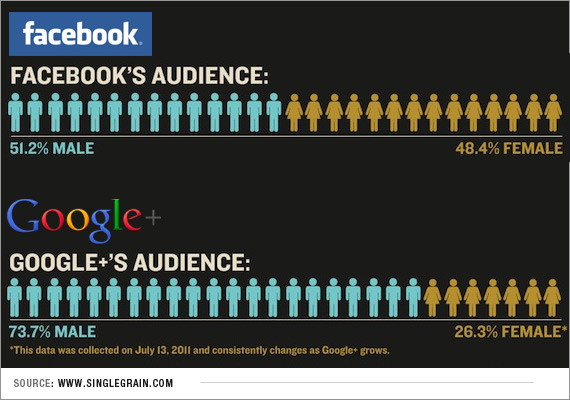

Google, which has a small presence in social networking with Orkut, now hopes to challenge Facebook with Google+.

The more Google changes, the more it remains the same -- what it has been almost from the beginning, an Internet search company. Google's filings with the Securities and Exchange Commission state that about 97 percent of its roughly $10 billion in quarterly revenue comes from two main sources of advertising: AdWords, those four-line text ads that appear with search results, and AdSense, the "Ads by Google" you encounter while wandering around other sites.

Ads Are Us

Co-founder Larry Page was blunt about Google’s business model at the company's annual meeting in June. "We spend the vast majority of our resources on search and advertising.” People outside the company may find “the latest crazy thing that Google did” more interesting, he added. “But it tends to be three people somewhere in the company that are having a good time doing that … We’re not betting the farm on these things."

Google’s dependence on advertising helps explain many of its recent moves, even those that, on the surface, appear to have nothing to do with search or ads. "There isn't necessarily anything wrong with a company having one core business, as long as it's a business that does really well," said Rory Maher, analyst with Hudson Square Research in New York. Most tech companies are far more diversified.

Even with a stock price that has fallen more than 20 percent from its all-time high in 2007, Google is trading at more than $500 a share and has a market capitalization of more than $165 billion. During the last four quarters, its revenues have increased an average 7.3 percent, its profits an average 11.3 percent, and its profit margins have exceeded 50 percent. Its per-share earnings are expected to rise 15 percent when it reports third quarter results on Thursday.

Google's current competition in search comes almost entirely from Microsoft, whose Bing search engine, also used by Yahoo, has about a third of the market. Facebook represents a bigger threat. It has the potential to erode the importance of Google's algorithmic search by emphasizing a different way of finding things on the Web, one that involves the likes and dislikes of an individual's circle of friends, and it also generates income from advertising. If this sort of "social search" becomes more important, Google wants to own it just as it does traditional search.

+ the Next Challenge

When co-founder Page was made CEO earlier this year, his main task was tackling the Facebook challenge. "Google +" went public last month, and saw a spectacular surge in growth, in part due to promotion from the main Google search page. "I can't think of another site that has seen so much growth in traffic in a single week," said Matt Tatham of Hitwise. But with Facebook’s current 100-to-one lead in page views, says Tatham, Google has a challenge on its hands. "It's going to be very tough for them," says Tatham. A recent report from Chitika, a data analytics company, found that traffic to Google+ has fallen sharply since the launch.

Google is estimated to have 65 percent of the search business, according to Hitwise, which tracks Web traffic. Search is the key to its contextual ad business and Google is relentless in defending it. Last month, executives were hauled before Senate anti-trust investigators to deny charges that Google abused its dominant market position by unfairly promoting its own content in search results over material from competitors, such as Yelp, which reviews local businesses.

Google has spent billions of dollars over the last few years developing its Android mobile phone platform, which has been a global success even surpassing Apple's iPhone in sales. But Google makes no money from mobile phones. Instead, it gives the software away for free to handset manufacturers, as a way of insuring that the growing armies of smart phone users continue to do their searching via Google.

It's widely believed that Google is buying Motorola is for its valuable collection of patents, and doesn’t plan to get into the hardware business. There has been an explosion of mobile-phone patent lawsuits in the last two years: Oracle vs. Google; Apple vs. HTC, an Android maker; Microsoft vs. Motorola. Motorola’s patents can help Google play defense as well as offense. Google executives haven’t commented.

Many of Google’s non-advertising activities have little or no potential of adding to its top line revenue growth. Google Apps for Business, its cloud-based alternative to Microsoft Office, has grown quite slowly and remains a tiny business. The self-driving car is a sort of science project from a vastly profitable company that sees itself, and likes to be seen, as a collection of brainy innovators. Nearby Stanford University has an active robotics program that has been working on self-driving vehicles for many years, with considerable federal support. Google hired some of the researchers to fine-tune their work. The result was a publicity coup for the company, even though Google says it has no current plans to market either a car or automotive control software.

Page had an incentive to minimize Google's work outside of new advertisingsupported digital products at the annual meeting, as shareholders invariably tend to be fidgety about any corporate spending that does not involve the firm's "core" business. But he was entirely accurate in his assessment, says Randall J. Stross, a Silicon Valley historian and author of Planet Google: One Company's Audacious Plan to Organize Everything We Know. “Google … has three thriving businesses: advertising, advertising, and advertising.”