An announcement Wednesday about coordinated action by the Federal Reserve, European Central Bank, Bank of Canada, Bank of England, Bank of Japan, and Swiss National Bank to cut the cost of dollar swaps sent markets surging.

But it could seriously deflate the value of the dollar. Economist Gavyn Davies even argues in an FT column today that the move is nothing more than a new round of quantitative easing.

We were initially taken aback by this suggestion, so we did some digging. Turns out this whole swap deal could end up being highly controversial in Washington.

At issue here is expansion of the Fed's balance sheet, which ultimately amounts to expanding the number of dollars in the system. Technically, the dollar swap facility does not cost the U.S. anything—the Fed loans dollars out in exchange for foreign currency and gets them back at the same exchange rate plus interest. But in the short term, giving out dollars increases the amount of U.S. currency in circulation, something that some economists worry could lead to inflation.

Davies mentions this 2010 report (pdf) from the NY Fed, and here is it ist explanation of how the Fed dealt with this last time:

Initially, the Fed funded the dollar swap lines by reducing its holdings of Treasury securities, particularly Treasury bills. Later, as the swap lines and other liquidity facilities expanded in size, the Fed increased its liabilities commensurately, taking on the proceeds from the sale of a special series of Treasury bills and boosting incentives for depository institutions to hold reserves at the Fed. No other institution was in a position to undertake these efforts in support of dollar funding markets.

In the short term, the Fed could sell securities to sterilize the effects of the swap—like the short-term securities it's selling as part of "Operation Twist" to offset purchases of long-term securities. But if the level of demand for dollars increases significantly enough, the Fed may have to return to balance sheet expansion because it can't sell securities that don't exist.

Further, right now it probably doesn't want to sell securities. At their last meeting, some members of the Federal Open Market Committee already favored more easing, despite fears that it could provoke out-of-control inflation. Although economists demanding action to counter inflation have been quiet lately, they could start piping up again after this.

The Fed has been looking to make its monetary policy even more accommodative in the short term to prevent potential deflation, and so this is a stroke of luck for them. Not only does the dollar swap plan maintain liquidity in the global fiscal system, it is a tool to stimulate the domestic economy.

Inflation hawks do have merit on one point, however. This dollar swap action—thought temporary—could also take place on a dramatic scale. From Davies's column:

From the US perspective, the Fed has potentially announced a further extension to QE, the amount of which is hard to predict, and may be hard to control. Like other liquidity operations, it is intended that this will be limited and temporary, but who can tell?

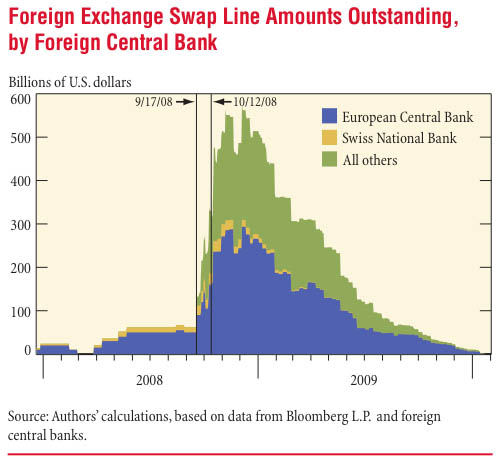

To get an idea of how large this swap program could be, just take a look at what happened at the lending facility last time. 'Nuff said.