Economists, whether leaders of the Fed, stock market analysts or political pundits, have long been caught in a Catch-22 In the public’s eye, economists are responsible for predicting what will happen tomorrow, next quarter or next year to stock markets, housing prices, and even orange futures.

Yet this dismal science is wrought with uncertainty and flooded with conflicting assessments. Some economic predictions pan out; many more do not, leaving the public to wonder if economists are bad at their jobs or simply making wild guesses. As economist John Kenneth Galbraith once said, “The only function of economic forecasting is to make astrology look respectable.”

In 2008, economist and columnist Tim Harford examined the forecasts for the United Kingdom, United States, and Eurozone from 2002 to 2008 and learned that while analysts were all predicting similar results, the economy would invariably and disobligingly do something else. Such misguided flock behavior is best illustrated by the Citigroup Economic Surprise Index – a measure of the gap between expectations and reality shown below. A high positive index indicates real economic data is outperforming analyst’s expectations; a negative index indicates the economy is fairing much worse than anticipated.

Some economic predictions need no graph to understand how historically terrible they were. On October 21, 1929, Yale economics professor Irving Fisher said “Stocks have reached what looks like a permanently high plateau.” Three days later, Black Thursday ushered the United States into the Great Depression.

In 1968, Business Week magazine captured the mindset of American carmakers: “With over 15 types of foreign cars already on sale here, the Japanese auto industry isn’t likely to carve out a big share of the market for itself.” Forty years later, Detroit was in disarray and Toyota surpassed near-bankrupt General Motors as the world’s largest car manufacturer in the first quarter of 2008. And in 1987, Southern Methodist University professor Ravi Batra published his spectacularly incorrect predictions in his book, “The Great Depression of 1990.”

Next month, the Fed is planning to gaze into its crystal ball and risk publishing regular forecasts of future interest rates in a push for increased transparency and public understanding of its efforts. But some economists fear such forecasts will tether the country to a path inconsistent with the future economic climate or worry that any deviations from a predicted path would create unnecessary turbulence in the financial markets.

From the internet bubble to the Great Recession and the slow recovery since, the 21st century has endured its own fair share of cringe-worthy predictions. We share some of the worst economic predictions over the last 12 years and look at what may (or may not) be in store for 2012.

1. Dot Com Bust

For financial publications that save their year-end issues for annual top stock picks, each new decade provides the unique (and gainful) opportunity to not only prophesize the next twelve months, but the next 10 years of market movement. In December 1999, SmartMoney magazine couldn’t resist sharing its own views for the turn of the century. Unfortunately, many of their hot picks, like AOL and Yahoo, cooled. AOL lost more than 70 percent of its stock value the year after its 2001 merger with Time Warner. Another top pick, MCI WorldCom, made history by 2002 as the largest bankruptcy case in the United States at the time. Nortel also liquidated in 2009, becoming one of Canada’s largest business failures in under a decade.

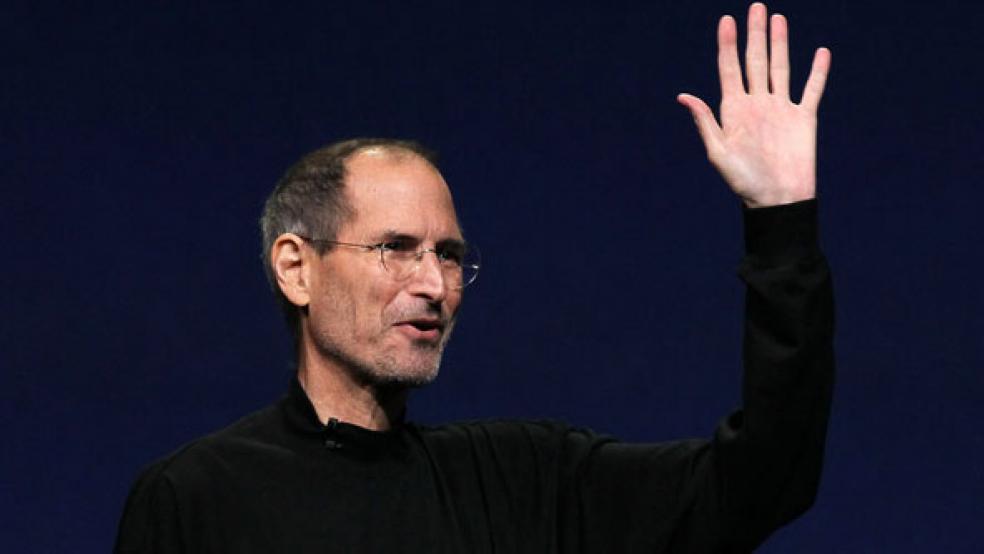

2. Rotten Apple

After the worldwide commemoration to his life and death this October, it’s hard to imagine a time when anyone doubted the influence Steve Jobs’ company would have on business and technology. But when Apple first launched retail stores in May 2001, many experts were skeptical. David Goldstein, president of Channel Marketing, may have said it best: “I give [Apple] two years before they’re turning out the lights on a very painful and expensive mistake.” Far from a mistake, Apple’s stores helped the company become the second company after Exxon Mobil to exceed a market cap of $300 billion. How ‘bout dem Apples.

3. Good Derivatives Gone Bad

After overseeing the U.S. economy for nearly two decades and seemingly ushering in the Clinton-era economic boom, Federal Reserve Chairman Alan Greenspan was considered one of the greatest economists of all time. It wasn’t until after the financial crisis in 2008 that economists realized his famously vague testimonies were questionable and some, like a 2005 statement on derivatives, were downright wrong. Greenspan said, “The use of a growing array of derivatives and … more-sophisticated approaches to measuring and managing risk are key factors underpinning the greater resilience of our largest financial institutions ... Derivatives have permitted the unbundling of financial risks.” Three years later, the widespread use of derivatives sent the economy into a tailspin.

4. Boom, Goes Real Estate

When NYU economic professor Nouriel Roubini professed his fears of a “once in a lifetime” housing bust leading to a great recession in front of a crowd at the International Monetary Fund in September 2006, he was practically laughed off stage and subsequently named “Dr. Doom.” The consensus during the housing bubble was that home prices could do nothing but grow. One leading optimist was David Lereah, chief economist for the National Association of Realtors, who in February 2006 published “Why the Real Estate Boom Will Not Bust,” a guide for homeowners on how to profit from the expanding real estate market. Today, a used hardcover version can be bought on Amazon.com for a penny.

5. The Subprime Market “Contained”

When Ben Bernanke took the helm of the Federal Reserve in 2006, indications of the impending recession were merely whispers. Only a year later, however, the Fed’s chairman noted the turmoil in the subprime mortgage market in a testimony on the economic outlook to Congress’s Joint Economic Committee. Bernanke recognized the continued decreasing demand for housing, yet he remained optimistic, saying, “At this juncture, however, the impact on the broader economy and financial markets of the problems in the subprime market seems likely to be contained.” Bernanke, Congress and the rest of America would soon learn how wrong he was.

6. We Won’t Lose a Dollar

In 2007, Joseph Cassano, AIG’s financial product head said, “It is hard for us, without being flippant, to even see a scenario within any kind of realm of reason that would see us losing one dollar in any of these [credit default swap] transactions.” One year later, Cassano’s realm of reason was turned upside down, and a $182 billion taxpayer bailout saved the United States largest insurance company from bankruptcy caused by these transactions. It would have been wise if Cassano and his team had looked a little harder for the worst-case scenario staring them in the face.

7. Freddie and Fannie Are Fine

Soon-to-be-retired representative Barney Frank has never been one to keep his comments to himself, making a name for himself as Massachusetts’ openly gay and quick-witted Congressman. While his liberal politics have divided public opinion, both Republicans and Democrats can agree that Frank was wrong in July 2008 when he told CNBC, “I think this is a case where Freddie Mac and Fannie Mae are fundamentally sound. They're not in danger of going under … I think they are in good shape going forward." By September 2008, both mortgage institutions were in free fall, receiving billions in bailouts from the U.S. government.

8. The Most Honest Man on Wall Street

Perhaps the most disarmingly true prediction of the early 2000s came from its most dishonest villain. On October 20, 2007, money manager Bernie Madoff explained during a panel in New York City titled The Future of the Stock Market, "In today's regulatory environment, it's virtually impossible to violate rules. This is something that the public really doesn't understand.... It's impossible for a violation to go undetected, certainly not for a considerable period of time." This statement proved accurate when a year later, investigators discovered Madoff’s ponzi scheme had cost his investors $65 billion.