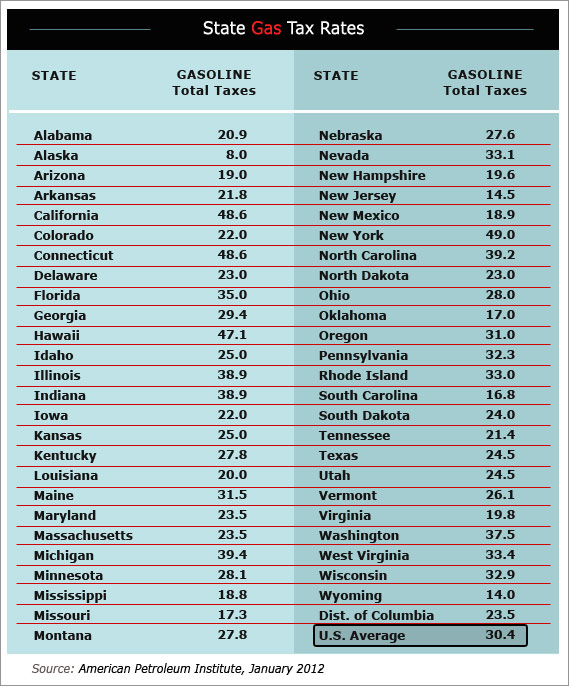

While American drivers endure higher prices for gas brought on in part by a volatile global oil market , residents of California, New York, Hawaii and Connecticut are likely feeling even more pain at the pump than folks in the rest of the country.

That’s because the state taxman plays a role in hiking gas prices – more so in some states than in others.

The state tax is lumped on top of the federal gas tax rate of 18.4 cents per gallon, which is used to finance infrastructure projects. Those four states currently boost state levies to the tune of over 45 cents a gallon, while other states like New Jersey and Wyoming have rates in the neighborhood of 14 percent.

State legislators decide how much fuel tax to levy per gallon of gas; then they add that to the retail price. They can opt to change fuel tax rates, and sometimes do multiple times per year, as state economic conditions change and more or less revenue is needed to finance road and bridge construction. (The idea was first introduced by Herbert Hoover in 1932 to help close a $2.1 budget deficit.)

The introduction of fuel-efficient vehicles is connected to many states’ decisions to hike their gas taxes, said Kim Rueben, a state and local finance expert at the Tax Policy Center. Since gasoline is taxed per-gallon, and fuel-efficient cars need less of it, states are having a harder time keeping up with construction and road maintenance costs, she said. Consequently, some car manufacturers like General Motors have actually urged states to increase gasoline taxes to encourage fuel-efficient car purchases.

While the high gasoline prices in New York and Connecticut are largely attributable to the relatively high gasoline taxes, there are other regional factors that determine prices in California, Hawaii, and elsewhere.

In California, the highest-in-the-nation gas price is also spiking because of the heavy pollution and smog rules, which require that the formula of the fuel itself be different. “There’s a different type of gasoline used, which means a more expensive cost to distill and formulate it to comply with the rules, and that weighs into the final cost, too,” Rueben said. For Hawaii, the historically high gas prices result partly from the higher costs of transporting the fuel off the mainland of the U.S. to the state, she said.