The recovering economy and booming stock market helped mint 200,000 more millionaires in the U.S. last year – but even those wealthy Americans are worried about the future.

According to the results of a survey by Spectrem Group, a Lake Forest, Ill.-based consulting firm focused on the affluent, the financial concerns among households with net worth between $100,000 and $1 million have not fallen much even as the economy has shown signs of improvement.

“What has changed over the last three to four years is concerns that folks have for their children or grandchildren,” said George Walper, Spectrem’s president. While parents were always concerned about being able to provide for their kids’ educations, the financial worries have become much more broad-based. “Folks are saying, ‘I’m not sure the next generation – my children or grandchildren – will have as good a life as I did.’ That’s a pretty significant change in our country’s psyche.”

RELATED: Down and Out on $250,000 a Year

That concern extends to millionaires, 57 percent of whom say they are concerned about the future of their descendants. That has fallen substantially from 69 percent last year, “but it’s still much higher than it was pre-2008,” Walper says.

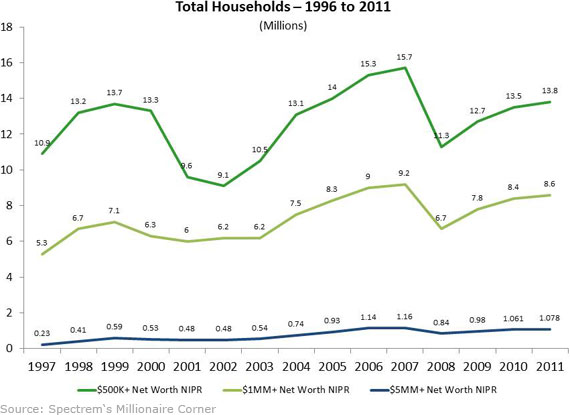

The number of U.S. households with a seven-figure net worth, not including their primary residence, edged up to 8.6 million last year. The financial crisis took a heavy toll on the number of new millionaires being minted, which plunged by 27 percent from 2007 to 2008. Since then, though, the millionaire’s club has grown for three straight years, even as the economy has struggled generate stable and solid growth. Even so, the club grew much less in 2011 – 2 percent – than in either of the prior two years, and membership still hasn’t gotten back to its pre-recession level. In 2007, there were 9.2 million households with more than $1 million in assets.

The survey of 12,519 Americans also found that the ranks of “affluent investors” in general – defined here as those with net worth of $100,000 or more – also grew in 2011:

• $100,000 or more: 36.7 million, up from 36.2 million in 2010 and 31.2 million in 2008.

• $500,000 or more: 13.8 million, up from 13.5 million in 2010

• $5 million or more: 1.078 million, up from 1.061 million in 2010

• $25 million or more: 107,000, up slightly from 105,000 in 2010

At the same time, 83 percent of those affluent investors worry that it’s “getting harder to achieve the American Dream,” – whether that means owning a home, as 59 percent of those under 40 tended to define it, or saving enough for retirement, as nearly 70 percent of investors over age 50 described it.

Retirement, not surprisingly, was more of a concern for those with a net worth in the six figures than those who have reached the million-dollar mark. “While the wealthiest households feel they have enough assets to make it through retirement, the Mass Affluent continue to have significant concerns about retirement and are looking for guarantees that will ensure they have adequate monthly income,” the report notes.

The housing crisis has taken a toll as well. The Spectrem report offers another indication of just how crucial a housing rebound is for the economy, as primary homes account for 29 percent of total assets for those mass affluent. “Even if they are not directly impacted, continuing high unemployment and the depressed housing market are bedeviling wealthy investors,” Walper says.

Millionaires aren’t without worries, either. About 60 percent say they are concerned about the health of their spouse or a family health catastrophe, and 58 percent say they worry about maintaining their financial position in life. Nearly half say they are also concerned about having enough money for retirement.

The way Americans view the political system has also changed in recent years, Spectrem has found. It used to be that Americans focused on, and worried about, the political climate from Labor Day until Election Day, primarily during years that had a presidential election, according to Walper. “It was really only those three or four months,” Walper says.

That began to change a few years ago. “About two and a half years ago or so we started seeing every month that investors are extremely concerned about the political climate in Washington relative to their financial future. It no longer has to do with a presidential election.” It has more to do, essentially, with Washington’s failure to get things done.

Nearly three-quarters of investors aged 51 to 60 say the “current political climate” is an obstacle preventing people from achieving the American Dream. Among those age 60 and over, 84 percent blame the political system.

The wealthy have another reason to be wary of Washington. They were much more likely to be audited by the Internal Revenue Service last year than the year before, according to new data released by the IRS. Overall, 1.1 percent of tax returns were examined by the tax collection agency, but among taxpayers with income of $1,000,000 or more, 12.5 percent were audited, up from 8.4 percent in 2010.