President Obama on Tuesday announced a far-ranging plan to crack down on oil speculation, which he blames in part for the recent run-up in oil prices. The high prices are lightening consumer wallets during the summer driving season, posing a threat to the economic recovery.

President Obama’s $52 million plan would raise the margin requirements for oil traders, increase penalties on those who trade unlawfully and give more power and resources to the Commodity Futures Trading Commission to track oil market trading. Violators could face fines of up to $10 million.

RELATED: High Gas Prices? Blame Goldman Sachs

“We can't afford a situation where speculators artificially manipulate markets by buying up oil, creating the perception of a shortage, and driving prices higher -- only to flip the oil for a quick profit,” the president said. “We can’t afford a situation where some speculators can reap millions, while millions of American families get the short end of the stick,” Obama said.

The president also wants Congress to reverse last year’s budget compromise that could lead to cuts in the number of staffers at the CFTC, which oversees commodities trading. “Congress should provide immediate funding to put more cops on the beat to monitor activity in energy markets,” the president said. “This funding would also upgrade technology so that our surveillance and enforcement officers aren’t hamstrung by older and less sophisticated tools than the ones that traders are using. We should strengthen protections for American consumers, not gut them.”

The legislation is unlikely to get much traction in the Republican-controlled House and drew immediate scorn on Wall Street, which is the target of increased government oversight.

"The call for much higher margin requirements has been a rallying cry for the those who prefer to blame the price discovery mechanism for the underlying conditions that produce the prices being paid,” John Kilduff, a partner at Again Capital in New York, told the Christian Science Monitor. “Oil supplies are routinely under threat from governments that control the spigot and disaffected populations that want a bigger piece of the rock. Demand has gone nowhere but up.”

The move by Democrats in the White House and on Capitol Hill has been in the works for weeks as a response to charges by Republican frontrunner Mitt Romney that the Obama administration’s energy policies are to blame for skyrocketing gasoline prices.

A coalition of consumer groups, petroleum marketers and some industrial users last month called for new controls on oil futures markets. The demanded curbs on speculation that they say is driving up oil and gasoline prices and threatening to derail the economic recovery.

Speaking to reporters at a press conference called by the Consumer Federation of America, economist Mark Cooper and University of Maryland law professor Michael Greenberger, who in the late 1990s oversaw derivatives trading at the Commodity Futures Trading Commission, called for laws that would stop investment banks like Goldman Sachs and Morgan Stanley from selling oil-based commodity index funds; order an immediate Justice Department probe into oil speculation; and add 400 oversight staff to the CFTC to police oil and other futures markets.

“The American consumer is paying 75 cents more per gallon because of excessive speculation,” said Cooper. “That’s eating a hole in consumers’ pocketbooks and the U.S. economy.”

With the economy showing signs of taking off and the private sector adding jobs, the Romney campaign has highlighted pain at the pump to the many reasons why it says Americans should dump Obama for his allegedly failed economic stewardship. Gasoline prices have reached $4 a gallon in many parts of the country and are now approaching levels not seen since the height of the financial crisis, when prices also temporarily soared above $4 a gallon.

.

Republicans on Capitol Hill blame the price run-up on the administration’s failure to open more public lands to drilling and what they say is Obama’s misguided touting of clean energy technologies. The Obama administration counters that the U.S. is producing more oil than ever, and is now a net exporter due to his decision to open more lands to drilling and the industry’s new drilling technologies.

U.S. dependence on foreign oil has in fact fallen from a peak of 60 percent in 2005 to 49 percent in 2010 because of increased domestic production. Falling demand from more fuel-efficient vehicles has also contributed to falling imports. The Energy Information Agency predicts U.S. consumption of foreign-produced oil will decline to 36 percent of total supply by 2035.

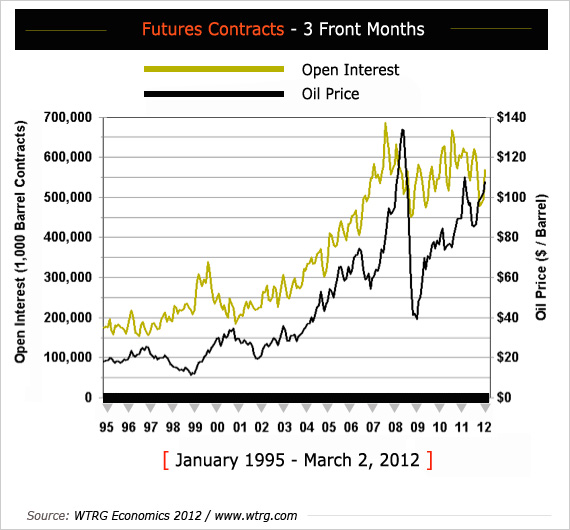

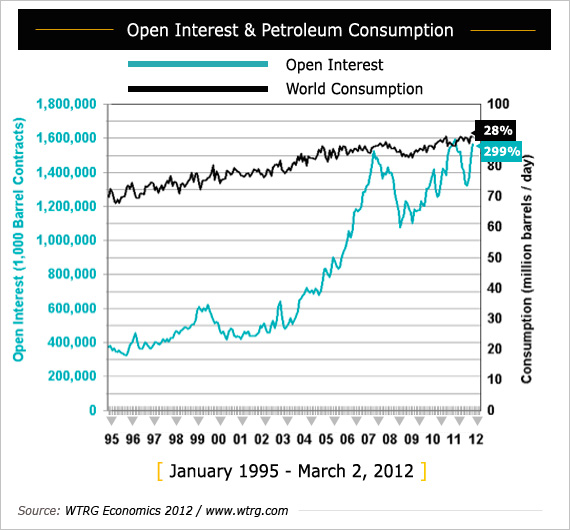

Given the U.S.’s declining dependence on foreign oil, which is a globally traded and priced commodity in any case, Democrats plan to point in coming weeks to oil speculators as a major cause of the recent run-up in prices, just as they did in 2008. During both price spikes, there was a coincident massive jump in the number of open crude oil futures contracts sold on the New York Mercantile Exchange, where cheaper West Texas Intermediate Crude sold for about $103.21 a barrel in late trading Thursday afternoon, over $10 a barrel more than a year ago.

The recent spike clearly has nothing to do with underlying demand, which has fallen by nearly 10 percent in the past year. “Anything over $80 is certainly linked to some extent to speculation,” said James Williams, a long-time oil industry economist at WTRG Economics.

The Securities Industry and Financial Markets Association, which represents investment banks like Goldman Sachs, refused to comment for this story.

Since repeal of the Glass-Steagall Act in the late 1990s that separated traditional banking from other financial activities, investment banks have been allowed to sell exchange-traded futures funds linked to commodities. The volume of oil sold in these “synthetic” markets is now equal to 18 times daily consumption compared to 6 or 8 times daily consumption in the 1990s. “The market functioned quite well at eight days,” Williams said. “There were plenty of speculators to keep the market liquid.”

But before consumers grab their hatchets to go looking for a Goldman Sachs scalp, they should realize that the speculators pouring money into the commodity-based ETFs include major pension funds, hedge funds and other money managers seeking higher yields. When oil prices begin to rise because of heightened tensions with Iran or an oil workers strike in Venezuela, they buy the ETFs in hopes of making a quick killing on rising prices.

The investment bank that underwrites that contract, in turn, goes into the futures markets to offset its risk. Since there are few speculators betting the market will go down in such an environment (the buyers outnumber the sellers by a wide margin), the futures price goes even higher.

That rising price feeds back into the physical market where real people actually buy and sell oil. Oil producers look at the futures price and tell the refiners that they won’t deliver supply at the current price because they can make more money by holding onto it for another 30 days. The storage price is less than the differential, Williams explained. That immediately drives the spot price higher because the refiners need crude. The price at the pump rises right along with it. “Anytime the future price is above the cost of storage, it will drag up the price on the spot market,” Williams said. “There actually is a connection.”

At a public hearing of the House Democratic Steering and Policy Committee Wednesday, Gene Guilford, who heads the Independent Connecticut Petroleum Marketers Association, demanded that only companies that actually use commodities – the end-users of products like oil – be allowed to participate in futures markets. A final rule on end-users under the Dodd-Frank financial reform legislation is hung up at the CFTC.

“This game of Wall Street placing bets on the direction of these products . . . should not be allowed,” the former Reagan administration Energy Department official said. “What we’re talking about here is the food that Americans buy and the energy we rely upon to run our economy.”