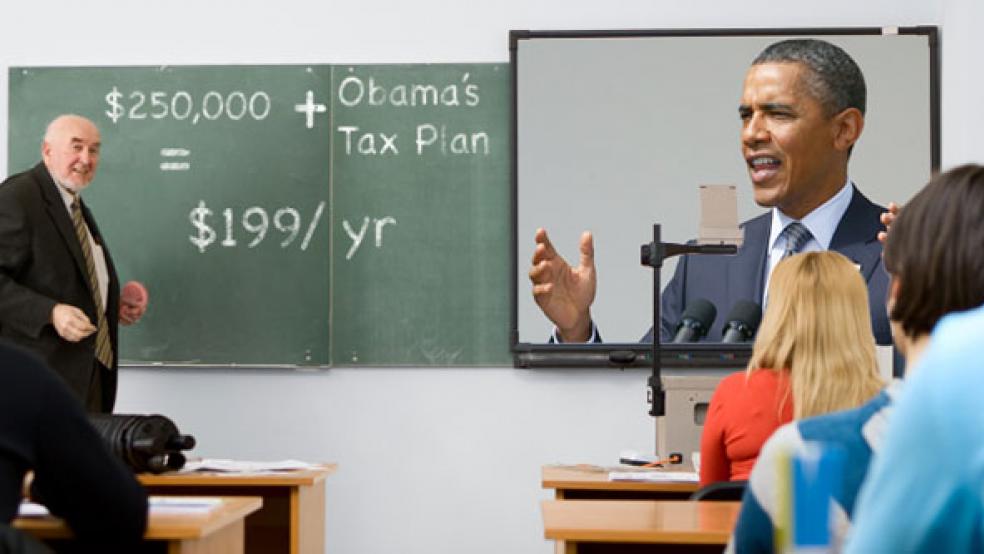

The fierce debate over President Obama’s plan to hike taxes on families with incomes above $250,000 a year has mostly revolved around ideologically-fueled disputes about the impact on the broader economy—and has ignored the consequences for individual taxpayers.

Republican presidential challenger Mitt Romney predicts an increase would cripple growth as tens of billions of dollars flow away from the private sector each year, while Obama claims that a beleaguered middle class would suffer from the brunt of spending cuts needed to preserve the lower rates that were first introduced by President George W. Bush in 2001 and 2003. Voters heading to the polls in November will decide not just the occupant of the Oval Office, but what income tax rates will look like starting in 2013.

RELATED: Down and Out on $250,000 a Year

So what would it mean for the roughly two million American families and individuals on the higher end of the spectrum? That crucial question has escaped the partisan bickering so far.

For most, it’s likely a modest bump, according to independent analyses. At incomes above $1 million—about 378,000 people—the government would start extracting sums equal in size to a salaried job, and after that point the magnitude of the increases would snowball in exponential terms.

“The vast majority of people who are above these thresholds would face small to moderate tax increases, if they face increases at all,” said Joe Rosenberg, a tax policy researcher at the Urban Institute.

The numbers look intimidating at first. Obama would raise the tax rate from 33 percent to 36 percent on household incomes between $247,000 and $398,350. (The ceiling for individuals is $200,000.) Any earnings above that would be taxed at 39.6 percent, compared to the current top level of 35 percent. For those above that ceiling, tax rates on capital gains and dividends would also climb, a key change since many retirees and wealthy individuals derive their income from investments.

But families with $250,000 to $300,000 in taxable income would on average owe an additional $199 a year, according to projections drawn from Census and IRS data by the progressive Citizens for Tax Justice. That works out to $16 a month, enough to reduce the number of afternoon stops at Starbucks but not so devastating that the beach vacation gets canceled.

“What gets lost in this debate is a lot of people in that range aren’t going to be affected,” said Nick Kasprak, who has analyzed Obama’s proposal for the non-partisan Tax Foundation and created an online calculator to see estimated tax bills.

That’s not quite the warning being sounded by Romney, who blasted the proposal this month to the conservative radio show host John Fredericks as “a massive tax increase job creators and on small business.

“This will be another kick in the gut to the middle class in America,” he continued.

Many families will have thousands of dollars in deductions that either put them slightly above or just below the $250,000 threshold. And because the United States has a marginal tax system— charging a smaller rate at each level of less income—much of their earnings would be protected from the increases called for by Obama and congressional Democrats.

The marginal system is a critical element that often gets glossed over in the political debate, distorting how people think about the proposal. Obama, in some ways, has mischaracterized his position by saying it’s a return to the policies of President Clinton during the 1990s, a period associated with the prosperity of the tech boom.

“I just believe that anybody making over $250,000 a year should go back to the income tax rates we were paying under Bill Clinton -- back when our economy created nearly 23 million new jobs, the biggest budget surplus in history, and plenty of millionaires to boot,” Obama said in a White House speech earlier this month.

But due to the marginal system, the country would not return to a Clinton-era tax code. Obama favors keeping the lower rates established by Bush for all earnings under $250,000 for at least one year. Even the wealthiest who would sacrifice a little more for the good of the federal budget would still benefit from those lower rates.

If the full Clinton tax code was restored, those same families earning $250,000 to $300,000 could have legitimate reason to protest. Their bill to the IRS would surge by $10,259, according to Citizens for Tax Justice.

“We’re a little amazed by this actually,” said Steve Wamhoff, legislative director for the organization. “There are some people who don’t realize that Obama would be extending tax cuts for a lot of wealthy people.”

The nature of the debate is muddled a bit by a host of other tax issues that shape the blitz of competing economic studies and analyses. For example, an Ernst & Young study released this month on by the National Federation of Independent Business includes in its model—which projects the loss of 700,000 jobs— a separate tax increase associated with Obamacare.

What’s clear is that the further up someone is on the economic food chain, the more those Bush-era cuts disappear and the higher the tab with the IRS. In other words, the political debate is really about whether multi-millionaires and billionaires should face a substantially higher tax burden, rather than those with relatively generous salaries but middle class lifestyles.

The Tax Foundation calculator estimates that a typical two-child household with $400,000 in salary and investment income would pay $3,541 more in taxes under Obama. Those figures build to the point that a family earning $10 million to $20 million would see their bill balloon by almost $700,000.

And that reflects the underlying philosophical difference between Obama and Romney. To Romney, this group includes job creators whose business incomes are taxed at individual rates (pass-through taxation). These include partnerships in professions like law and medicine as well as small individual business owners who may not hire additional workers if their incomes are dramatically reduced. By contrast, Obama looks at the economic troubles across his time in office and concludes that prosperity will not trickle from the top, saying this month, “We’ve tried it their way. It didn’t work.”