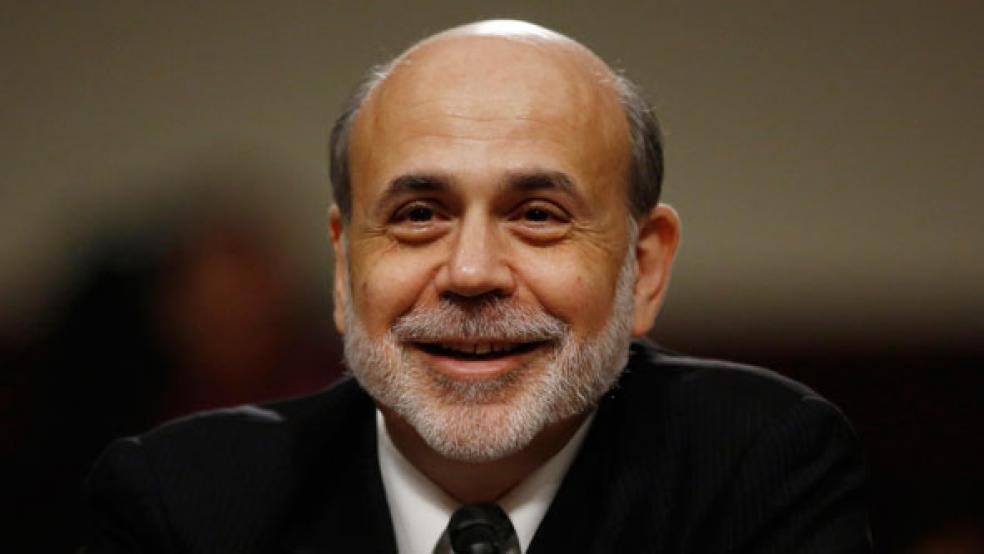

Federal Reserve Chairman Ben Bernanke on Friday said the U.S. economy faced "daunting" challenges and that progress reducing unemployment had been too slow, but he stopped short of providing a clear signal of further monetary policy easing.

Bernanke said the central bank would act as needed to strengthen the recovery but he also said it had to weigh the costs as well as the benefits of more monetary stimulus, although he hinted the costs may be worthwhile. "It is important to achieve further progress, particularly in the labor market," Bernanke said at the Kansas City Fed's annual Jackson Hole symposium. "Taking due account of the uncertainties and limits of its policy tools, the Federal Reserve will provide additional policy accommodation as needed to promote a stronger economic recovery and sustained improvement in labor market conditions in a context of price stability."

That was a somewhat weaker hint of policy easing than the minutes of the Fed's last policy meeting had delivered. At that meeting, many members judged that "additional monetary accommodation would likely be warranted fairly soon" unless the economy showed substantial strengthening.

Bernanke, however, made clear he was not satisfied with the economy's progress. "The stagnation of the labor market in particular is a grave concern not only because of the enormous suffering and waste of human talent it entails, but also because persistently high levels of unemployment will wreak structural damage on our economy that could last for many years," he said.

U.S. stocks initially pared gains but soon moved higher as investors digested Bernanke's remarks. Investors had been bidding up stock prices in recent weeks on expectations the U.S. central bank would launch a new round of bond buying soon.

Prices for U.S. government bonds rose and the dollar hit session lows against the euro.

"These headlines seem to capture the essence of a more dovish Bernanke than we expected -- 'grave' concern with labor market is striking," said David Ader, head of government bond strategy at CRT Capital Group in Stamford, Connecticut.

DOWNPLAYS RISKS OF UNCONVENTIONAL POLICIES

Bernanke downplayed the potential risks from the Fed's unconventional policies and argued that the asset purchases had been quite effective at boosting economic growth and fostering job creation. "The costs of nontraditional policies, when considered carefully, appear manageable, implying that we should not rule out the further use of such policies if economic conditions warrant," Bernanke said.

In response to the financial crisis and recession of 2007-2009, the Fed cut official rates to zero and bought $2.3 trillion in government and mortgage securities. It next meets on September 12-13.

The economy emerged from recession nearly three years ago, but growth has remained tepid. U.S. gross domestic product grew at a 1.7 percent annual rate in the second quarter, too weak to bring down the nation's 8.3 percent unemployment rate. "Unless the economy begins to grow more quickly than it has recently, the unemployment rate is likely to remain far above levels consistent with maximum sustainable employment," Bernanke said.

U.S. economic data has improved since the Fed's meeting, which came before a stronger-than-expected reading for July employment. Reports on retail sales, exports and housing have also been relatively solid. Data on consumer spending for July on Thursday showed the strongest reading in five months.

The data has led some market participants to dial back their expectations of a fresh round of bond purchases when the Fed meets in September.

As an alternative, many economists say, the Fed may simply push further into the future the date it thinks it will finally start to move interest rates higher. The central bank has said since January that it expects to keep rates near zero at least through late 2014.