Uncertainty over the economic outlook has added between one and two percentage points to the U.S. unemployment rate since 2008, according to an estimate from the San Francisco Federal Reserve Bank.

The finding, published on Monday in the regional Fed bank's latest Economic Letter, quantifies for the first time the drag that uncertainty has had on the economy since the Great Recession.

"Had there been no increase in uncertainty in the past four years, the unemployment rate would have been closer to 6 percent or 7 percent than to the 8 percent to 9 percent actually registered," wrote San Francisco Fed research advisors Sylvain Leduc and Zheng Liu.

The Fed sent short-term interest rates to zero in December 2008 to counter the deep recession, and bought trillions of dollars of bonds to further lower long-term interest rates.

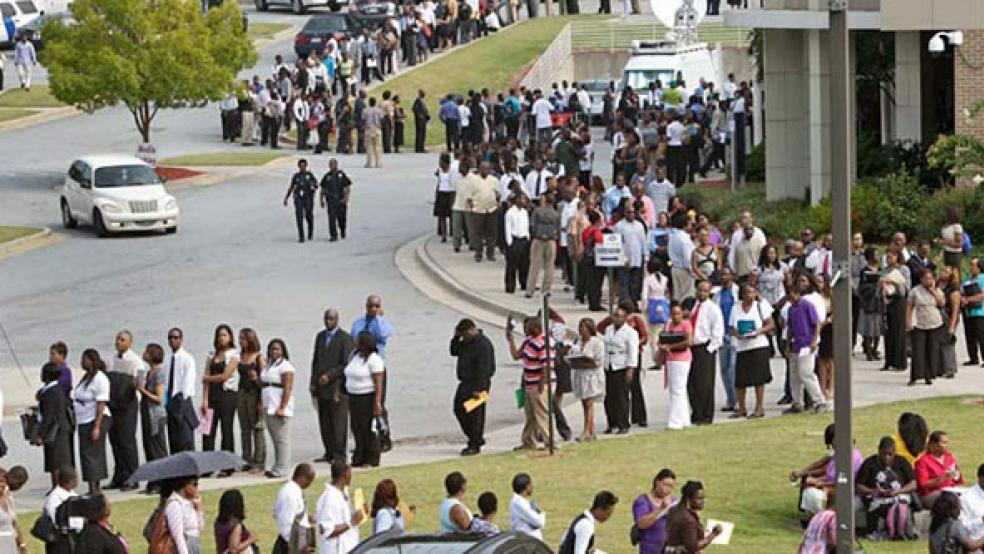

But unemployment has remained stuck above 8 percent a full three years after the start of recovery. Last week the U.S. central bank embarked on a fresh round of bond-buying, saying it will not stop the purchases until it sees substantial improvement in the job market.

Inflation hawks have opposed the new effort at quantitative easing. Some, including Dallas Fed chief Richard Fisher, have argued that new monetary stimulus will be useless because it is uncertainty over taxes and regulation rather than the level of borrowing costs per se that is holding back the economy.

RELATED: QE3: Will the Fed's New Plan Really Help Housing?

The research published Monday offers empirical evidence that uncertainty has indeed deepened the recession and slowed the recovery, elevating the jobless rate despite the Fed's efforts to bring it down.

It does not suggest that monetary policy is helpless in the face of uncertainty, but only that its ability to counteract uncertainty is limited when rates are already near zero.

Uncertainty acts on the economy like a drop in overall demand, holding back economic activity and inflation at the same time, the researchers found. It is not always a factor in recessions: it played almost no role in the 1981-1982 recession or the recovery that ensued, the same research showed.

When it does come into play, policymakers are usually able to offset the economic drag the same way they counter a drop in demand, by lowering interest rates.

During the recent recession they were unable to do so because interest rates were already near zero. "Because nominal rates cannot go significantly lower than their current near-zero level, policy is less able to counteract uncertainty's negative economic effects," they wrote.

Their research used a statistical analysis of consumer confidence surveys in the United States and the United Kingdom, CBOE Holdings Inc's VIX fear index, and macroeconomic data like inflation and unemployment rates.

Chairman Ben Bernanke has acknowledged that uncertainty has kept firms from hiring, but does not believe that fact should keep the Fed from doing what it can to help. "I can certainly confirm that as the Reserve bank presidents and governors made their reports today and yesterday around the table, there was considerable discussion of ... fiscal policy uncertainty and the implications of that for hiring and investment decisions," Bernanke said last week after the Fed's policy-setting panel voted 11-1 to ease policy further. "It is something that is affecting behavior now."