Three years after a recession-ravaged public held back spending on health care, health insurance premiums are finally beginning to reflect the change. It is especially welcome news for small and medium-sized businesses, whose health insurance plan costs will rise 5 percent on average this year, down from 8.2 percent a year ago, a new survey shows.

Premium increases will range from 4.1 percent to 6.0 percent, according to a survey by United Benefit Advisors. Members of UBA collected responses about health plans from 11,711 employers with 1.1 million employees and nearly 5 million covered lives.

The survey parallels findings from the annual Kaiser Family Foundation survey of more than 2,000 firms, which was released last week. It showed price increases for employer-provided family plans will rise by 4 percent this year, down from a 9 percent increase in 2011. The average plan will cost $15,745.

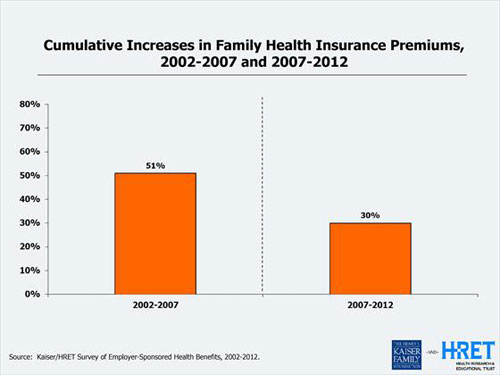

A hopeful sign, for sure. Still, the average plan has increased 97 percent since 2002, a near doubling in a decade. The KHF survey pointed out that growth was nearly three times faster than employee wages and more than three times faster than general inflation. Money that employers shell out for higher health insurance premiums is one reason for wage stagnation.

“It is a welcome change,” said Bill Stafford, vice president of member services for UBA. “But sustainability is an issue. I don’t think after the election we’ll see a continuation. You can only push off costs for so long.”

“Health care use and the economy have always been closely tied, and my sense is that the recession and slow recovery are responsible for much of the recent health spending and premium trends,” said Drew Altman, president of the Kaiser Family Foundation, in his latest column. “Increases in recent years in cost sharing through high deductible plans have probably played a supporting role. In tough times, when wages are flat, people avoid using the health care system if they can.”

The slowdown in price increases for private sector plans parallels the overall trend in health care costs, which includes public programs like Medicare and Medicaid. The last three annual reports by actuaries at the Centers for Medicare and Medicaid Services have shown annual health care spending increases hovering around four percent. CMS officials also cite the economic downturn and consumer reluctance to shoulder the rising cost of co-pays and deductibles as the main factors driving a slowing rate of increase in health care utilization.

However, some analysts say provisions of the health care reform law may be contributing. New medicalloss ratio regulations now in effect limit what insurance companies can charge small businesses for administration, marketing and profits to 20 percent of overall premiums. Larger plans are limited to spending 15 percent on overhead. “The President was right: health reform is slowing the growth of medical spending,” said Harvard health economist David Cutler, a fellow at the Center for American Progress and a former adviser to the Obama administration.

“A certain amount has to be spent on beneficiaries, so less is going to administration,” agreed Elliot Dinkin, president of Cowden Associates in Pittsburgh, which advises small and mid-sized firms on their health insurance coverage choices. “If you’re conscientious of that factor, you are a little more reluctant to pass costs along.”

TEMPORARY RELIEF, NOT A CURE, UNLESS….

However, count UBA officials among the skeptics who believe the pace of health care cost increases will quicken once the economy begins humming again. “There aren’t many real cost control measures in the Affordable Care Act,” said Stafford. “And you still have all the issues around obesity and life style factors, which drive 70 to 75 percent of all costs. Until we find ways of getting serious about that, you’ll see continued growth in the premiums that insurance companies have to charge.”

Yet a new report from the Institute of Medicine released earlier this month suggested there are plenty of ways of lowering costs without affecting the quality of care or meeting the health care challenges of an older, fatter nation. The comprehensive report put the imprimatur of the prestigious IOM on previous estimates that about 30 percent of all health care spending or about $750 billion a year is wasted.

For example, poor performance by the nation’s 5,000 hospitals results in one of three patients being unnecessarily harmed during their stays, the report noted. One in three Medicare patients are re-hospitalized within 30 days of being discharged.

Performance between hospitals within the same city and between states can vary widely. One study cited in the report estimated 75,000 deaths a year could be avoided if every state delivered care at the quality level of the best-performing state.

The report called for greater coordination of care for people with chronic health conditions like diabetes, heart disease and arthritis; greater use of electronic medical records; ending unnecessary and duplicative tests and procedures; and better use of data to improve the health care system – similar to the way manufacturers used statistical process control to improve quality during the 1980s and 1990s. The report’s recommendations mirrored many of the initiatives contained in the 2009 stimulus act and the 2010 Affordable Care Act as pilot projects.

The IOM committee, whose 18 members included leaders of academic medical centers, physicians, business groups and consumer groups, said pilot projects won’t be enough to reform the health care system. “It's time to get all hands on deck," said committee chair Mark D. Smith, president of the California HealthCare Foundation."Our health care system lags in its ability to adapt, affordably meet patients' needs, and consistently achieve better outcomes.”