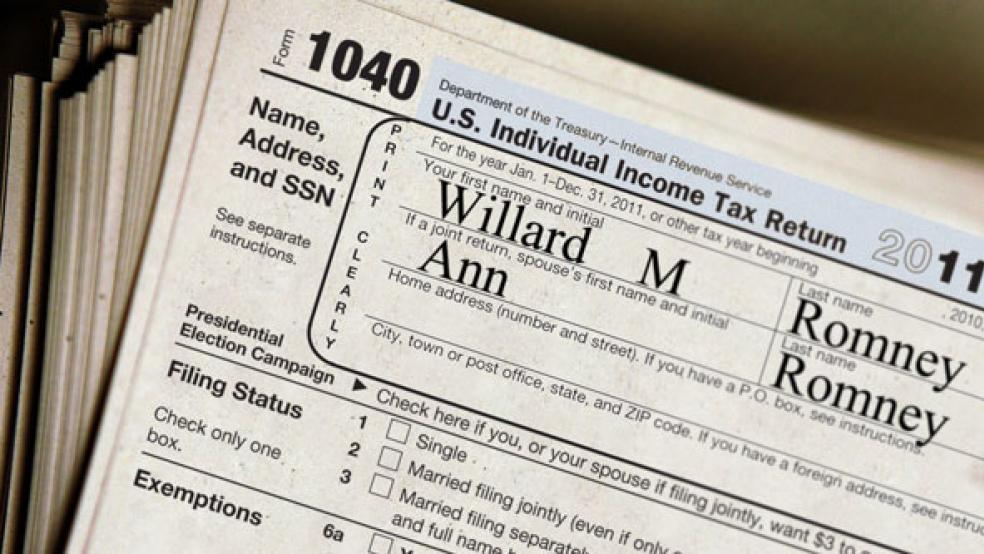

Republican presidential candidate Mitt Romney paid $1.9 million in taxes on more than $13 million in income in 2011 for an effective tax rate of 14.1 percent, his campaign said on Friday ahead of the promised release of the full return later in the day.

Fighting back against Democratic claims he paid little or no taxes in earlier years, the Romney campaign also plans to release a letter from accountants saying he paid an average effective federal tax rate of 20.2 percent over the 20-year period ending in 2009.

Democrats led by Senate Democratic Leader Harry Reid have questioned whether Romney paid taxes in at least some of those earlier years. Despite heavy political pressure, Romney has refused to release his earlier returns.

President Barack Obama and his Democratic allies have used Romney's refusal to release more returns as evidence that he is an out-of-touch millionaire.

Romney, who faces Obama in the November 6 election, earns the majority of his income from investment profits, dividends and interest, which is taxed at a lower rate than wage income, which is taxed at a top rate of 35 percent.

Romney released his 2010 return in January, which showed he paid an effective tax rate of 13.9 percent, and promised to release his 2011 return before the election. A summary of the 2011 return said Romney donated about $4 million to charity in 2011, amounting to nearly 30 percent of their income.

The release on Friday, traditionally a day when politicians release information they hope will not attract heavy news coverage, comes after a brutal week for Romney's campaign.

A secretly recorded video was released earlier in the week showing Romney denigrating the 47 percent of Americans who would back Obama "no matter what" as government-dependent victims. That followed last week's fumbled response to attacks on U.S. compounds in Libya and Egypt.

Romney's campaign said the lowest annual effective federal personal tax rate Romney paid over the 20 years was 13.66 percent, and over the entire 20-year period he and his wife Ann gave to charity an average of 13.45 percent of their adjusted gross income.

In refusing to release the full returns from earlier years, Romney said it would just give Democrats "hundreds or thousands of more pages to pick through, distort and lie about."

The Obama campaign released an ad earlier in the year questioning the decision and noting Romney's accounting techniques and tax havens to minimize his tax burden.

Reporting by Alistair Bell and John Whitesides