Even if the country doesn’t slide over the fiscal cliff, any deal to blunt the impact of the scheduled tax hikes and spending cuts is likely to create at least some drag on an economy that is still growing only modestly. The full package of changes set to take effect in January would suck more than $600 billion out of the economy, according to the Congressional Budget Office. And while the outlines of any deal are still sketchy to say the least, Goldman Sachs economists are modeling a $233 billion economic hit as their “base case scenario.”

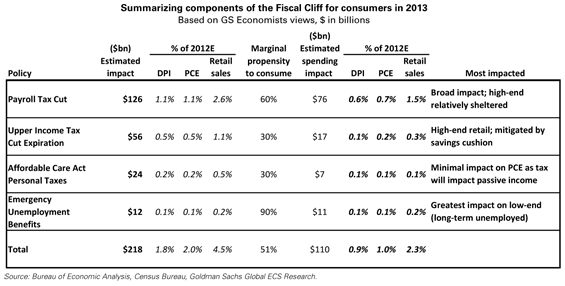

Most of that impact, $218 billion, would hit you where it hurts: your wallet. “Given the range of items in our base case fiscal cliff forecast, consumers across the spectrum would be impacted,” Goldman analyst Matthew Fassler wrote in a note published on Friday.

The biggest dent would come from the expiration of the payroll tax cut, with a total cost of $126 billion.

Goldman calculates that a $218 billion loss in consumer income would translate to a $110 billion bite to consumer spending. Based on past history, Fassler writes, “categories that could be most impacted include autos, consumer electronics, home furnishings, home improvement, lodging and gaming, specialty apparel, and sporting goods. Categories that could be least impacted include drug stores, food, and tobacco.”

While consumers have been less concerned about the fiscal cliff than businesses, they may be starting to show signs of anxiety about the upcoming policy changes as a steady drumbeat of media coverage plays up the year-end deadline. A new holiday shopping survey by the Consumer Electronics Association, the trade group promoting tech gadget makers, found that the average American adult will spend $218 just from Thursday through Monday, up sharply from $159 last year.

At the same time, just over half (51 percent) of those surveyed said they would curtail their overall holiday spending this year because of risks they see in the fiscal cliff. Nearly one in five consumers said the cliff “was going to have a large impact on their overall spending this holiday,” according to the electronics group.

Those lost sales are precisely why Matthew Shay, the president and CEO of the National Retail Federation, sent a letter to President Obama a week ago urging quick action – “preferably before Thanksgiving” – to avert the fiscal cliff. “Many retailers rely on the holiday season for a quarter of their annual sales, and any disruption to consumer confidence and spending during this season could prompt a crisis for retailers and the millions of U.S. jobs the industry supports,” Shay wrote.

“Demonstrating the ability to work in a bipartisan manner will ease consumers’ worries and avoid severe economic consequences during the single most crucial spending season of the entire year.”

Before the cliff negotiations between Obama and congressional leaders began on a somewhat optimistic note last week, the retail trade group had forecast that holiday sales would increase 4.1 percent to $586.1 billion this year. But, similar to the Consumer Electronics Association’s findings, a National Retail Federation survey of more than 3,300 adults conducted in early September found that about 57 percent knew what the fiscal cliff was and 64 percent said that “the current political and economic uncertainty” was weighing on their spending plans. In an early October conference call with the media, Shay had warned that Congress’s inability to act could be “the Grinch that stole Christmas.”

Analysts at Moody’s Investor Service were more optimistic that consumers wouldn’t let the policy Grinches in Washington completely spoil their holiday shopping plans. “Consumers typically want to celebrate the holidays by shopping, and in the past have shown their ability to ignore negative fiscal policy headlines during the end-of-year shopping season," Margaret Taylor, Margaret Taylor, a Moody's senior credit officer, said in a statement.

Still, the Moody’s analysts said consumers are likely to “rein in” their spending compared with last year – Moody’s is projecting holiday sales growth of about 4 percent, down from 6.5 percent in 2011 – “and are likely to pull back further in the first quarter of the new year.”