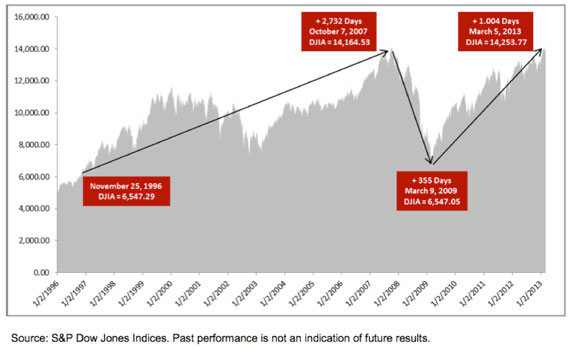

When is a stock market record not a record? Investors may have shrugged off the latest round of Washington’s fiscal follies to finally push the Dow Jones industrial average above its nominal all-time high set in October 2007, but by a couple of measures the new closing record of 14,253.77 set Tuesday isn’t quite as momentous a milestone.

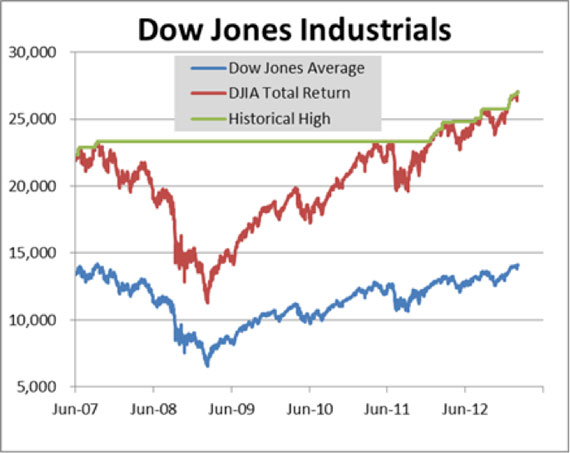

First, as Daniel Wiener, chairman and CEO of Adviser Investment Management, points out, dividends count. Factoring in those dividend payments along with stock price changes, the Dow reached a new record on April 29, 2011 and then went on to set 31 more record highs in 2012 and 16 more records in 2013. “On a total return basis, the Dow Total Return Index has actually been setting highs regularly since 2011,” Wiener wrote yesterday.

Source: Daniel Wiener/Adviser Investments

On the other hand, factoring in inflation over the last five and a half years leaves the index about 10 percent shy of the record. The Dow would have to get to 15,502 to match the inflation-adjusted level from October 2007, according to JPMorgan Chase. But adjusting for inflation also leaves the October 2007 peak shy of the real record reached in January 2000, when the Dow nominally hit 11722.98. To reach a new record when adjusting for inflation using 1994 dollars, the Dow would have to reach 16052.22, or 13 percent above Tuesday’s close, according to The Wall Street Journal. Even including dividends, the index would have to rise several percentage points more to set an inflation-adjusted high.

The record books might have a new entry as of yesterday, but investors paying attention to the real-world returns they’re getting will have to wait to celebrate.