Freddie Mac (FMCC.OB), the No. 2 provider of U.S. mortgage money, posted its second-largest quarterly profit in company history in the first quarter due to rising home prices, falling mortgage delinquencies and increased refinance activity.

For the first three months of the year, the government-controlled company on Wednesday reported net income of $4.6 billion, up from $577 million in the year-ago quarter. It was the company's sixth straight quarter of profits, and the largest since a $5.7 billion gain in the third quarter of 2002.

Freddie Mac, which faced insolvency when it was seized by the U.S. government in 2008, paid $5.8 billion to the U.S. Treasury in the first quarter as a dividend payment under the terms of its government bail-out.

RELATED: Guess Who Benefits from New Asset Bubbles?

It said it would face another $7 billion payment in June based on its current net worth, and suggested it could record gains in the second quarter on billions of dollars worth of assets it had written down, leading to an even bigger payment. "The strong rebound in the housing market of which we're all aware continues to be reflected in our excellent financial performance," Freddie Mac Chief Executive Officer Donald Layton told reporters on a conference call. "We expect that the housing recovery will continue to bolster our financial performance."

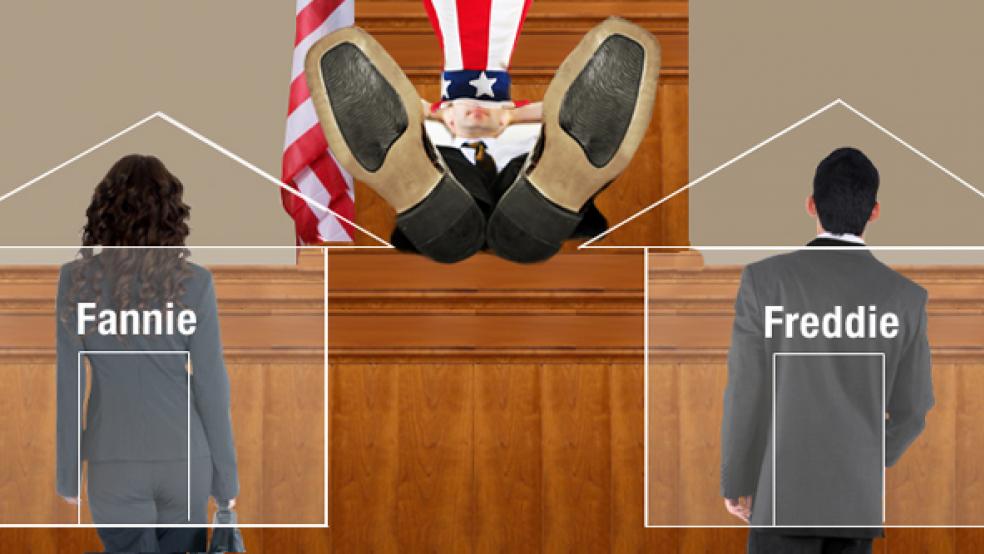

Freddie Mac and its larger rival Fannie Mae (FNMA.OB), which together own or guarantee about half of U.S. home loans, have been sustained by taxpayer support since September 2008, when they were placed in a government conservatorship. The two state wards' return to profitability has taken the heat out of efforts to lay a new base for the future of the nation's housing finance system. The Obama administration outlined three broad approaches in 2011, but has stopped short of saying which route it would prefer.

RELATED: Why Paul Ryan Wants to Dump Fannie and Freddie

Meanwhile, lawmakers in Congress, both Democrats and Republicans, think Fannie Mae and Freddie Mac should eventually be wound down. However, there is no agreement about what should take their place or how large a role the government should play in making sure mortgage credit is available.

The companies have drawn $187.5 billion from the Treasury since being seized. Freddie Mac has now paid $29.6 billion in dividends to the Treasury since conservatorship began, while Fannie Mae has paid almost $36 billon.

Fannie Mae, which has yet to post its first-quarter results, reported 2012 net income of $17.2 billion, its largest annual profit ever and the first in six years.

Under new bailout terms that went into place this year, Freddie Mac and Fannie Mae must turn over most of their profits to the government. Previously, the two were required to pay a 10 percent dividend even if they faced a loss and in some quarters, they had to draw on taxpayer funds just to make the payment even if they had a small increase in net income.

Now that both companies are enjoying record or near-record profits, they have become a steady source of revenue. Their return to profitability has allowed them to consider booking gains from so-called deferred tax assets that they had written down, which would increase their net worth and lead to large one-time payments to the Treasury.

Freddie Mac decided in the first quarter not to reverse about $30.1 billion in the write-downs of its deferred tax assets, but it suggested it might reverse the write-down as early as next quarter. "The company currently expects that we will no longer be in a three-year cumulative loss position," it said.

Fannie Mae is weighing whether to reverse a write-down on about $60 billion.

This article is by Margaret Chadbourn of Reuters.