We really do have to worry about the federal budget. Really.

A long-feared fiscal crisis that could shut down the government is rapidly coming to a head, as House Speaker John Boehner and President Obama on Wednesday each staked out rigid positions on spending, the debt ceiling, and the future of the Affordable Care Act, known as Obamacare.

Congress now has until Sept. 30 to approve a stopgap measure to keep the government operating. Treasury Department officials warn that – without hiking the debt ceiling – the government could begin to default on its obligations as early as mid-to-late October.

Under pressure from about 40 conservative and Tea Party members of the GOP caucus, Boehner (R-OH) said today the House would vote on Friday to keep the government open through Dec. 15, provided funding is eliminated for Obamacare. The bill is meant to stop enrollment in the program’s insurance exchanges, scheduled to be fully operational on Oct. 1.

“The law is a train wreck,” Boehner said of Obamacare. “The president has protected American big business. It’s time to protect American families from this unworkable law.”

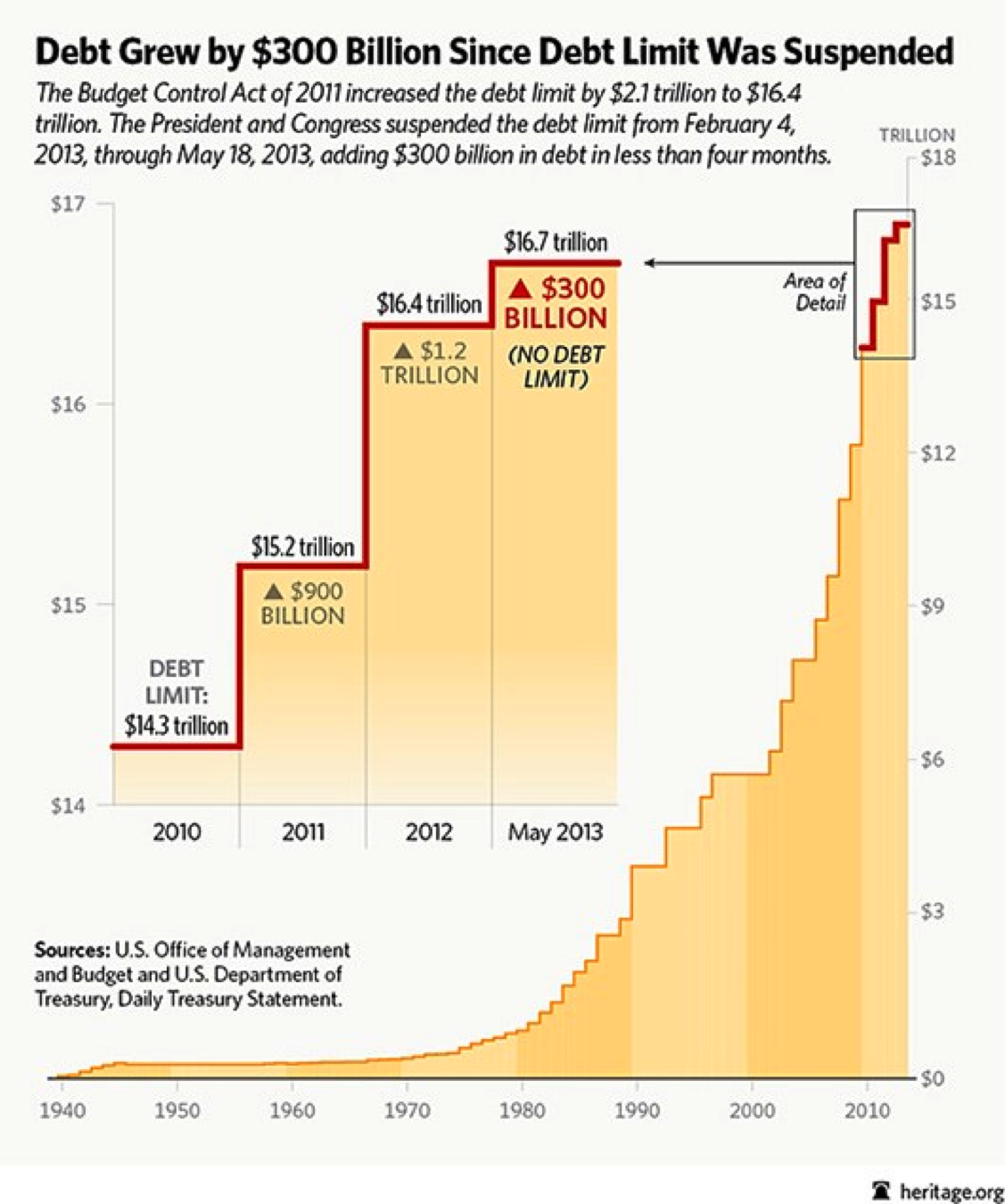

House Majority Leader Eric Cantor (R-VA) also unveiled a package of other legislative demands that he said would be attached to a bill that would raise the current $16.7 trillion debt ceiling, including a delay in Obamacare, an overhaul of the tax code, and an approval of an energy pipeline running from Canada to the Gulf Coast.

NO BARGAINING CHIP

A resolute Obama, appearing before a prominent group of business leaders, declared again that the debt ceiling should not be used as a bargaining chip.

“What we now have is an ideological fight that’s been mounted in the House of Representatives that says we’re not going to pass a budget, and we will threaten a government shutdown unless we repeal the Affordable Care Act,” Obama told the Business Roundtable in Washington. “We have not seen this in the past, that a budget is contingent on us eliminating a program that was voted on, passed by both chambers of the Congress, ruled constitutional by the Supreme Court, [and] is two weeks from being fully operational.”

Obama said he’s willing to negotiate the terms of a new budget for the coming fiscal year and address Republican concerns, including the projected long-term explosion in the cost of Medicare, Medicaid and other entitlement programs. “I am prepared to look at priorities Republicans think we should be promoting and priorities they think we shouldn’t be promoting,” he added.

“What I will not do is to create a habit, a pattern, whereby the full faith and credit of the United States ends up being a bargaining chip to set policy,” he said. “It’s irresponsible. The last time we did this in 2011, we had negative growth at a time when the recovery was just trying to take off and it would fundamentally change the how American government function.”

FEW PARALLELS

The mounting fiscal crisis has few parallels in budget warfare history. For the past two years, Obama and his Republican foes have tangled bitterly over the best approach for controlling the deficit, which soared well above $1 trillion a year throughout the president’s first term. The dispute was largely over how deeply to cut into domestic and defense programs, how to tame entitlement growth, and whether or not to raise taxes on wealthy Americans.

With the deficit now projected to temporarily decline over the next few years before accelerating, Republicans have shifted their focus from spending and tax issues to the fate of Obamacare. They’re demanding the administration agree to put the program on hold – or kill it outright – in return for GOP cooperation in raising the debt ceiling and keeping the government operating beyond Sept. 30.

The new tactic carries enormous risks for the Republicans, who likely would be blamed by the public for a government shutdown or, worse, an unprecedented default on U.S. debt, according to polling and political analysts. Experts and economists largely agree that hitting the borrowing limit could seriously hurt the economy.

The Bipartisan Policy Center reported that even a temporary delay could cost at least $20 billion, as well as another credit downgrade like the one from Standard & Poor’s that followed the 2011 battle.

Yet the political implications of a debt crisis are far from clear-cut. A recent Wall Street Journal/NBC poll shows that just 22 percent of respondents said they believe lawmakers should hash out a deal to raise the debt limit, while 44 percent oppose increasing the government’s borrowing authority.

WORKERS ON THE EXCHANGES: A GROWING TREND

The Obamacare predicament comes as multiple companies have expressed interest in having their employees enroll in the exchanges. Walgreen, Sears, and Darden Restaurants have all proposed having their workers on the exchanges, while IBM and Time Warner have indicated they would shift retirees from company plans to the exchanges, according to The Wall Street Journal.

CBO anticipates that companies will move 2 million of their employees onto the exchanges next year, a figure projected to reach 8 million by 2018.

The outcome of a budget breakdown could be far worse than in 2011, when Congress and the White House came within days of a Treasury default before nailing down a deficit reduction agreement.

“It’s like a bunch of kids playing with matches and everyone saying they haven’t lit their pants on fire the last time they did this, so let’s hope they don’t do it this time,” said former CBO Director Robert Reischauer. “There’s no assurance.”

The Fiscal Times’ Josh Boak contributed to this report