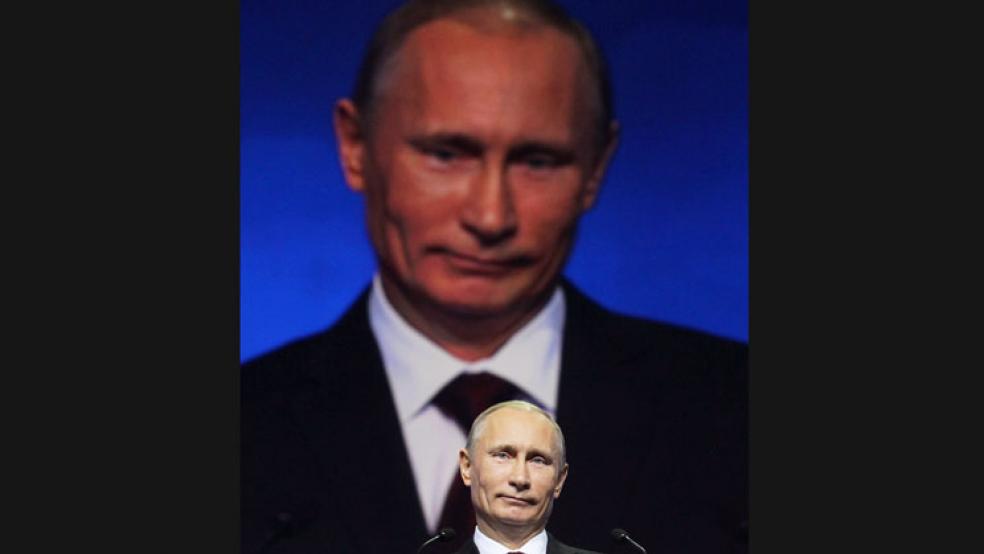

Another round of sanctions against Russia announced Monday morning make it clear that the Obama administration’s game plan remains the same: to make life uncomfortable for the oligarchs in President Vladimir Putin’s inner circle while limiting the damage to the overall Russian economy.

The new round of sanctions targets seven individual members of the Russian government and 17 businesses, including three banks, all of which were added to the list of “specially designated nationals” maintained by the Treasury Department’s Office of Foreign Assets Control. U.S. individuals and U.S.-based companies are not allowed to do business with individuals and entities on that list.

Related: Economic Sanctions Are “Wounding” Russia’s Economy

An earlier round of sanctions had effectively shut down the international business of St. Petersburg-based Bank Rossiya, which provided financial services to the Russian political elite and businesses in the country’s essential energy sector. The sanctions announced Thursday appear to be in the same vein.

Among the individuals targeted are Vyacheslav Volodin, Putin’s chief of staff; Sergei Cemezov, the director general of the state-owned technology export firm Rosnet; Igor Sechin, the chairman and president of state-owned petroleum company Rosneft; and Evgeniy Murov, the director of Russia’s Federal Protective Service and a general in the army.

Among the businesses are several banks, construction and transportation firms, and companies connected to Russia’s oil and gas production industries.

U.S. officials say the sanctions were imposed because Russia has not taken steps to enforce an agreement reached in Geneva earlier this month that sought to deescalate the crisis in Ukraine. After Russia’s annexation of the Crimean peninsula earlier this year, pro-Russian militants have taken over buildings – and in some cases, whole towns – in the eastern part of Ukraine, and are calling for Russia to annex that Area as well.

Related: Putin Divulged His Plot to Reunify the USSR Years Ago

The Geneva agreement had obligated Russia to not provide support to the separatists and to take steps to persuade them to stand down.

Calling Russia’s acts in Ukraine thus far “illegal and illegitimate,” Treasury Secretary Jack Lew on Monday announced the new round of sanctions. “Since Russia has refused to follow through on its Geneva commitments, today the United States is following through on its statements – we are imposing additional costs against Russia, including sanctions on individuals in the Russian leadership’s inner circle and 17 entities closely linked to previously sanctioned members of the inner circle.”

Lew went on to claim that the sanctions imposed so far have contributed to a downturn in the Russian economy. “Russian economic growth forecasts have dropped sharply, capital flight has accelerated and higher borrowing costs reflect declining confidence in the market outlook,” he said. “Our goal continues to be for Russia to deescalate the situation so that additional sanctions are not needed. However, we are resolved to continue to work with our international partners and take the steps required, including action against individuals and entities in specific sectors, if Russia continues to press forward.”

Related: World Leaders Mull More Sanctions as Markets Punish Putin

While the sanctions in place now have certainly had some effect on Russia’s economy, it is not clear that they deserve most of the credit. The private sector has been pulling money out of Russia on concerns about stability and the prospect of a military confrontation with Ukraine that could spread to other parts of Europe. Investors have been unwilling to buy Russian bonds except at extremely high risk premiums, which has forced the country’s Finance Ministry to withdraw proposed bond sales.

While the Obama administration has avoided the kind of sanctions that would be outright crippling to Russia, that does not mean those imposed Monday will have no impact. Tagging people and companies with the “specially designated national” label makes it illegal for U.S. companies, including U.S. banks, to do business with them, and that can have an impact that extends far beyond the United States.

For example, a large percentage of international wire transfers are routed through banks based in the U.S. It is now illegal for U.S. banks to process transactions connected to any of the people or companies on that list, so they will not just be policing just their own accounts, but will also require the non-U.S. banks that use their networks to attest that they do not do business with Specially Designated Nationals either.

The practical effect of this is that, for many, if not all of the people and entities on the list, doing business and traveling internationally will become very difficult, if not impossible. Firms that value their connection to the U.S. economy will no longer want to take the risk that providing them services, for fear of U.S. businesses concerned about federal penalties cutting them off.

Top Reads from The Fiscal Times