Reigning celebrity economist Thomas Piketty first gained attention in the U.S. through his income concentration trend estimates. Piketty, an economist at the Paris School of Economics and author of the best-seller Capital in the Twenty-First Century, collaborated with University of California-Berkeley economist Emmanuel Saez to produce the figures, which go back one hundred years. Along with Piketty’s book, the Piketty-Saez research represents a great achievement in data collection and compilation.

Prior to the publication of their figures in the early 2000s, only scattered attempts to analyze trends in income concentration existed; none of them took the data as far back as Piketty and Saez did or as far forward. Piketty and Saez improved on the basic methods used by their predecessors, and they provided a multitude of trends in a spreadsheet that continues to be updated and made available to the public.

However, while their estimates are potentially the best that can be made given the scope of their project, as indicators of the run-up in income concentration since the 1970s, they have a number of potential problems. In a previous essay, I described how their estimates are affected by a number of measurement and conceptual issues. Their figures are for “tax units” rather than households. They do not include government benefits or employer-provided health insurance, and they look at pre-tax income. In other words, they do not account for the main ways in which we mitigate income concentration via public policy.

These issues overstate income concentration levels and even exaggerate the increase over time. Finally, the difficulties involved in measuring capital gains and losses that accrue to assets potentially overstate the increase in income concentration dramatically. Capital gains show up in the Piketty-Saez data as giant lumps of income accruing to the top one percent when asset markets are booming, but that obscures the slower and steadier accumulation of gains over time (and nearly all of the gains to middle-class households, which do not appear in the tax data).

Given the problems with estimating capital gains, it is worth considering whether there might be other income concentration measures that do not require grappling with these conceptual and measurement problems. Since capital gains accrue mainly to the top, looking at income concentration measures that fail to take them into account will understate the level of income concentration in America. However, the trends might not necessarily be affected.

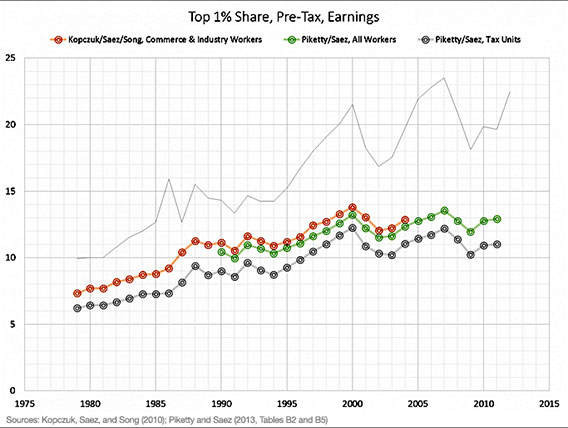

The chart below provides several trendlines for earnings concentration in the U.S. The basic Piketty-Saez income concentration series is included for context, shown alongside other series the two have created and one from another paper by Saez. From 1979 to 2007, the increase in the top one percent of workers’ share of earnings was from 7 percent to 14 percent, and the increase in the tax-unit earnings of the top one percent of tax units was from 6 percent to 12 percent. (Tax units are tax returns, with non-filers’ incomes estimated and added in. A married couple filing jointly is a single tax unit, while single taxpayers and married couples filing separately are their own tax units.) Income concentration doubles over the period. There are three points to emphasize from this chart.

First, there really is no escaping the issue of capital gains because income from stock options is sometimes treated as earnings, sometimes as capital gains. Since the Tax Reform Act of 1986, stock options have become an increasingly large part of executive compensation. Stock options give their recipient a chance to purchase company stock in the future at a fixed price, so that if the stock appreciates in the meantime, the employee will stand to profit. Options must be held during a vesting period before being exercised.

Depending on the type of option, the holding requirements and taxation differ. Non-qualifying stock options generally have a short vesting period, and when options are exercised, the difference between the stock price and the price when the options were granted is taxed as ordinary income, showing up as earnings on tax returns. With incentive stock options, so long as they are not exercised prematurely, the only income taxed is the capital gain that is realized after exercising the options and later selling the stock.

The idea behind incentive stock options is that lower capital gains tax rates will be attractive to grantees, and so they will not exercise the option as soon as they could in return for the tax benefit. However, the 1986 tax reform lowered the top ordinary income tax rate from 50 percent to 28 percent and raised the top capital gains tax rate. This change had several effects. It caused some grantees of non-qualifying options to delay exercise them until 1988 or later, it caused some grantees of incentive stock options to exercise them early triggering a tax liability under ordinary income rates, and it made non-qualifying options more popular than incentive stock options after 1986.

The impact of the tax law changes is evident in the above chart, where the share of earnings received by the top jumps two percentage points between 1986 and 1988. This raises a second point: the richest Americans are especially sensitive to tax law changes, and their responses affect measured trends in income concentration. The 1986 to 1988 jump is even more evident in the income concentration trend for pre-tax and -transfer income after capital gains are excluded entirely (not shown).

In addition to the stock option issue, lower individual income tax rates as corporate tax rates stayed in place increased the incentives to organize corporations under Subchapter S of the tax code rather than the traditional Subchapter C. Profits to S-corporation owners appear on individual income tax returns annually rather than on corporate income tax returns. More S-corporations means more income in the tax return data for the richest Americans.

These jumps in income concentration are obviously artificial, but it does not follow that the rise in income concentration is an artifact of tax law changes increasing income from non-qualified stock options and S-corporations. In the absence of the 1986 changes, incentive stock options and sale of ownership shares of C-corporations would have generated larger capital gains income. It may be that the primary effect of the 1986 legislation and other tax law changes is to alter the timing of when income is received at the top without affecting the basic increase in income concentration shown in the tax return data. (I have previously argued that these legislative changes likely do affect the measured trend, but I have come to believe that conclusion is unjustified.)

Nevertheless, the 1986-to-1988 jump should concern us that the top one percent—or the top one percent of the top one percent, which drives the increase in income concentration—are not only sensitive to opportunities for tax arbitrage but able to take advantage of them in ways that may make tracking trends in their income difficult. In particular, the very richest Americans may be able to take advantage of obscure provisions that hide their incomes from the tax data, and changes in tax law and other economic incentives may provide a misleading picture of trends in top incomes.

Since top income tax rates have fallen since the 1970s, the concern is that the incentives for tax avoidance and evasion have fallen. That would cause more income to show up on tax returns rather than being hidden in tax-exempt or tax-deferred forms, or otherwise sheltered from the view of the IRS. In other words, it is possible that part of the apparent increase in income concentration is simply the result of a more transparent picture of incomes at the top. Combine that with the capital gains issue, and it is easy to imagine that Piketty’s view of income concentration trends may be distorted by shortcomings of the data.

Finally, note the change in earnings concentration from 1989 to 2007 among tax units—a rise from 9 percent to just 12 percent (and one that is likely overstated because of the rising share of stock options that shows up as earnings in the tax data). This small increase buttresses the conclusion of Richard Burkhauser and his colleagues that when capital gains are treated appropriately, income concentration did not rise between 1989 and 2007 and may have fallen.

Note the claims being made here. It is likely that income concentration has increased in the United States since the 1970s, but the magnitude of the increase is unclear. Income concentration may not have grown much (or at all) since the 1980s, which would be consistent with the researcher consensus that inequality between the middle class and poor has not increased since then.

Much of Piketty’s case for worrying about inequality lies in extrapolating various trends into the future, but a number of the trends are ambiguous (or not worrying at all). It matters whether income concentration has more than doubled or whether it has increased by a third or less. Sometimes the right conclusion to draw from the data is that we do not know what has been happening. But admitting that weakens the case for a policy agenda built on unjustified certainty.

Scott Winship is the Walter B. Wriston Fellow at the Manhattan Institute for Policy Research. You can follow him on Twitter here.

This article was originally published on e21, a website of the Manhattan Institute, on May 1, 2014.

Read more at e21: