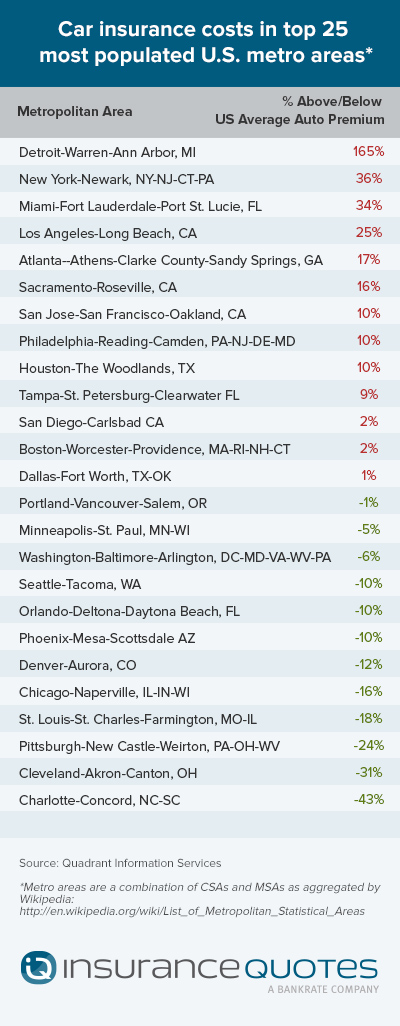

Detroit may have one of the lowest costs of living in the country, but its residents are paying 165 percent more for car insurance than the national average, according to a new analysis by InsuranceQuotes.com.

By comparison, drivers in the New York metro area, the next most expensive city, pay 36 percent more than the national average, and in third-place Miami, they pay 34 percent more.

The average cost of car insurance nationwide was $797 in 2011 (the most recent data available), according to the National Association of Insurance Commissioners.

Motor City residents pay so much more than drivers elsewhere because car insurance in Michigan includes unlimited personal injury protection, and the city has a high percentage of uninsured motorists. “That unfortunately raises the rates for those who do have car insurance,” InsuranceQuotes.com analyst Laura Adams said in a statement.

Related: 5 Things Consumers Don’t Know About Car Insurance

The least expensive cities for car insurance are Charlotte (43 percent less than the national average), Cleveland (31 percent less), and Pittsburgh (24 percent less). Local rates reflect traffic density, accident rates and state regulations.

In addition to shopping around and purchasing a policy at the right time of year, drivers may be able to reduce their premiums by bundling their home and auto policy with the same insurer, increasing their deductible, or switching to a pay-as-you-drive policy.

Also, drivers shouldn’t file a claim unless absolutely necessary, since a single filing can drive rates up an average of 38 percent.

Top Reads from The Fiscal Times: