Did the Facebook (FB) IPO fiasco have a chilling effect on the market for new companies going public? It was actually more like a deep freeze.

After Facebook’s flop, 39 days passed without a U.S. IPO, the eighth-longest such stretch since 2000, according to a new report from IPO research firm Renaissance Capital. So while April was a busy time for new offerings, May and June were very, very quiet.

RELATED: Darrell Issa's Misguided Push to Fix the IPO Process

“Following an active first quarter and the second busiest April for pricings in a decade, the mismanaged Facebook offering and heightened market volatility led to an abrupt, month-long shutdown in the U.S. IPO market,” according to the Renaissance Capital report.

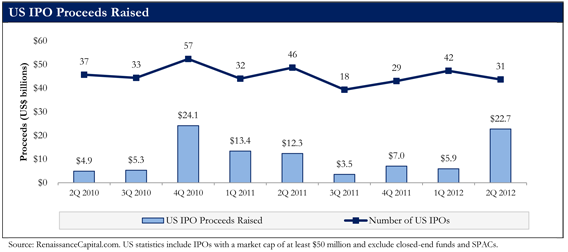

The number of deals in the second quarter – 31 – was off 33 percent from the 46 deals in the same quarter a year ago. The median deal size dropped 7 percent. Excluding the huge Facebook IPO, proceeds dropped 50 percent, according to the report.

But while the Facebook deal fizzled spectacularly and the broader stock market swooned in the second quarter, some IPOs fared much better. Despite a weak stock market, the average total return for IPOs in the U.S. was 7 percent, in line with the 8 percent gains experienced in the second quarter of 2011. “However,” Renaissance explains, “the majority of returns were a result of price discounting, evidenced by the 45 percent of deals that priced below the initial range.”

RELATED: Facebook's IPO Fiasco: 5 Less Than Obvious Losers

Once the stocks were public, the average return was a 2 percent loss. Excluding Supernus Pharmaceuticals (SUPN), which more than doubled last week after the Food & Drug Administration provided tentative approval for its epilepsy drug, the average return was a 6 percent loss, in line with the overall performance of the S&P 500. Other top-performing IPOs included benefit-program provider WageWorks (WAGE), up 63 percent, and digital marketing company Acquity Group (AQ), up 58 percent.

Three “big data” companies also fared well in their first weeks in the market: Splunk (SPLK) jumped 56 percent, Infoblox (BLOX) gained 37 percent and Proofpoint (PFPT) climbed 30 percent.

While Facebook shares, at around $31, remain well below their IPO price of $38, the social media giant wasn’t actually the worst-performing IPO of the quarter. Five newly public companies have done worse, with the poorest performer being PetroLogistics LP (PDH), which bills itself as “the only independent dedicated propylene producer in the United States.” After pricing its IPO at $17 a share, the bottom of its expected range, the stock has slumped to just above $10.