Consumers are racking up credit card debt again. Data released by the Federal Reserve on Monday showed that consumer credit soared by $17.1 billion in May following a $9.95 billion increase in April. The May increase was higher than economists had expected and was the biggest increase in five months. It included an $8 billion rise in revolving credit, the category that includes credit cards. That jump was the highest since November 2007.

Non-revolving credit, including student debt and car loans, climbed by $9.1 billion in May. Loans held by the federal government – mostly student debt – increased by $6.2 billion as lawmakers debated how to pay for keeping interest rates on some educational loans from doubling to 6.8 percent. (President Obama last week signed into law an extension keeping rates at 3.4 percent for another year.)

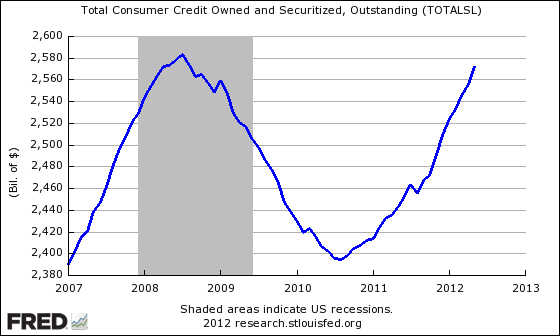

The new credit data may or may not be a sign that Americans are struggling to keep their heads above water as the economy continues to struggle and unemployment has stayed above 8 percent for nearly 3.5 years. Consumer might be putting charges on their plastic because they can’t afford to make those purchases otherwise, or they could just feel more comfortable using their credit cards and making their monthly payments.

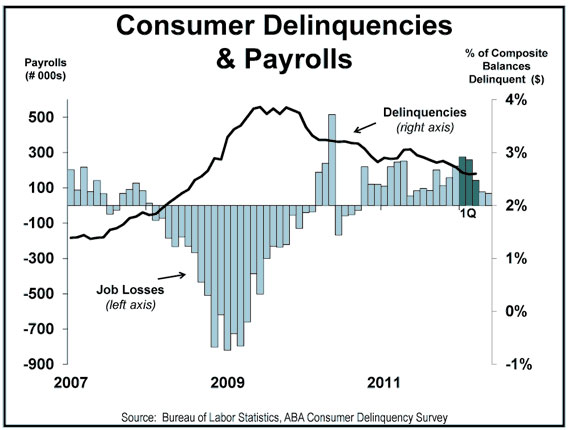

Some other data released last week suggest that consumers made good progress earlier this year in paying down their outstanding debt. The American Bankers Association said that delinquencies – payments 30 or more days overdue – fell during the first quarter of the year in ten of 11 categories it tracks, including personal loans, car loans and bank cards. The only category where delinquencies rose was home equity lines of credit. “This is another strong quarter of improving delinquencies,” the banking group’s chief economist, James Chessen, said in a statement announcing the numbers. “Consumers have done a remarkable job getting their finances under control.” Chessen also noted that the improvements came during a period when rising gas prices might have made it even harder to pay off debt. “Gas prices have fallen 48 cents a gallon since the first quarter so that pressure has abated somewhat and freed up precious resources,” he said.

Even so, Chessen said he expects the improvements to slow some as we head toward 2013 and beyond: “We’ve moved back to historical norms now and further improvement could be hard to achieve.”