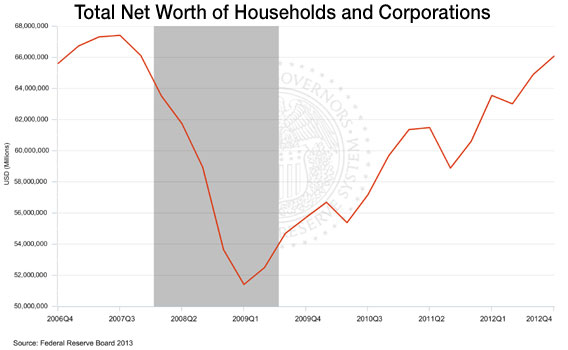

The slow and not-so-steady climb back from the Great Recession is nearing another milestone. The total net worth of U.S. households and non-profits is nearly back to 2007 levels, according to flow of funds data released by the Federal Reserve.

A rebounding housing market and booming stock market helped household net worth climb $1.17 trillion over the fourth quarter of 2012. The increase brought total net worth for households and non-profits up 9 percent from the end of 2011to nearly $66.1 trillion. That’s the highest it’s been since the end of 2007, when the net worth for those categories totaled $66.12 trillion.

Given the continued gains in home prices and the stock market’s strong rally to start the year, we may well have topped the all-time nominal peak of $67.41 trillion, reached in the third quarter of 2007 – remember those good old days?

The value of financial assets owned by U.S. households grew by $784.4 billion in the fourth quarter and by nearly $3.8 trillion over all of 2012. An improving housing market helped considerably. The value of real estate owned by households grew by about $450 billion in the fourth quarter and by $1.4 trillion over the year. Americans’ household equity – the portion of their home values that they own, rather than their mortgage lender – rose to 46.6 percent at the end of 2012, up sharply from 40.5 percent at the end of 2011.

The Federal Reserve, with its quantitative easing program, has been looking to spur consumer demand by creating just such a wealth effect. Yet while the gains illustrated in the chart above indicate that the improvement in household balance sheets continues, the long slog back to break-even comes with a caveat or two. “Even when consumers recover all of their lost wealth,” writes Moody’s Analytics economist Scott Hoyt, “they will have gone nearly six years without any gain.”

Also, the Fed data don’t account for inflation and population growth since the end of 2007. Factoring in those changes, the rebound isn’t as nearly strong as today’s “We’re in the Money” headlines make it seem. Moody’s Analytics economist Scott Hoyt notes that real per capita wealth plunged 27 percent and has recovered less than half of that loss – so while gaining back the $16 trillion lost during the recession is great, household balance sheets on average remain much weaker than they had been before the recession.