• Private-sector companies added only 72,000 jobs per month since April •Second-quarter profits of S&P 500 companies rose 38 percent from a year ago • Business productivity dropped 1.8 percent last quarter |

Workers didn't have much to celebrate this Labor Day after news that the unemployment rate ticked up to 9.6 percent in August. That’s especially true with many companies now having second thoughts about the economic recovery. Until a few months ago, corporations seemed increasingly confident that the economy was at least slowly headed in the right direction. Then it veered off course, taking hopes for a stronger labor market along with it.

Corporate America is taking a step back that could weigh heavily on the economy, especially job growth. The turn began with Europe’s sovereign debt crisis and new worries about credit markets, which slammed stock prices. Questions about future tax policy, new regulations and health care reform added more uncertainty to growth prospects, along with fears that Washington had already spent most of its policy ammunition with little to show for it. Concerns that the federal deficit had handcuffed policy, as Congress allowed funding for unemployment benefits and state aid to expire, also clouded the outlook.

The August employment report from the Labor Deptartment buoyed hopes that businesses were not pulling back so sharply as to drag the economy back into a recession, but the numbers continued to show very cautious hiring patterns. Overall, payrolls shrank by 54,000 workers last month, as more temporary Census jobs drew to a close, but private-sector payrolls showed a gain of 67,000, a bit better than expected. Monthly private-sector increases over the past four months have averaged only 72,000, but earlier this year companies had shown enough confidence in future demand to lift their payrolls by 158,000 workers in March, followed by 241,000 new hires in April. The recent pace of job growth suggests modest gains, at best, in consumer incomes and spending.

New corporate caution will restrain the economy in other ways, as well. During the first half of the year, business outlays for equipment grew at a 21 percent annual rate, the fastest pace in 15 years, which added, on average, 1.4 percentage points to the 2.5 percent growth in first-half GDP. That strength, along with the boost from rising business inventories, accounted for the lion’s share of economic growth. However, both orders and shipments of capital goods dropped in July, suggesting a much smaller contribution this quarter. “The July report sent a worrisome sign the strength in equipment spending is rapidly slowing,” said economist Michael Feroli at J.P. Morgan Chase.

Companies show a continuing desire to protect their profit margins at the expense of labor costs. Despite the second-quarter slowdown in the economy, profits continued to perform extremely well. Earnings per share for the companies in the Standard & Poor’s 500-stock index rose 38 percent from a year ago, according to Thomson Reuters, with 75 percent of the companies beating Wall Street expectations. Meanwhile, household income from wages and salaries has grown only 0.8 percent over the past year, well below inflation and far below the 5 to 6 percent pace prior to the recession.

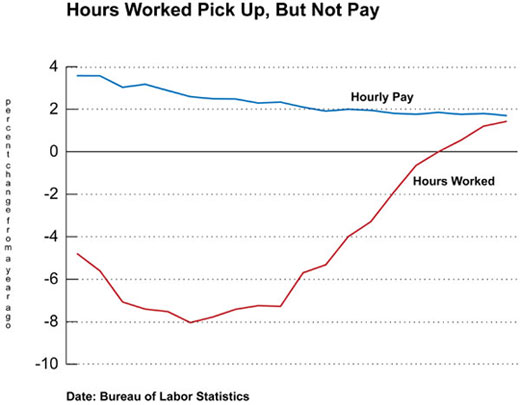

In recent months, businesses have avoided the big costs associated with new hires by stretching out the hours worked by their existing employees. Companies increased hours worked by their employees by 3.5 percent last quarter, at a time when output grew only 1.6 percent, a combination that resulted in a 1.8 percent drop in productivity. Continued weak productivity amid weak demand would be a bad omen for profits — and an incentive to trim payrolls.

Earnings already appear to be under new pressure. The Commerce Department’s economy-wide tally of second-quarter profits posted an advance from a year ago similar to that for the S&P 500, but showed a significant slowdown in earnings growth from the first quarter. Moreover, Thomson Reuters has counted 70 companies in the S&P 500 that say their third-quarter earnings will miss current expectations. The ratio of negative to positive pre-announcements — comments about earnings before actual results are released — stands at 2.3, well above the 0.9 ratio at this point in the second quarter and above the long-term average of 2.1. If demand is not meeting companies’ expectations, managers may have no choice but to keep productivity high by cutting back on hours worked.

A new round of defensive behavior by the business sector, and its potential impact on labor markets, is beginning to grab the attention of policymakers, both at the Federal Reserve and in the White House. President Obama and his economic team are considering new tax breaks for lower-and middle-class families, additional infrastructure spending, and tax incentives to spur business investment. Fed Chairman Ben Bernanke has already laid out steps that the Fed might consider if needed, including a new round of asset purchases, and other ways to lower interest rates.

Economic reports in recent days have been mildly reassuring. August reports from purchasing managers implied good growth in manufacturing but a slower pace for the service sector. New claims for unemployment insurance dipped for two weeks in a row, retracing some of their surge in previous weeks, and fresh reports on home sales and mortgage applications suggest housing may be stabilizing after its summer plunge. However, even if the economy manages around 2 percent growth in the second half, that’s not enough to generate the kind of strong job growth that American workers would like to see. And any further retrenchment by businesses would only add to their disappointment.