• The economy grew 2 percent in the third quarter. • Overall demand has grown 1 percent so far in the recovery. • Spending is 1.6 percent below its pre-recession peak. |

According to a recent poll by the Pew Research Center, voters are tracking news on the economy more intensely than news about tomorrow’s midterm elections. That says a lot about where voters’ heads are as they make their choices.

If all goes as the polls project, the Republicans will take over the House of Representatives, and they have a shot at gaining control of the Senate. Whatever the outcome, some degree of policy gridlock appears likely, as Congress and the White House butt heads, especially over how best to deal with the economy. Given that scenario, what will the elections mean for the economy?

Not much. The economy’s problems run deep, and policy options are limited. “International experience suggests that recoveries from recessions that were spurred by financial crises tend to be slower than average,” Congressional Budget Office (CBO) Director Doug Elmendorf said at a meeting in New York last week. After such a shock, he says, it takes time for consumers to rebuild their wealth, for financial institutions to restore their capital bases, and for nonfinancial firms to regain the confidence required to invest in new plant and equipment. “All these forces tend to restrain spending.”

The challenge facing policymakers is clear from Friday’s report on third-quarter gross domestic product, showing the economy grew 2 percent. That pace was slightly faster than the second quarter’s 1.7 percent advance, but compared with the average 4.4 percent clip in the two prior quarters, the recovery has clearly lost momentum. With election expectations factored in, 43 economists polled in the latest Associated Press Economy Survey project 2.7 percent growth in 2011, close to the drab expected for 2010, and they foresee little progress in reducing unemployment, with the jobless rate ending the year at still-high 9 percent.

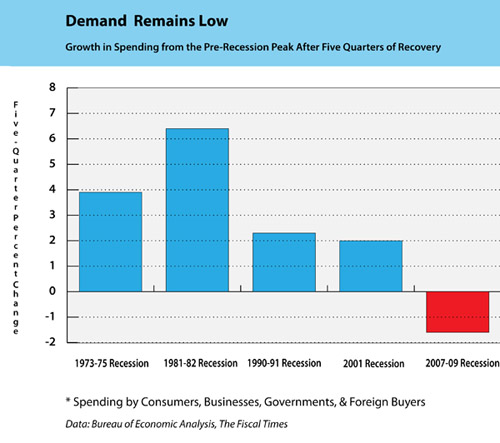

The problem is demand. Since the recovery began, overall spending by consumers, businesses, governments, and overseas buyers has grown by a chilly 1 percent annual rate, far below the 2.8 percent pace of GDP. That gap, with output growing faster than spending, reflects efforts by businesses to ramp up production in order to replenish depleted inventories. That explains this year’s strength in factory production. However, with stockpiles now in better alignment with demand, factory output and GDP will be hard-pressed to grow much faster than overall spending, which is still 1.6 percent below its level prior to the recession. This is the only recovery since the 1930s in which demand has failed to surpass its pre-recession peak in the first five quarters of a recovery.

Unfortunately, policymakers are running out of low-cost options for boosting demand. An analysis by the nonpartisan CBO shows that several temporary stimulus measures, such as aid to the unemployed, cuts in employers’ payroll taxes, and expensing of business investments, could have a relative high bang for each budgetary buck. However, the overall effect of any effort would depend on the scale. And there’s the rub. “Making a significant difference in an economy with an annual output of $15 trillion would involve a considerable budget cost,” says CBO’s Elmendorf. It would also require a much larger effort from the Federal Reserve than the Federal Reserve is currently expected to deliver.

With little policy support from either Congress or the Fed, the economy will be left to survive on its own devices. On that score, the news is not all bad. In fact, several trends are encouraging, especially given that recent economic reports have been strong enough to reduce the risk of the economy sliding back into recession. One bright spot in Friday’s GDP report was a 2.6 percent advance in consumer spending, the strongest quarter in nearly four years. Plus, weekly claims for unemployment insurance through Oct. 23 appear to have resumed their decline, suggesting at least gradual improvement in job growth.

In addition, the financial markets are sending out favorable signals for 2011. That’s especially true for the stock market, which tends to be a foreshadowing indicator of the economy’s path. The Standard & Poor’s 500 stock index is up nearly 13 percent since the end of August. Investors appear encouraged by expectations the Fed will begin purchasing securities in an effort to lower borrowing costs further, although the size of the program may affect their enthusiasm. Investors also expect market-friendly election results; Wall Street likes policy gridlock in the belief that it minimizes the damage politicians can do.

Plus, corporate earnings continue to come in ahead of expectations. With two-thirds of the companies in the S & P index having reported through Oct. 29, earnings per share are headed for a gain of about 30 percent from a year ago, according to Thomson Reuters. Thanks to better-than-expected earnings in the financial, industrial, and information technology sectors, 77 percent of reporting companies have beaten market expectations. In a typical quarter, 62 percent of companies beat expectations. Economists at JPMorgan Chase say profits probably were helped considerably by the combination of lower interest rates and a cheaper dollar.

However, there is also a downside to strong earnings in the face of tepid GDP growth. It means businesses are maintaining their profit margins by keeping productivity high and costs low. That pattern suggests companies are still holding a tight lid on their payrolls, which remains the key to a stronger recovery. And if voters are heading to the polls thinking the election outcome will spark a quick revival in the economy and jobs next year, they are likely to be disappointed.