• The tax deal could push 2011 economic growth to 3.5 to 4 percent. • It will boost after-tax household income by 4.5 percent in the first quarter. • The deal will add about $375 billion to deficit estimates for 2011-12. |

The tax deal between the White House and Republicans that was passed by Congress last week is a big deal for the recovery. Most economists agree there is enough new stimulus in the package, signed into law by President Obama on Friday, to add somewhere between 0.5 and 1 percentage point to economic growth in 2011. That extra oomph could be a game changer. Economists believe it will give the economy enough power to create jobs at a pace sufficient to make a meaningful dent in the unemployment rate and assure a self-sustaining recovery.

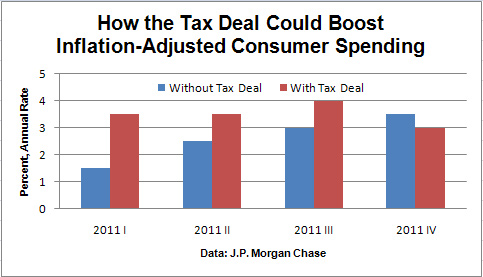

The timing of the tax deal is especially fortuitous. The boost to the economy will be concentrated in the first half of the year, just when the waning stimulus from the 2009 Recovery Act would have exerted a heavy drag on growth. Even more important, almost all of the kick will be felt where it is needed the most — in consumer spending, which accounts for more than two-thirds of GDP and is crucial to a lasting recovery.

Households will benefit handsomely from the tax package’s biggest surprise: a 2 percent reduction in payroll taxes, which promises a sizable boost to after-tax income early next year. Before the deal, the expiration of tax credits that were part of the Recovery Act were set to subtract some $60 billion from after-tax income in the first quarter, as withholding rates reverted to prior levels. Now, the cut in payroll taxes will more than offset that drag by adding about $110 billion to income. Economists at J.P. Morgan Chase, who had expected household income to shrink at a 0.5 percent annual rate in the first quarter, adjusted for taxes and inflation, now project it to surge by 4.5 percent.

Given the jolt to incomes, the extra lift to consumer spending in the first two quarters could be worth well more than 1 percentage point for the economy’s first-half growth rate. J.P Morgan, which previously forecast GDP growth of 2 percent and 3 percent in the first and second quarters respectively now expects advances of 3.5 percent and 4 percent.

So far this year, the economy has been coasting along at a 2.7 percent annual rate of growth, too slow to jump-start the labor markets and dispel fears that the recovery could falter. That pace has created only 106,000 private-sector jobs per month, which is barely enough to keep the current 9.8 percent jobless rate from rising further, let alone push it lower. Reflecting the tax deal, many economists are now scrambling to boost their growth forecasts for 2011 into the 3.5 to 4 percent range. Economists at Moody’s Analytics now expect job growth to be more than twice the 2010 pace, and the unemployment rate to end 2011 well below 9 percent.

The timing of the package is also lucky in that the new stimulus appears to be catching the economy in an updraft. Any added thrust next year would come even as growth in the current quarter is already showing surprising consumer-led momentum. The government’s report on retail sales in November far exceeded expectations, with upward revisions to sales in both September and October, and retailers continue to offer upbeat reports on holiday sales. Many economists now believe consumer spending is growing at a 3.5 percent annual rate, or greater, in the current quarter. If so, that would be the strongest quarterly gain in four years and a big boost to this quarter’s GDP growth.

The tax compromise also offers some incentives to the business sector. For one, it allows businesses the chance to deduct 100 percent of the cost of qualifying capital equipment purchases made in 2011. The provision is intended encourage capital spending by reducing the cost of expansion and adding to cash flow, but most economists expect only a modest impact.

Perhaps the more important benefit for businesses is that the deal greatly reduces uncertainty about 2011, which has been one factor holding companies back. Questions about the extension of the Bush tax rates, credits for lower-income individuals, a continuation of the emergency jobless benefits, a patch for the Alternative Minimum Tax, and other unknowns are now answered. Greater visibility of what lies ahead in the coming year should lift growth prospects and encourage expansion.

Given the suddenly brighter view of 2011, policymakers at the Federal Reserve are most likely breathing a sigh of relief. Many Fed officials, including Chairman Ben Bernanke, have suggested that additional fiscal stimulus could raise the effectiveness of the Fed’s efforts to boost the economy. Stronger growth would take some pressure off the Fed, given the criticism its latest round of $600 billion in purchases of Treasury bonds has received. Stronger growth next year would reduce the chances the Fed would feel the need to issue a third round of purchases.

Clearly, the tax deal’s boost to the economy comes with a cost: It will further widen an already-huge federal budget deficit in both 2011 and 2012. However, analysts had already factored most of the package’s provisions into their deficit projections. The new elements of the deal, mainly the payroll tax cut and the equipment expensing allowances, are what will add to current estimates. For example, economists at UBS, who had been projecting deficits of $1.1 trillion in fiscal year 2011 and $850 billion in 2012, now expect those estimates to rise by as much as $230 billion and $145 billion, respectively.

That’s a heavy price to pay. But if the new stimulus results in a stronger economy that is less vulnerable to a new downturn, the benefit in later years will far outweigh the cost.