When federal finances are discussed, it is almost always in terms of the difference between expenditures and revenues. Usually, the former exceed the latter and we have a deficit. The cumulative total of deficits less the occasional surpluses is what we call the national debt. When we analyze the debt in terms of its burden, it is usually by looking at it in terms of the gross domestic product. Presently, debt held by the public, the most common measure of federal debt, is $9.3 trillion, or about 60 percent of GDP.

If the federal government was a corporation and one was contemplating buying shares of its stock, however, one would certainly want to know much more about its finances. One would want to know about the government’s assets as well as its liabilities. And one would want to know whether there are any liabilities other than those included in the figures for debt held by the public, among other things.

These data are not easy to come by. For many years they appeared only in an obscure mimeographed document called the Statement of Liabilities and Other Financial Commitments of the United States that the Treasury Department produced only because it was required by a 1966 law to do so. The reason is that the financial statement showed vast government liabilities not included in the usual figures for the national debt. Since 1998, these data have been published in a document called the Financial Report of the U.S. Government. The fiscal year 2010 edition was released on Dec. 21.

Private corporations are required to use

accrual accounting and corporate

executives would be jailed for using the

sort of accounting that the federal

government routinely uses.

The most important difference between the Financial Report and the federal budget is that the former calculates costs on an accrual basis, whereas the latter only measures cash flow. Thus if the federal government incurred a debt that would not be paid until some time in the future, that cost would not be part of the conventionally measured national debt. It would only add to the debt when cash had to be expended to cover the expense that had been incurred. It’s worth remembering that private corporations are required to use accrual accounting and corporate executives would be jailed for using the sort of accounting that the federal government routinely uses.

The difference in accounting methods is most easily grasped in terms of Social Security. It has a liability over the next 75 years of $8 trillion more than the projected revenue from payroll taxes and interest on the Social Security trust fund. In every meaningful sense of the term, this is part of the national debt, but is excluded from the official debt figures.

Another consequence of ignoring future liabilities in calculating the national debt is that programmatic changes that save money in the future are similarly ignored. Thus, according to the Financial Report, Medicare had estimated liabilities in excess of future revenues over the next 75 years of $38 trillion at the end of fiscal year 2009. However, in the meantime, Congress enacted the Affordable Care Act, which contains significant cost controls on future Medicare spending. As a consequence, Medicare’s long-term liabilities fell by $15 trillion in 2010.

It was not politically expedient to remind the

elderly that health reform is largely

financed on their backs.

Of course, these Medicare savings will pay to subsidize health insurance for the uninsured. Whether that cost will be more or less than $15 trillion over the next 75 years, we don’t know because there are no estimates of the 75-year cost of ACA. Nevertheless, it is important to know that one portion of our nation’s indebtedness shrank very significantly as a result of health reform. Yet, oddly, I don’t recall the Obama administration ever calling attention to this fact. Perhaps it felt that it was not politically expedient to remind the elderly that health reform is largely financed on their backs.

Financial Report of the U.S. government

The unfunded liabilities of Social Security and Medicare aren’t the only ones left out of the national debt calculations. The federal government also owes federal employees and veterans future benefits of close to $6 trillion. The Financial Report also estimates more than $300 billion of future environmental cleanup costs and more than $600 billion of costs associated with loan guarantees, insurance commitments and liabilities related to Fannie Mae and Freddie Mac, the big housing agencies.

The costs associated with loan guarantees are based on estimates of losses that will be incurred if borrowers with guaranteed loans fail to repay them. The face value of these guarantees – the theoretical maximum cost if every loan went bad – is much greater, estimated by the Financial Report at close to $2 trillion. Theoretical insurance commitments are even larger. Those for federal deposit insurance, pension benefit guarantees, and potential losses from flood insurance would add up to many trillions of dollars.

…It would have almost doubled last year’s

budget deficit from $1.3 trillion to $2.1 trillion.

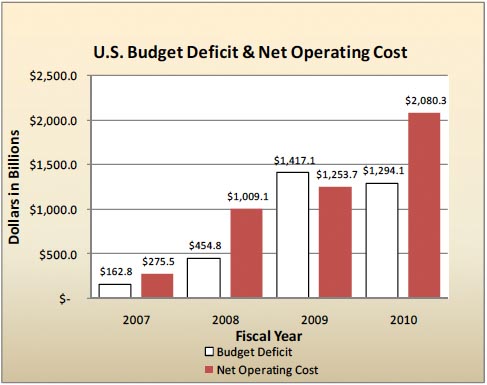

In principle, changes in the cost of long-term commitments should be included in the budget, as they would under accrual accounting. The Financial Report takes a stab at doing so and finds that it would have almost doubled last year’s budget deficit from $1.3 trillion to $2.1 trillion.

Financial Report of the U.S. government

Of course, the government also has assets, but no one really knows what their value is because they are carried on the government’s books at historical cost. Since assets such as the millions of square miles of land owned by the government were acquired for nothing, they are implicitly valued at zero.

However, the government’s most important asset is simply its taxing power, which is theoretically unlimited. During the 1940s and 1950s, the top tax rate exceeded 90 percent and even those in the middle class paid tax rates that would be considered confiscatory today. Although it’s unlikely that rates would ever rise again to such levels, the possibility can’t be ruled out. Polls show that most Americans are open to the idea of raising taxes on the rich to protect themselves from higher taxes or cuts in benefits. History shows that once rates on the wealthy begin to rise, higher rates on the middle class eventually follow.

…Delay in achieving fiscal consolidation will raise

the cost and make higher taxes more likely.

Every serious budget analyst knows that getting our debts – however defined – stabilized at a level the nation can bear will require higher revenues. Only the delusional and deeply partisan deny this fact. However, even they would undoubtedly agree that delay in achieving fiscal consolidation will raise the cost and make higher taxes more likely.

The Financial Report illustrates this fact by estimating how much fiscal contraction – spending cuts and/or higher revenues – would be required to prevent the debt-to-GDP ratio from rising over the next 75 years. That would require running a primary surplus of 0.5 percent of GDP every year for the next 75. (The primary surplus or deficit is calculated by subtracting interest outlays from spending.)

Since the report now projects a deficit of 1.9 percent of GDP over that period, we would have to immediately cut spending and/or raise revenues by 2.4 percent of GDP to keep the debt-to-GDP ratio from rising. That would require a $360 billion cut in just the 2011 deficit and the equivalent every single year thereafter for 74 more years.

And the cost of delay increases the size of the necessary adjustment significantly. If we wait until 2021 to begin consolidation, the annual required adjustment rises to 2.9 percent of GDP; if we wait until 2031, the adjustment rises to 3.7 percent of GDP. For perspective, total federal revenues are now less than 15 percent of GDP.

Although looking at our debts over a long time period magnifies them to the point where they may seem insurmountable, keep in mind also that we can change programs today in ways that won’t affect very many current voters that could yield very significant long-term savings. A good example is raising the age at which people can qualify for Social Security and Medicare benefits.

If phased in over a long period of time, a higher retirement age would hardly be noticeable. I don’t recall ever hearing a member of my birth cohort complain that we must wait until age 66 to draw full Social Security benefits, while those just a little older than we are got full benefits at age 65. As long as people have plenty of advance notice, they can plan and adjust.

To be sure, raising the retirement age is politically unpopular even when it wouldn’t take effect for decades. But if people are faced with the choice of losing hundreds of billions of dollars in near-term benefits or paying higher taxes, and cutting the equivalent deficit in present-value terms by raising the retirement age decades in the future, the political dynamics could change dramatically. (A present value calculation adjusts future dollars for inflation and interest to make them equivalent to dollars today.)

The first step in getting people to accept and Congress to enact the necessary fiscal adjustments is to stop running the federal budget on a cash basis. That makes it too easy to promise benefits and incur liabilities in the future that appear to have no cost. Using accrual accounting would put current spending and future spending on an equal footing and also show people how things like raising the retirement age can produce future savings that will show up in the budget today, which could obviate the need for near-term fiscal contraction that may be economically destabilizing.