· Consumer spending jumped 4.4 percent last quarter. · Households saved $655 billion in both 2009 and 2010. · Household wealth increased $7 trillion due to stock gains. |

It wasn’t so long ago that many economists believed consumer spending was doomed by the near doubling in household debt during the seven years prior to the recession. Given that consumers account for 70 percent of all spending, the economy would suffer for years, they said, as consumers adjusted their finances. The analysts were half right. Households are still rebalancing their debt loads — deleveraging, as economists call it — but that process is no longer preventing consumers from taking a leading role in powering economic growth.

That much was clear from Friday’s GDP report for the final quarter of 2010. The economy grew at a 3.2 percent annual rate last quarter, with a healthy 4.4 percent advance in inflation-adjusted consumer spending, the strongest quarterly gain in nearly five years. The report suggested continued momentum in early 2011. Overall spending throughout the economy was so strong that inventories are not growing fast enough to keep up. “The combination of solid final sales and very little inventory growth in the fourth quarter set the stage for more rapid economic expansion in the first quarter, especially in manufacturing,” said J.P. Morgan economist Robert Mellman.

The economy’s growing momentum is one reason why last quarter’s pickup in consumer spending was no flash in the pan. Many economists now expect even stronger GDP growth in the current quarter, which will support faster job growth and income gains, although progress in reducing the 9.4 percent unemployment rate will continue to be slow. Winter storms have almost certainly restrained consumer buying in January, but upcoming data on retail sales and payrolls will most likely say more about the bad weather than the economy.

Another big reason the recovery in consumer spending is real is the progress households have made in rebalancing their finances. In the years prior to the recession, when housing values and stock prices were booming, the rise in household assets made it easy for consumers to handle their larger volume of debt. When their net worth plunged by $16.8 trillion from 2007 to 2009, households quickly became greatly over-leveraged. Simply put, they had too much debt. That touched off the steepest drop in spending since the Great Depression, along with a sharp rise in the savings rate.

However, the deleveraging that is most damaging to growth is over. Economists at J.P. Morgan point out that the rebalancing of debt occurs in two stages. The first reflects households adjusting their saving behavior. In order to pay off debt, they have to save a bigger portion of their income and spend a smaller portion, thus sapping growth. Personal saving as a share of after-tax income rose from 2 percent in 2007 to a peak of 7.2 percent 2009. To reach that higher rate, personal savings increased by $589 billion when after-tax income rose $732 billion. That left a mere 20 percent of the increase in income to support new spending, which consequently collapsed.

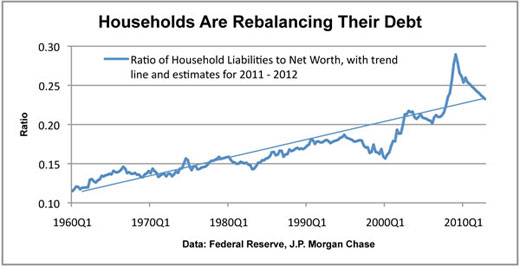

The second stage of the adjustment began in 2009 and is more benign. The growth-sapping rise in the savings rate is now over and the higher level means consumers have three times more money, compared to three years ago, to either pay off debt or build assets. Personal saving totaled $655 billion in 2010, the same as in 2009 and up from $215 billion in 2007. At the current savings rate, the J.P. Morgan economists estimate that household leverage, measured as the ratio of all household liabilities to net worth, will return to its long-term trend by the end of 2012. This measure of leverage already declined significantly through the end of last year.

At the same time, because the savings rate has stabilized at its new level, income growth this year will feed more fully into spending growth. For example, if payroll gains pick up to about 200,000 jobs per month, as is widely expected, then household income this year would grow by about 5 percent. With inflation projected to run at about 1.5 percent, income growth would be sufficient to fuel a healthy 3.5 percent growth rate in inflation-adjusted consumer spending. The bottom line is that spending can pick up, even while households continue to rebalance their debt.

Of course, that’s a lot of “ifs.” Not only must job growth pick up as expected, but both the stock market and housing prices will have to avoid any sharp setbacks. Stock prices will be the more important factor. Despite the weakness in home prices, stock market gains over the past year and a half have fueled a nearly $7 trillion rise in household net worth through the end of last year, based on the market’s 10 percent gain last quarter, replacing about 40 percent of the wealth lost during the recession. Modest gains in 2011 will help to continue the process.

Even as their net worth is rising, households continue to slash their liabilities, which most likely fell last quarter for the ninth consecutive quarter. A reduction in home mortgage debt, which makes up 75 percent of household liabilities, is leading the contraction. Some households already feel confident enough to take on more debt. Consumer credit actually rose by $22 billion in the third quarter, the latest available data, the largest quarterly increase in two years, but that rise was swamped by a $64 billion drop in mortgage debt.

Plus, stimulus from the December tax deal, mainly the 2 percent reduction in payroll taxes that kicked in on Jan. 1, will further support deleveraging by boosting after-tax income. Economists expect household income, after adjusting for inflation and taxes, to grow between 4–4.5 percent this quarter, compared to the 2.4 percent pace for all of 2010. Extra income will also help debt-burdened households meet their payments. Through the third quarter, the share of after-tax income needed to service all household financial obligations, such as mortgages, rents, consumer credit and auto leases, already had fallen to 16.8 percent, the lowest level since 1995.

Friday’s GDP report and other recent data make a strong argument that consumers have already made great strides in adjusting their debt burdens, and further progress is on tap for 2011. And with the hard part of household deleveraging now over, consumers are ready to lead the recovery to the next level.