|

The need for more workers is becoming increasingly evident. Companies have stretched production by existing employees about as far as they can in the face of stronger demand. In classic business-cycle fashion, productivity gains, measured as output per hour worked, are diminishing. Most obvious, this means more hiring, but it also presages higher production costs, upward pressure on inflation, and downward pressure on profits.

Businesses added 216,000 workers to their payrolls in March, the Labor Dept. said on Friday, on top of 194,000 new hires in February. Gains in the private sector, boosted by greater service-industry hiring, are accelerating, with monthly increases averaging 188,000 per month in the first quarter, up from 146,000 in the fourth quarter and from 104,000 in the third quarter. Plus, falling unemployment continues to defy earlier expectations. The March unemployment rate dipped to 8.8 percent, from 8.9 percent in February, and has declined by a full percentage point since November. In January, the consensus forecast of 50 economists surveyed by Blue Chip Economic Indicators was that the jobless rate would be 9.1 percent by the end of 2011.

Many businesses are hiring because they have stretched their workweeks to the limit. The average workweek held at 34.3 hours in March, matching a 29-month high. That’s still below the average 34.6 hours before the recession in 2007, but economists at UBS say that comparison is misleading. The difference entirely reflects shifts in the mix of payrolls away from industries, such as construction, which have longer work weeks, and toward those, mainly service businesses, that tend to have shorter weeks. The workweek in most industries has returned more or less to its pre-recession level, the economists say, meaning that further increases in demand for goods and services will require additional hiring.

Total hours worked increased 1.6 percent last year, compared with a decline of 5.8 percent in 2009, when companies were slashing payrolls. That swing largely explains the sudden slowdown in productivity growth, to 1.9 percent per quarter last year, from 6.7 percent during 2009. A further slowing in productivity growth in 2011 appears increasingly likely with labor markets continuing to strengthen.

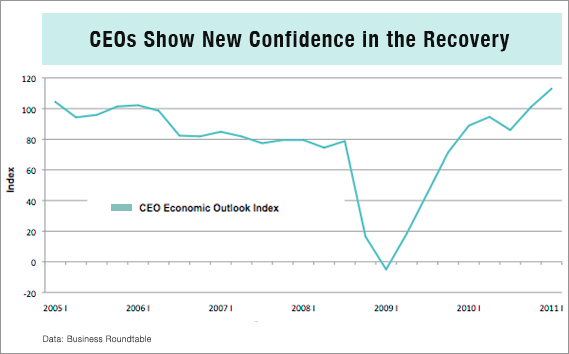

Companies say they are planning to beef up their payrolls this year. CEOs of big corporations sound especially upbeat. The Business Roundtable’s first-quarter CEO Economic Outlook Index, which reflects projections for sales, capital spending, and hiring over the next six months, rose to the highest level since the survey began in 2002. In particular, 52 percent of CEOs expect to boost payrolls, up from 45 percent in the fourth quarter and 29 percent a year ago. The spring 2011 survey of small and mid-size companies conducted each quarter by PNC Bank shows that 24 percent of companies expect to hire full-time employees during the next six months, an increase over previous responses.

Perhaps the most important implication of slower productivity growth in 2011 will be the potential to put upward pressure on production costs, which could fuel the urge for companies to lift prices. On average, the cost of materials and supplies, which have surged with the steep rise in commodity prices and generated inflation fears, make up only about 10-to-20 percent of total U.S. production costs. Labor costs, which average about 70 percent of total costs, have always held the bigger inflation threat.

So far, hourly wages and benefits have grown only modestly. Through last year’s fourth quarter, they grew only 1.8 percent, slightly less than the 1.9 percent pace of productivity. That means the labor cost of producing one unit of output, what economists call unit labor costs, actually fell 0.1 percent. At that rate, there’s no great push for businesses to raise prices for their products. In the coming year, though, as labor markets continue to firm up, so will wages, and as hiring and hours worked accelerate, productivity rates will slow further. Wage growth in excess of productivity gains would put upward pressure on unit labor costs, which are the most important factor in a company’s pricing decisions.

Protecting profits becomes increasingly more difficult as productivity slows and costs pick up. By the end of 2009, earnings were soaring along with the surge in productivity, as businesses barely increased their output but slashed payrolls. Even though pay and benefits rose 2.8 percent that year, unit labor costs plummeted 3.5 percent. Although pricing power was weak to nonexistent, profit margins rebounded and earnings took off. Fast forward to 2010, with productivity growth having slowed sharply, profits of U.S.-based nonfinancial corporations fell in the fourth quarter of last year from the third quarter, according to the Commerce Dept.’s accounting.

Small businesses are already starting to pass along their higher non-labor costs. According to the same PNC Bank survey, 37 percent of small businesses plan to raise their selling prices, while only 7 percent intend to cut prices. That gap indicates a significant rise in pricing pressure compared with previous surveys, and 82 percent say they their intent is to avoid a squeeze on profits. Those results are consistent with an earlier Federal Reserve canvassing showing a similar shift in pricing policies.

Given that productivity is likely to slow further, much of the outlooks for inflation and profits in the coming year will depend on how rapidly the labor markets and wages recover. Through March, the job numbers are already looking stronger than most analysts expected only a few months ago. If that pattern continues, 2011 could be a year of warmer inflation and cooler profits.

Related Links:

Corporate Profits at All Time High as Economy Stumbles (Huffington Post)

Wages Fail to Keep Up with Inflation (Wall Street Journal)

Surge in Jobs Fuels Economic Optimism (Boston Globe)