|

After nearly three years of economic recovery, the crisis in state and local budgets continues to worsen. Even though state tax revenues are picking up, mandated spending obligations and the loss of federal stimulus money still put heavy pressure on state finances. The squeeze on local governments is intensifying, reflecting cutbacks in state aid and the effect of the housing recession on property taxes. All this will exert a downdraft on economic growth and employment in the coming year, and the strains will continue at least until growth in the private-sector economy shifts into a higher gear.

Fiscal 2012 will be one of the toughest on record, says the Center on Budget and Policy Priorities (CBPP). That’s because the options for eliminating the gaps between revenues and spending, as required by balanced-budget laws in 49 states except Vermont (which usually balances its budget anyway), are now fewer and more difficult. States already have acted to address gaps totaling $431 billion heading into the fiscal years 2009, 2010, and 2011. The economy isn’t helping much. Last week the Commerce Dept.’s second estimate of first-quarter GDP left growth unchanged at the originally reported annual rate of 1.8 percent, down from 3.1 percent in the fourth quarter. Economists had expected an upward revision.

For fiscal 2012, 44 states and the District of Columbia, project budget shortfalls totaling $112 billion, says the CBPP. These gaps come at a time when rainy-day reserves are essentially depleted and federal assistance under the Recovery Act, which had played a big role in closing earlier shortfalls, is set to drop by more than $50 billion.

Economists at UBS estimate that required budget cuts for fiscal 2012, which begins on July 1 for 46 states, would be close to $50 billion, about 40 percent greater than in the previous year. That’s enough to cut fiscal-year GDP growth by about one percentage point, they say, about a third more than the loss in fiscal 2011.

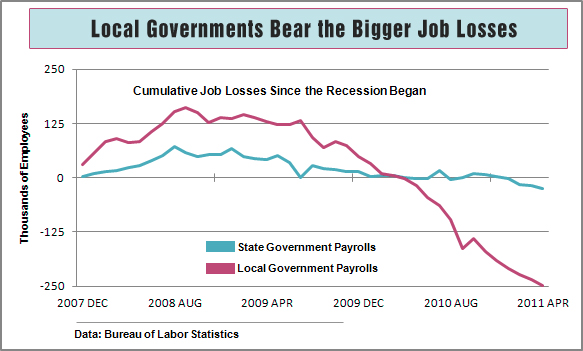

Budget cutting will have an effect beyond the public sector. The Economic Policy Institute (EPI) estimates that each $1 of spending cuts at the state and local level results in $1.41 of lost economic activity and more than 18,000 lost jobs. Using EPI estimates, economists at UBS say that $50 billion in budget cuts in the coming year would result in around 630,000 job losses at state and local governments—on top of nearly 500,000 already lost since August 2008—plus another 270,000 in the private sector.

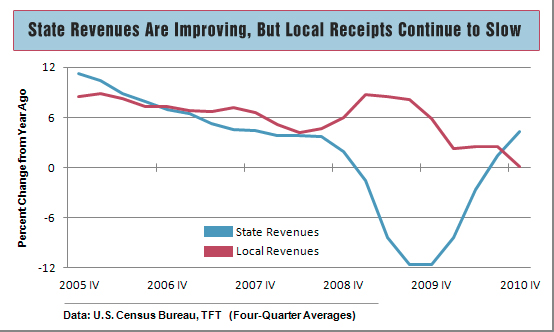

State tax revenues are improving, but not fast enough to cover additional spending in the face of less federal assistance, especially for Medicaid and education. First-quarter preliminary data from 47 states, compiled by the Rockefeller Institute, show a strong 9.1 percent advance in tax receipts from the same quarter last year. The growth rate has been progressively faster for three consecutive quarters. However, in FY 2012 states will have only $6 billion in Recovery Act funds to assist in closing their shortfalls, compared with $59 billion in fiscal 2011.

The Recovery Act’s extra assistance for Medicaid ends on July 1. High unemployment continues to push more people into the public health program, which is now more than 20 percent of state budgets. The Medicaid case load has risen about 8 percent per year over the past two years, according to The Kaiser Commission on Medicaid and the Uninsured, and the group expects the state cost of Medicaid in FY 2012 to increase by 25-to-33 percent. States told Kaiser that spending levels over the three previous years have been difficult to maintain even with the enhanced federal help.

The newest problem is at the local level. Municipalities are only now beginning to feel the delayed effects of the recession’s impact on home prices and property tax collections, in addition to ongoing cutbacks in state aid. In 2007, prior to the recession, property taxes accounted for 34 percent of all city revenues, while state grants contributed 40 percent. That’s 74 percent of local revenue, which in the coming year will be declining. Already, local governments accounted for 80 percent of the nearly 500,000 state and local jobs lost through April 2011, mostly in local education.

States are slashing their aid to cities. In the 2003-04 period of stress on state budgets, states cut municipal aid by 9 percent, according to the National League of Cities. This time, pressure on state budgets is the worst since the 1930s, and the cutbacks will be far greater. In fiscal 2011 the budgets of more than 20 states contained cuts in local aid, altered revenue-sharing agreements, or cuts in state programs run by local governments, according to the National Association of Governors and the National Association of State Budget Officers.

At the same time, property taxes, which accounted for 85 percent of local tax receipts in the fourth quarter, as other revenues dwindled, are finally starting to fall. In the fourth quarter of 2010, they were down 3 percent from a year ago after adjusting for inflation, say analysts at the Rockefeller Institute, the first decline since the mid-1990s. Given the unprecedented 30 percent drop in home prices since 2006, Rockefeller economist Donald Boyd warns there is more weakness to come. Up to the fourth quarter, property tax receipts had grown more slowly but hadn’t fallen. History shows that the impact of changes in real estate values on property assessments and taxes has a lag of two-to-three years. That means the brunt of the property tax pressure is in the future.

All this has raised some concern in the municipal bond market since the turn of the year. Federal Reserve Chairman Ben Bernanke has said the Fed is monitoring the muni market “closely,” and measures of risk have been looking better, reflecting expectations of improvement in state and local finances. “If the economy continues to strengthen at about the pace projected by the Federal Reserve and many private forecasters, states and localities may start to get a little breathing space,” Bernanke said in a speech in March. That’s a big “if,” especially given that many economists since March have been ratcheting down their growth forecasts.

Related Links:

Extreme Weather Batters State Budgets (The Fiscal Times)

State Budgets: Echoes of the B-Word – Bankruptcy (The Fiscal Times)

State and Local Budget Cuts are Slowing U.S. Economy (Huffington Post)