|

As economists try to gauge the outlook for the second half of the year, all eyes will be on consumers. A slowdown in household spending in the first half is cutting deeply into economic growth and raising concerns about the recovery’s stamina. Now, with incomes and confidence having taken a hit from higher gas prices and cautious hiring, a new headwind is stirring: Stock prices have tumbled nearly 7 percent since late April, as investors fret over U.S. growth and Greece’s finances, wiping out nearly all of the year’s earlier gains.

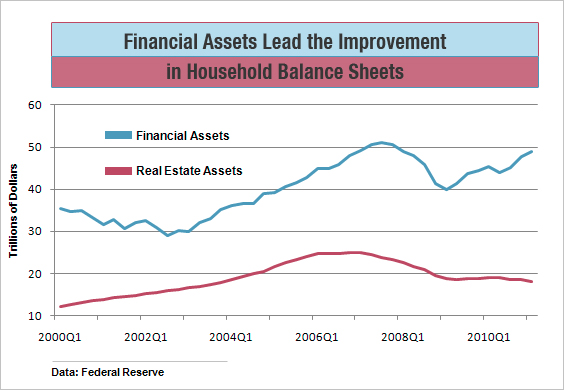

The labor markets will always be the heart of the consumer outlook, but in this particular recovery the stock market is playing an unusually important role. The recession wiped out $16.4 trillion in household net worth—or the value of all household assets minus liabilities—including losses of nearly $11 trillion in financial assets and almost $6 trillion in real estate values, according to Federal Reserve data. With home prices still losing ground and interest rates at rock bottom, gains in stock portfolios have taken a commanding role in shoring up household balance sheets. That means households are especially vulnerable to a major market correction.

Over the long-run, household wealth plays two important roles in consumer spending: It affects the amount of income households feel they need to save, and it has an impact on spending independent of the patterns in jobs and income growth. Many economic studies have shown that consumers tend to spend about 4 cents of every dollar increase in net worth, with the effects spread out over a couple of years. As the recession showed, this relationship also works in reverse. Plus, wealth gains are a form of savings. As net worth increases, households tend to save a smaller share of their current income, and spend a greater share. That also works the other way.

The savings issue is especially important to the outlook for the second half of the year. From September through April, inflation-adjusted consumer spending slowed, but still grew three times faster than the sluggish pace of household income. To keep up their spending as soaring gas prices grabbed more of their take-home pay, consumers drew down their savings by $149 billion, which cut savings to 4.9 percent of income, from more than 6 percent last year. Falling stock prices, along with weaker job markets, could make households more cautious in coming months, causing them to restore their savings back to earlier levels—at a cost to spending and economic growth.

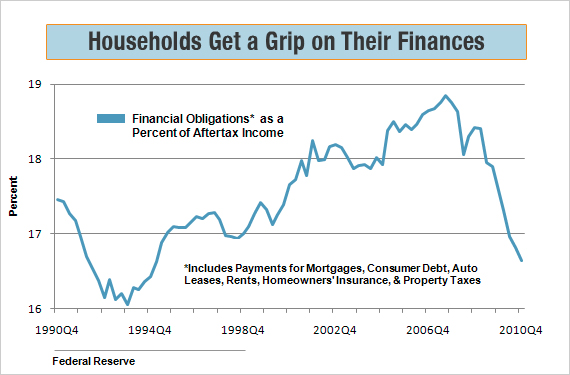

Households have made great progress in righting their finances after the ravages of the recession. In addition to asset gains, they have reduced their outstanding debts by nearly $700 billion over the past 2½ years. More important, the amount of income households must scrape together each month in order to service all their obligations has fallen back to where it was in 1995, a huge shift that has freed up billions in income that can be either spent or saved. The ratio will continue to fall, as consumers further reduce their debts.

They still have a long way to go, however, and the boost from stock prices is likely to be less in the next two years than the gain of the past two years. Through the first quarter, household net worth has increased by $8.7 trillion since hitting bottom two years earlier, restoring 53 percent of consumers’ lost wealth, based on the latest Federal Reserve update.

During that two-year period, all types of financial assets grew by $8.9 trillion, more than accounting for the gain in net worth, with a 66 percent rally in stock prices as the driver. Real estate values, down $650 billion, continued to slide. In the absence of a recovery in home prices, the Standard & Poor’s 500 stock index, which closed at 1271.50 on Friday, would have to soar well above 2000 in the next two years to fully restore all the wealth households lost during the recession, and help from home values is a long way off.

Even before the housing bust, real estate was only about 30 percent of all household assets, while financial assets were 62 percent. Now real estate is down to about 25 percent, as prices keep slipping. There are scattered signs that home values may stabilize by year end. CoreLogic, which supplies the price data for the Fed’s tracking of real estate values, also collects data on prices of homes that are not part of distressed sales, such as those in foreclosure. After seasonally adjusting CoreLogic’s data, analysts at J.P. Morgan say prices of homes not involved in distressed sales have increased in each of the past four months and have risen at a 4.7 percent annual rate during the past six months. Still, the downward pressure from foreclosures will not let up any time soon.

Although home prices affect more households than stock prices do because more people own homes than stocks, the effect of stock portfolios on consumer spending is larger than generally appreciated. Prior to the recession, 51 percent of all U.S. households owned stock, either the shares themselves or via mutual funds, retirement plans, and such, according to the Fed’s Survey of Consumer Finances, and stock holdings accounted for 53 percent of all families’ financial assets. It’s true that stock wealth is more prevalent among higher income households, but high income families contribute a disproportionate share of consumer spending. The Labor Dept.’s latest Consumer Expenditure Survey shows that 17.9 percent of consumers earn more than $100,000 per year, but they contribute 35.3 percent of all household spending.

Right now consumers are fighting through the headwinds from disappointing job gains and sluggish income growth. Inflation-adjusted consumer spending grew at only a 2.2 percent annual rate in the first quarter, and economists say spending through May is on a pace to slip below 2 percent in the second quarter. If the stock market swoons in big way, households—and the economy—could end up with an even bigger problem in the second half.

Related Links:

Consumer Spending Hit by High Energy, Food Prices (The Hill)

U.S. Household Net Worth Climbs 1.2% (Wall Street Journal)

Obama’s “Recovery Summer” Still a Work in Progress (USA Today)