|

Despite the sluggish recovery, American businesses show a growing willingness to invest in new equipment, software, and construction. Real—or inflation-adjusted—capital outlays surged at a 16.3 percent annual rate in the third quarter, contributing a sizeable 1.5 percentage points to the quarter’s 2.5 percent growth in real GDP, the Commerce Dept. reported on Oct. 27. But there’s a paradox. Historically, payrolls have grown generally in sync with capital spending as more equipment needs more employees. So, why aren’t companies hiring more people?

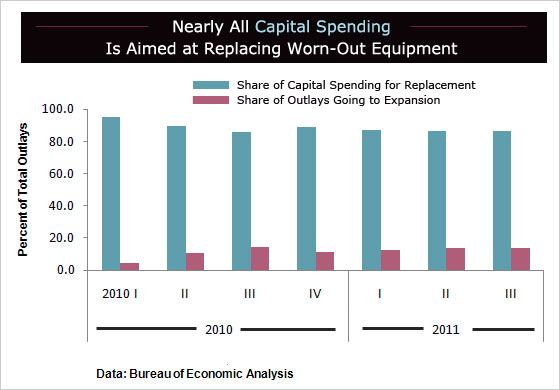

What’s gone largely unnoticed about the strength of capital spending is not what businesses are buying, a big portion of which is high-tech gear and software, but why they are buying it. Since the recovery began in the second quarter of 2009, 94 percent of business outlays for new plant and equipment have gone to replace worn out high-tech equipment, machinery, and buildings. In the recoveries of the 1990s and 2000s, the share of replacement outlays averaged 68 percent and 77 percent, respectively. Only 6 percent of spending in the current recovery has been targeted for the actual expansion of production capacity, which is a key reason why job growth has lagged behind the brisk pace of capital spending.

The outsized amount of replacement outlays in this recovery reflects the unprecedented cutbacks in capital spending during the recession. Businesses slashed outlays by so much during 2009 that their equipment and buildings were wearing out faster than they were being replaced. Said another way, the stock of productive capital in the business sector actually shrank for the first time since the 1930s. As a result, even amid sluggish demand, businesses have a lot of catching up to do as they upgrade outmoded tech equipment, old software, sputtering transportation equipment, and dilapidated buildings.

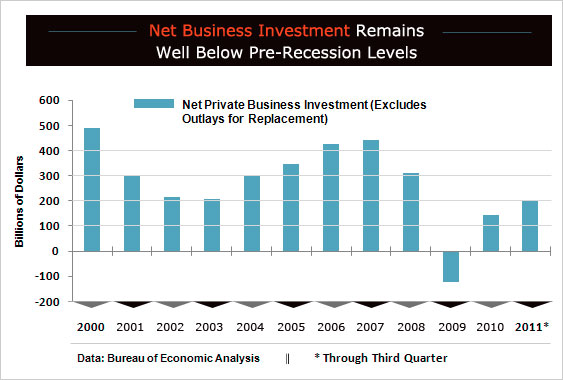

The key difference is gross investment vs. net investment. Businesses have to do more than just compensate for worn-out or obsolete equipment in order to expand their production capacity, beyond short-term adjustments that lengthen work hours of existing employees or longer-term gains from upgrading old technologies. In the third quarter, the annual rate of gross outlays by businesses totaled $1.51 trillion, according to the Bureau of Economic Analysis. Overall spending has surged 42 percent in the past two years, recovering all but 9 percent of the record plunge during the recession. However, net outlays -- for expansion of production capacity -- were only $206.5 billion last quarter, still 55 percent below their pre-recession peak.

Make no mistake: Capital spending has been one of the unsung heroes of the current recovery, says J.P. Morgan economist Michael Feroli. Since the recovery began, outlays for equipment and software have accounted for about a third of GDP growth and over half of the increase in overall spending throughout the economy, he calculates, even though equipment and software represent only 7 percent of all spending. Last quarter’s 1.5 percentage point contribution to GDP growth by business investment nearly matched the 1.7 percentage point offering from consumer spending, which weighs in at 70 percent of total spending.

Businesses are plowing some of their cash hoards back into their operations, investment that is helping to support economic growth. At the end of the second quarter nonfinancial corporations had more than $1.5 trillion in checking, savings, and money market deposits sitting on their balance sheets, according to Federal Reserve data, the result of soaring profits and expanding margins in recent years. Whether the money goes to replace equipment or expand operations, it all counts in GDP growth, but the impact of those outlays on job growth has been less than what past trends would have predicted. Payrolls have recouped just 24 percent of the jobs lost since the recession began almost four years ago.

Despite the strong contribution of overall capital spending, net business investment is running well below the pace needed to sustain a faster pace of economic recovery and generate stronger growth in jobs and incomes. So far this year, net investment outlays have averaged $198 billion per quarter, below the more than $300 billion averaged during the expansions of the 1990s and 2000s. As those expansions became more firmly established, net investment averaged more than $400 billion per quarter.

In the current business climate, policy incentives that aim to prod businesses to expand their operations bump up against other basic considerations. Profits may drive the ability of companies to spend more, but demand drives their willingness to expand. Right now, a lot of production capacity is available but idle, reflecting soft demand for goods and services. In September, manufacturers were utilizing only 75 percent of their productive resources, compared with more than 80 percent prior to the recession. Uncertainties about future demand also weigh heavily on corporate decisions, including questions about the direction of fiscal policy and its implications for taxes, healthcare costs, and new regulations.

Economists believe policies such as the current accelerated depreciation program are unlikely to have much impact. This policy lets companies take 100 percent of their depreciation allowances on new equipment purchased by the end of this year, with the aim of boosting capital spending. Such programs might feed the current boom in replacement outlays, since they lower the cost of capital, but results from similar policies in the past show little benefit. Capital is already historically cheap, as a result of the Federal Reserve’s interest rate cuts and credit easing. Also, a proposed tax holiday on the repatriation of foreign earnings would be a boon for cash flow, but corporations are already awash in cash.

In the coming year, overall capital spending appears destined to slow as the current rapid pace of upgrading equipment and facilities winds down, providing less of a boost for GDP growth. Business surveys by regional Federal Reserve banks, the Business Roundtable, and others show that spending plans have begun to trail off this year, likely reflecting the general mood of fading confidence. In a perfect world, policies that give companies a clearer view of the future and boost overall spending across the economy would be a sure fire way to encourage businesses to expand their facilities and hire at faster rates. For now, given that fiscal policy is in gridlock and the Fed has done about all it can, that kind of support seems unlikely.