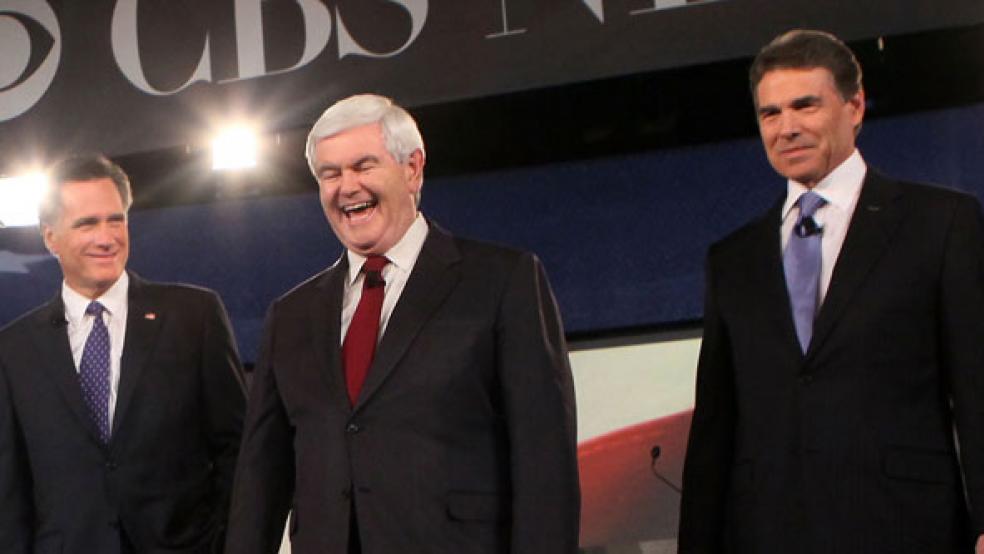

All Eyes on Newt

The sudden surge of Newt Gingrich in Iowa and New Hampshire have made him the “candidate du jour” to beat Mitt Romney for the Republican presidential nomination. But on the Sunday talk shows, the vitriol about the former House speaker was striking, both from the Left and the Right.

More important for who will actually win the Iowa Caucuses on Jan. 3 and the New Hampshire Primary on Jan. 10 is the emerging notion that the much-ignored candidacy of Texas congressman Ron Paul actually has legs – and that if Paul is denied the GOP nomination and mounts a third-party threat, he could be the spoiler in November 2012.

“In a year when the Republican field is unusually fractured, with front-runners coming around as often as carousel ponies, Mr. Paul’s ability to mobilize niche groups like home-schoolers may make a big difference,” Trip Gabriel wrote in The New York Times. “His campaign, which has won a number of straw polls and is picking up momentum, has demonstrated its ability to organize and mobilize supporters, which is particularly relevant in Iowa, where relatively small numbers can tip the scales in the caucuses.”

On Fox Sunday, commentator Brit Hume said of Gingrich: “…He now occupies the single most dangerous place to be in American politics, which is the non-Romney leader in the Republican field, the position that has been occupied by everybody from Donald Trump to most recently Herman Cain, with a couple others in between who have fallen by the wayside.

“With the added attention and spotlight comes the scrutiny,” said moderator Chris Wallace, noting that a string of stories last week revealed Gingrich had “made somewhere between $1.5 million to $1.8 million advising the failed mortgage giant Freddie Mac. Then it came out that his think tank got $37 million from various major healthcare companies. How damaging do you think that is to his narrative that, yes, he was an insider, but now he's an outsider and he's the man to really shake up this town?”

A.B. Stoddard of The Hill newspaper said: “I think he's been disingenuous in his answers…the healthcare companies and drug firms did not pay his consortium $37 million because of his grasp of history. Freddie Mac did not pay him $30,000 an hour for their monthly visits because of his grasp of history. And I think Iowa voters will begin to discern, as they learn more about his activities, whether his answers are reasonable and credible and forgivable”.

On ABC’s This Week, liberal economist and New York Times columnist Paul Krugman said of Gingrich: “Somebody said he's a stupid man's idea of what a smart man sounds like….”

But conservative columnist George Will (who has taken some heat for not disclosing that his wife has worked for the campaigns of first Michele Bachmann and the Rick Perry) was even more devastating in his criticism.

“Gingrich is an amazingly efficient candidacy in that it embodies almost everything disagreeable about modern Washington,” Will said. “He's the classic rental politician. People think his problem is his colorful personal life. He's going to hope people concentrate on that rather than on, for example, ethanol. Al Gore has recanted ethanol -- Newt Gingrich has served the ethanol lobby. Industrial policy of the sort that got us Solyndra, he's all for it.

“...When the Bush administration was trying to pass an unfunded, large new entitlement, the prescription drug entitlement, onto Medicare,” Will went on, “who was out there saluting this as part of his service…for big pharma? [Gingrich] denounces the Ryan budget as right-wing social engineering. He sits down to talk about climate change and cap-and-trade with Nancy Pelosi and others. The list goes on.

“But on top of all this, there's the absurd rhetorical grandiosity,” said Will, who knows rhetorical grandiosity when he hears it.

“The other thing to watch,” said Republican strategist Matthew Dowd, “is Ron Paul. …Right now, he's second in Iowa. He's second in New Hampshire. And of all the people that are in the top tier, he has the most passion behind his candidacy. I would not be surprised at all, seven weeks from now, that Ron Paul wins the Iowa caucuses and goes into New Hampshire and disrupts this field even more.”

“But, really, disrupt?” asked moderator Christiane Amanpour. “Or will it just be sort of a one-off for Ron Paul if he wins Iowa?”

“Oh, it would be disruptive,” said Wall Street Journal columnist Peggy Noonan. “When you win Iowa, you go into New Hampshire with a certain amount of momentum. And no one has ever taken Ron Paul seriously. Therefore, when Iowa does, everybody will stop and say, ‘What the heck?’”

“You said look out for [Ron Paul] in six weeks, seven weeks,” columnist Will said to Dowd. “Look [out] for him in eight months. He's not running for Congress again. He could be a third-party candidate. He has dedicated people in place. If he got 4 percent of the vote, there are a whole number of states with electoral votes he can tip over.”

“He would absolutely give the race to Obama,” Noonan said.

Would a Super Committee Flop Matter?

On Fox Sunday, economist Mark Zandi of Moody’s suggested that the failure of the Super Committee to find at least $1.2 trillion in budget cuts might not be the catastrophe that some have predicted.

“I think we came to terms around the debt ceiling debate back in August that we needed $4 trillion in 10-year deficit reduction,” Zandi said. “And I think the most logical approach would be about $3 trillion. That $4 trillion should be government spending cuts and $1 trillion should be additional tax revenue. So, we need both. We're not going to accomplish this until they come to that realization.”

“Let's assume for a moment that we get no deal,” said moderator Chris Wallace. “On the one hand, a terrible failure. On the other hand, the automatic triggers kick in. So we still get the deficit reduction. What do you think that the reaction will be from the markets?”

“You know, it's all relative to expectations and investor expectations with regard to the committee…are still very, very low,” said Zandi. “I don't think many expected much to come out of the process. So, you know, at the end of the day, I don't think there'll be a significant market reaction.”

“What do you see coming out of the committee that's going to create problems?” Wallace asked.

“First, very immediately, we are going to have to figure out what to do about a number of provisions in the tax code, government spending programs, that are going to expire at the end of the year,” Zandi said. “That matter a lot in the economy. So, for example, the payroll tax holiday that we all got this year expires at year's end. Everybody's taxes are going to go up on January 1. It doesn't seem that makes a lot of sense in the context of how weak this economy is. That could have significant implications for growth next year, and therefore, for financial markets.

Emergency unemployment insurance, that comes to an end. That will have the impact. You know, there's whole slew of things. But now, it's very unclear how Congress and the administration are going to come to terms and figure this out. I had hoped that they would figure it out as part of the Super Committee process. Of course, now, if that's dead, then that's a big problem.

“And then going into next year, the big problem is whether Congress or the administration has afforded to follow through on the automatic spending cuts that would hit in 2013. You know, it's unclear that they will follow through. If they don't, then that will be a fodder for problems in the financial markets and the economy.”