|

Washington’s ideological battle over how to restore fiscal stability continues to go nowhere—and the chief casualty is the U.S. economy. The Congressional Super Committee’s failure to agree on a plan for short-term stimulus and long-term deficit reduction means that policy uncertainty still reigns among boardrooms and households. Plus, without new action by the end of the year, several expiring programs will cut sharply into household incomes and spending early next year. The sad fact is that Washington’s gridlock threatens to curb economic growth just when the economy is starting to show some momentum.

A bevy of economic data make it clear that the economy is pulling out of its slump in the first-half, when real GDP growth fell to an average annual rate of only 0.9 percent. The economy grew 2 percent in the third quarter, and the breakdown of GDP flashed positive signs for fourth-quarter growth. Spending throughout the economy last quarter was the strongest since late-2010, and businesses saw their inventories dwindle by so much that stockpiles will have to be built up again in coming quarters. Many economists now expect fourth-quarter GDP growth of around 3 percent—a pace consistent with faster job growth.

The latest data support that expectation, especially news from the labor markets. Payrolls posted a broad rise of 120,000 in November, with a larger 140,000 gain in the private sector, even as the unemployment rate dipped to 8.6 percent, from 9 percent in October. Job gains over the past three months have averaged 143,000, up from only 83,000 in the previous three months. On the heels of strong retail sales in October, November ushered in a bounce in consumer confidence, a booming start to holiday shopping, and the best showing for car sales since the cash-for-clunkers surge in 2009. Plus, the nation’s purchasing managers last month reported a continued rebound industrial activity.

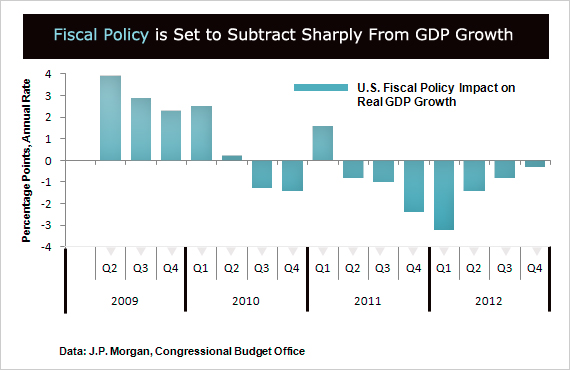

Will the momentum continue? Much will depend on Washington. The problem heading into 2012 is the fiscal drag on economic growth from expiring stimulus programs, including the last vestiges of the 2009 Recovery Act and this year’s temporary stimulus from the cut in payroll taxes and extension of unemployment benefits. Economists at J.P. Morgan estimate that, if all these programs expire on Dec. 31, as scheduled, the total fiscal drag on real GDP growth in the first half of 2012 would add up to 2.6 percentage points on the average annualized growth rate of GDP, with the biggest hit in the first quarter.

The focal point right now is the payroll tax cut and extended jobless benefits. Economists have already factored into their forecasts the loss of stimulus from the Recovery Act provisions, but the additional loss of these two programs would be a big blow to consumers, whose spending makes up 70 percent of GDP. “The end of these stimulus measures would pose a noticeable headwind to disposable personal income growth early next year,” says Barclays Capital economist Troy Davig. Less income would mean less spending, following by second-round effects on production and hiring.

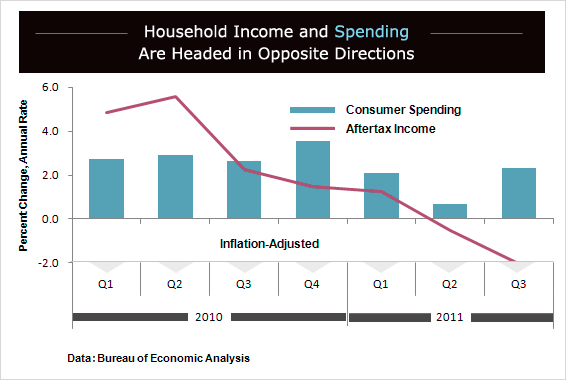

Somewhat surprisingly, consumers are a big contributor to the economy’s current momentum. Against the backdrop of a U.S. debt downgrade, historically low confidence, a hyper-volatile stock market, and weak income growth, households lifted their inflation-adjusted spending at a 2.3 percent annual rate last quarter, and the latest readings suggest an even faster fourth-quarter pace between 2.5 and 3 percent, economists say. Businesses have also contributed strongly, supported by solid profits. Profit margins for U.S. nonfinancial corporations in the third quarter rose to the highest level since the late-1960s, according to the Commerce Department.

Any hit to household income would come at a time when consumers may have already backed themselves into a corner. Household income, adjusted for taxes and inflation, fell in both the second and third quarters. To maintain their spending, households have been draining their savings, which as a percent of income stood at 3.5 percent in October. The saving rate has shrunk steadily from 5.8 percent in June 2010 to about a four-year low. “The decline in the saving rate is probably a warning of spending caution ahead,” says J.P. Morgan economist Robert Mellman. Skimpier savings means consumer spending is especially vulnerable to any further drag on income growth.

Economists at J.P. Morgan and other analysts estimate that the expiration of the payroll tax cut and extended unemployment benefits alone would knock about 1.5 percentage points off first-half growth. For example, J.P. Morgan forecasts that, if the two programs are extended, the economy will grow at a moderate 2.5 percent in the first half of 2012. If the programs expire, Morgan projects growth at a feeble 1 percent pace that would weigh heavily on job growth and put renewed upward pressure on the unemployment rate.

Lawmakers may yet come to their senses. Recent comments by the Republican leadership in Congress suggest some room for compromise on extensions of the two measures, both of which were part of President Obama’s $447-billion September jobs bill. That bill included a further reduction in the payroll tax for employees while expanding the cut to include employers at a total cost of $247.5 billion. Extending jobless benefits would cost an additional $48.5 billion.

After the high-profile failure of the Super Committee, Washington most likely feels the need to show they can do something. The question is how Congress will come up with the money needed to pay for the two programs, which brings the story back to ideology. Democrats want a surtax on millionaires, and Republicans want more spending cuts. And so it goes—with the economy hanging in the balance.