Op-Ed: America has long been a country where almost everyone, including the poor and unskilled, could get a job. Given the will to do a reasonable day's work, a job was a passport to economic and social well-being; it was the fount of self-esteem and the foundation of family life. Indeed, work was Life.

More than 15 million Americans no longer have that passport to Life. Think of it as roughly the entire population of the states of Connecticut, Delaware, Arkansas, Iowa, and Oklahoma, all standing idle—every man, woman, and child. The traditional breadwinners, namely men between the ages of 25 and 54, are among those hardest hit. According to an Investor's Business Daily/TIPP poll, some 25 percent of households include someone who is unemployed and looking for work. As well as laying waste to work, to the equivalent of losing every job created in the last decade, the Great Recession has visited us with reduced incomes, declining home equity, and a growing contraction in credit.

For the 80 percent of Americans born after World War II, this is their Depression. They have 5.5 million fewer jobs than at the recession's start in 2008, despite the most stimulative fiscal and monetary policy in our history. Employment has been below the pre-recession peak for over 50 months. It's the longest time since the Great Depression that payrolls have not made a new high. The 120,000 new jobs for March make no dent (and adjusted for the peculiarity of warm weather, the number of real net jobs created was 76,000); we need at least 125,000 jobs each month just to provide for new entrants in a rising population.

Discouraged workers dropping out of the labor force make the unemployment rate look fractionally better, but the 8.2 percent headline masks the misery. It is a reflection of the U-3 statistic, which counts only people who have applied for a job in the last four weeks. Among the jobless army, a staggering 42 percent of them are long-term unemployed, without jobs for six months or longer. Look instead at the more relevant U-6 statistic, which counts the number of people who have applied over the last six months. U-6 also includes those who are involuntarily working on a part-time basis. That U-6 unemployment is now in the range of 15 percent.

Since 2008, some 3 million people have dropped out of the job market. If they hadn't, the unemployment rate would be about 10.8 percent. In March, the unemployment rate seemed to fall a tenth of 1 percent, yet the number of people who are actually employed dropped by 31,000. Why? Because the number of people who looked for a job dropped by 164,000 and they are not considered unemployed. Not to mention that half the new jobs are in temporary help agencies.

America's great job creation machine is sputtering badly. Structural unemployment has risen from 5 percent before the crisis to close to 7 percent today.

America's great job creation machine is sputtering badly. It is now estimated that structural unemployment has risen from 5 percent before the crisis to close to 7 percent today. This means that one third of the rise in American joblessness may be impervious to the business cycle; it represents lost jobs that cannot be restored by boosting demand.

The problem now is not that people are being laid off by the millions. When an economy has reached bottom, as it did, it has already shed much of its labor, and layoffs slow. But the anemic recovery has not yielded job vacancies. Hiring today is at about 70 percent of the 2006 level. Given the increase in unemployed totals, job seekers are only about one third as likely to find work as in 2006.

Compare that to the fabled Great Depression of the 1930s. In the three years after 1933, the economy rebounded with growth rates of 11 percent, 9 percent, and 13 percent. But in 2010, months into our recovery, growth was about 3 percent, followed by 1.7 percent growth in 2011. The rate for 2012 could be about 2 percent—below the 3.4 percent throughout the postwar period.

What has happened? The process of making stuff fosters innovation, leading to new products. When companies go from prototype to mass production, they scale up, figure out where they can build factories affordably, and hire people by the thousands. But many enterprises in America have discovered they cannot compete in engineering or manufacturing with their Chinese or Indian counterparts, which are equally, if not more, productive with workers willing to accept significantly lower wages. In turn, they gain the skills, knowledge, and experience to innovate. Hence our loss of 6 million blue-collar manufacturing jobs.

The paradox is that the low labor costs which attract work abroad are now being visited on the American worker. In the past six months, according to a Bloomberg study, 70 percent of job openings have been in mostly low-wage sectors, including healthcare, leisure, hospitality, and retail. And some 7.7 million workers are stuck in part-time jobs, their pay inadequate for entry into the middle class. Why so much temporary employment? Because companies do not wish to pay for healthcare and retirement in a very uncertain economy, so they hedge their bets with short-term help.

They know that if they quit without another job they face the real prospect of never working again, certainly not at their former pay levels/

Remarkably, as David Rosenberg, chief economist of Gluskin Sheff, has reported, two thirds of the employment growth rate has been in the 55 and older age cohort. Since the recession began in December 2007, employment in this age group is up 4 million, even as total employment for everyone else is down.

What's going on here? The boomer population, Rosenberg notes, has seen its wealth destroyed by the bear market in equities and housing, and these people are now recalculating the date when they can retire with some sense of financial confidence and dignity. They know that if they quit without another job they face the real prospect of never working again, certainly not at their former pay levels, and that being without work means that they will receive lower retirement benefits from Social Security. So much for job mobility in America.

This creates a bottleneck for younger workers, especially young minorities. The jobless rate for workers ages 20 to 24 is over 13 percent; teenagers, 25 percent; Hispanic teenagers, 30.5 percent; and black teenagers, 37.9 percent.

Even people with a college education face unemployment rates of about 4.2 percent, which is about double the norm for this group. Those with a certificate from a community college or at least some college coursework have a jobless rate of 7.5 percent, again about double the norm; and people who did not finish high school have it worst at almost 13 percent.

Each month more Americans lose hope, permanently alienated from the workplace, their savings exhausted. The gradual expansion of the economy is too little to hope the cavalry is riding to the rescue. Real, authentic job creation will not come from Washington. It has to come out of the energy and spirits of the private sector. Two thirds of our employment is concentrated in 6 million small and medium-size businesses. We are not going to create jobs until they are in a state of mind to do so. They are not yet, and in part that's because of policy uncertainty that has depressed or confused them.

We need 1 million new businesses every year to keep us on the right track. Instead we have only about 400,000 firms starting up.

According to the Heritage Foundation, private sector hiring through June 2011 was 10 times slower following the passage of President Obama's healthcare bill compared to the prior 16 months. Economists at Stanford University and the University of Chicago estimated in the fall of 2011 that policy uncertainty has cost more than 2 million jobs since early 2010. These estimates reflect the small business community's reluctance to make new hires until employers know exactly what the law means in practice. The high level of temporary employment is a reflection of the same uncertainty. Businesses hedge their bets with short-term help.

We need 1 million new businesses every year to keep us on the right track. Instead we have only about 400,000 firms starting up. We need a labor market that creates over 400,000 jobs a month. We haven't seen anything like that. In fact, through the first few months of 2012, layoff announcements have risen 18 percent from a year ago, and hiring plans have dropped 82 percent.

Millions of people who had good private sector jobs now have to depend on the government for life support.

No wonder America's inflation-adjusted, after-tax income, which is the fuel for the consumer spending that drives the economy, has barely risen in the past six months. No wonder about half of Americans believe that their real income will contract in the coming months, while only about one fifth expect it to increase.

David Rosenberg also reports that nominal per capita disposable income—$37,606—is actually lower today than it was in May 2008 when the recession was in its infancy ($37,752). When you look at the data in real terms, adjusted for inflation, the comparison is even more startling: $32,600 now versus $34,641 back then. In fact, real personal disposable income per capita is lower now than it was in November 2006! And if you strip out government subsidies and assistance, real personal income is down even more from four years ago. This appears to be the first time since the 1930s that inflation-adjusted incomes of Americans have declined.

Don't talk "recovery" to these people, especially if you pause at a gas pump. The consumer remains constrained as well by the ratio of total household debt to after-tax earnings. It was down to 117 percent last year from a peak of 131 percent, but is still above the pre-bubble rate of 70 percent. We are still in an era of deleveraging, rising savings rates, home price deflation, and squeezed real income, all of which will continue to affect consumer spending.

The U.S. economic recovery is like a person who promises much and doesn't deliver.

The private sector workweek has stagnated at about 34.5 hours, and wage growth has been tepid at best with average hourly earnings eking out a 0.1 percent monthly increase for the last five months. Over the last nine months, overall consumer spending was up just 0.6 percent, adjusted for inflation.

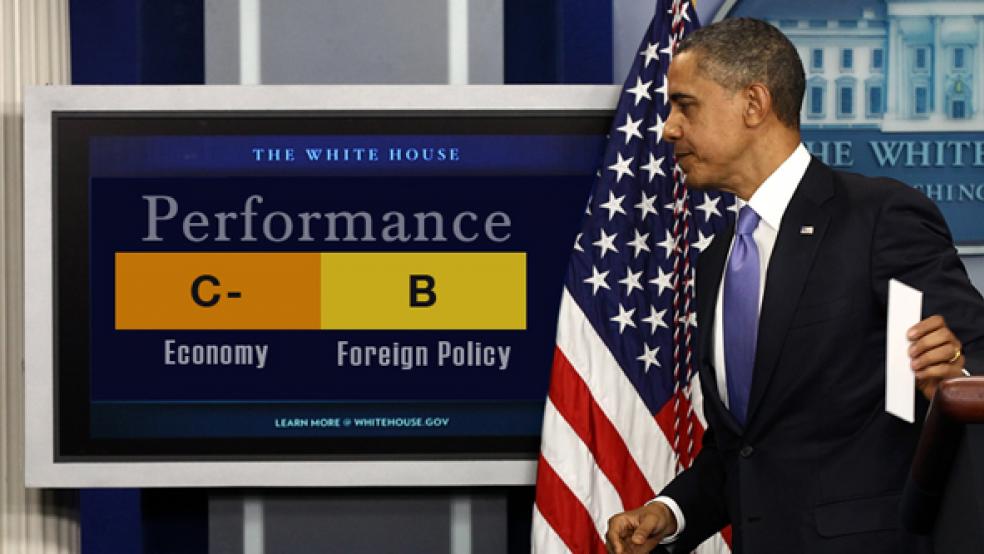

There is no doubt that the next presidential term will start with a rate of unemployment that is far higher than what President Obama inherited when he took office. The programs that he has put in place have failed. The U.S. economic recovery is like a person who promises much and doesn't deliver. There are not many months left for Obama to persuade the nation to measure his performance by a different mark.

What can we do to get out of this? How can we regenerate the high-paying jobs in service industries with sophisticated intellectual content such as entertainment, digital media, education, and financial services?

1. Push students to a higher level of education, if necessary by mandating at least a year of higher education or vocational training at the public's expense.

2. Increase the number of H-1B visas for foreign graduate students in the hard sciences. Crazily, we reduced them from 195,000 in 2003 to 65,000 today. This intellectual firepower is critical to growing industries that focus on the world of high tech.

3. Revise the tax system to encourage growth, not hamper job creation.

4. Create financial incentives for businesses to invest in America, rather than provoking American companies to reap greater rewards by laying off U.S. workers and outsourcing production to foreign countries that have lower environmental standards.

5. Focus on the problems of infrastructure and industrial policy.

America has a history of comebacks, of pulling itself out of a hole, and it happens when we're led with energy and conviction. When we feel we are, we will build a new version of the promised land: millions restored to Life.

More from U.S. News:

• See a collection of political cartoons on the budget and deficit

• Mort Zuckerman: Three Ways to Revive Our Sluggish Economy

• Check out U.S. News Weekly: an insider's guide to politics and policy