Remember back in the 1990s, when globalization was supposed to be the greatest thing since Saran Wrap? Maybe someday it will prove to be so, but right now we are walking on the dark side of the moon. Everything seems to happen in concert, or like a chain reaction, in a globalized economy, and that is what we are entering into now. Europe’s problems are spreading to the U.S., and both of them are sending China and India toward their second economic downturns since 2008.

Only a few months ago, Europeans looked to China to help fortify bailout mechanisms that would keep the EU’s ailing peripheral nations afloat. That option is off the table.

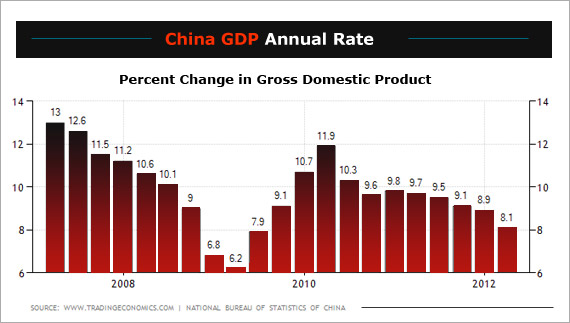

Reflecting weak demand for Chinese exports in Europe and the U.S., Beijing now forecasts a growth rate of 7.5 percent this year. Yes, it is enviable on the face of it, but it will be China’s worst performance since 2008. And as most analysts agree, China needs growth of 8 percent or so to maintain social and political stability.

China’s solution is tried and true among Asians. When the economy slumps, get the public works projects going. It always works, providing you can afford it. In 2008–09, Beijing poured nearly $600 billion into the domestic economy.

This time China will probably put $150 billion or so into new airports, green energy projects, highways, sewage treatment plants, and so on. No official figures have yet been announced.

India is in even worse shape, not least because it is carrying a burdensome deficit and does not have the money to spend its way out of a slowdown. Just before the weekend New Delhi reported first-quarter GDP growth of 5.3 percent, the economy’s worst performance in a decade and down from 9.2 percent in the same period a year earlier. New Delhi had begun the year anticipating growth of 9 percent or higher; India will be fortunate now to make 6 percent to 7 percent, according to new forecasts.

The U.S. economy is a big part of the problem. It is not creating jobs at nearly the rate the world economy needs, to say nothing of the needs of Americans themselves. On Friday, the Bureau of Labor Statistics reported that the U.S. added just 69,000 jobs in May, down from an average of 245,000 in the three months to the end of February. Atop this, we learn that the so-called revival of U.S. manufacturing is creating jobs that are paid too little to make much difference to U.S. consumption.

This means that a longstanding global economic pattern, wherein the U.S. buys Asian exports and everybody keeps growing, is no longer working. It is roughly the same in Europe.

As of this week, the future there depends almost wholly on Germany and Chancellor Angela Merkel. Unless the Germans give some ground and accept commonly issued eurobonds, an easing of fiscal discipline, and support for European banks, among other things, the European economy, which also represents a major market for Asian exporters, will not have sufficient demand to pull the Asian economies along. It certainly is not there now.

Plainly, hopes many of us shared after the financial crisis of 2008 have been dashed. The thought then was Asian giants would pull the world economy along while the Western nations regroup and restructure. It is not happening for the simple reasons that (1) the Asians are not nearly as developed as many of us tend to think; as “middle income nations,” they have too many domestic burdens to play that role, and (2) we are all more interdependent now than we were, and we have not anticipated the consequences.

OBAMA REELECTION ON THE LINE

As to the political dimension of this dark side of globalization—and there is one—we have the Greece elections later this month followed by the U.S. in November. It is perfectly possible that Alexis Tspiras, the 37-year-old leader of the Coalition of the Left, could cost President Barack Obama the White House. How? His coalition opposes the terms of Greece’s current bailout package, negotiated earlier this year, and it stands a good chance of winning sufficient votes this month to form the next government.

If Greece falls out of the euro zone, the economic consequences would be global. Disorder in Europe would deplete an already flagging confidence among U.S. investors. The Asians could expect even less than they have now by way of Western appetites for their exports. Recession could prove a stop on the way to a global depression.

We are all fighting in our own corners at this point, and more common thinking is required. Looking back to the years when globalization was gaining momentum, it seems now that nobody stopped to think that we would all some day have to think and act in concert, just as we are hoping the EU will now.

The EU has a summit scheduled for this month. What is needed along with it is a session of the Group of 20 nations to develop a global strategy to resolve what is, as of now, a global crisis. Before this is over, we may all have to reconsider just where national sovereignty begins and ends.