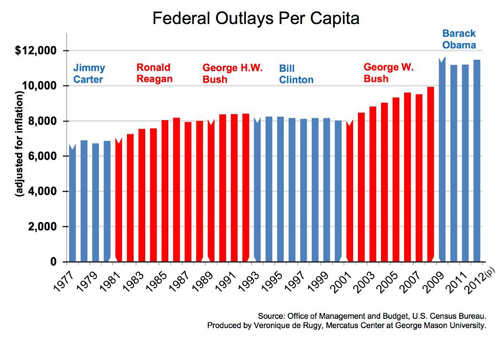

The chart below put together by my frequent collaborator Veronique de Rugy is, simply put, terrifying.

It shows the growth in inflation-adjusted federal outlays per capita. So what you're looking at is a trend line that accounts for population growth and inflation.

Two things stand out: George W. Bush was god-awful. And Barack Obama looks to be even worse (note: fiscal 2009 includes spending attributable to both adminstrations).

A third observation: The Republicans seem to be the ones who ratchet up spending while the Dems solidify that amount. Which party will grow into being the crew that brings spending down to something that is affordable?

This is no way to run a country. But it might be a great way to wreck the economy. Because government spending crowds out private investment and the "debt overhang" inevitably used to pay for open-ended government spending reduces future economic growth. At least in the 21st century, neither the Republican Party nor the Democratic Party has shown the slightest interest in actually reining in government spending. They've got slightly different reasons for keeping the cash flowing, but it will absolutely end with the same result: a broke-down and bruised body politic with a rotten future.

This blog first appeared in reason.com. Related stories from Reason:

"The 19 Percent Solution: How to Balance the Budget without Raising Taxes"

"Generational Warfare: Old-Age Entitlements vs. the Welfare State"